Analysts revisit Nvidia stock price targets as US restricts China chip sales

Nvidia said it expects new U.S. export restrictions to China will remain in place "indefinitely".

Nvidia shares tumbled in early Wednesday trading after the world's leading AI chipmaker was hit with new China export restrictions that could potentially impact billions in sales and add a new vulnerability to its near-term outlook.

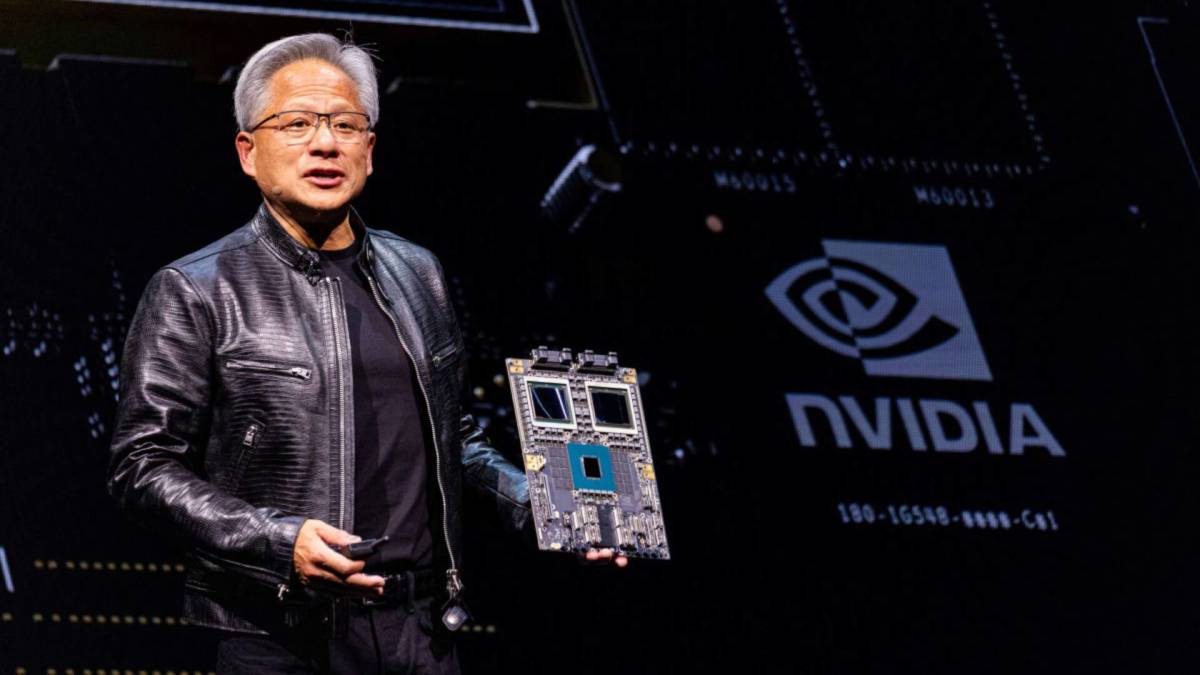

Nvidia (NVDA) said late Tuesday that its will require an export license from the U.S. government to sell its H20 AI chip to China-based customers. The H20 is the highest-performing of three processors designed by Nvidia to meet enhanced export restrictions put in place by the Biden administration in 2023.

The group said it will book a $5.5 billion charge to its first quarter earnings, which are expected on May 28, as a result of the new restrictions, while reports suggest it had booked around $18 billion in sales for the whole of 2025.

China sales accounted for around 14% of Nvidia's $39.3 billion in fourth quarter revenues, with more than four-fifths of that tally tied to H20 shipments.

"The (U.S. government) indicated that the license requirement addresses the risk that the covered products may be used in, or diverted to, a supercomputer in China," Nvidia said in a Securities and Exchange Commission filing. "On April 14, 2025, the (U.S. government) informed the Company that the license requirement will be in effect for the indefinite future."

Nvidia to take $5.5 billion charge

"First quarter results are expected to include up to approximately $5.5 billion of charges associated with H20 products for inventory, purchase commitments, and related reserves," the filing added.

Raymond James analyst Srini Pajjuri lowered his price target on Nvidia stock by $20, taking it to $150 per share following the group's SEC filing last night, but noted that robust AI spending and the ongoing ramp of its Blackwell chips should offset the hit to sales and first quarter margins.

Wedbush analyst Dan Ives, meanwhile, held his 'outperform' rating and $175 price target for Nvidia in place following last night's update, said markets are likely to focus on the "strategic blow" from the effective China blockade by the Trump administration.

Related: Nvidia stock leaps after massive U.S. investment surprise

"Nvidia is a key strategic asset for the US and the Trump Administration during this very tense period with China ... and the White House is going to make sure its chips do not help Beijing in the AI Revolution," Ives said.

"The Street will take this news with clear nervousness worried these are the first shots fired in the tech battle between the US and China and Beijing/Xi are not just going to take this news and walk away," he added. "We will continue to see a major back and forth between the US and China as the market and the economy is caught in the middle with this tariff battle royale."

Lost China revenues limit 2025 gains

Cantor Fitzgerald analyst C.J. Muse, however, thinks the H20 ban and the $5.5 billion charge will amount to a "fairly major hit" to Nvidia's first quarter earnings with the lack of China revenues a "meaningful limiter to upside through the year."

However, he sees the larger bull case for Nvidia remaining in place, and kept his 'overweight' rating and the group's designation as a 'top pick' in place.

More Nvidia:

- Bank of America offers Nvidia stock forecast amid tariffs

- Amazon directly targets Nvidia with bold new strategy

- Analyst unveils startling Nvidia stock forecast amid tariffs

"This is but a blip, and the market has been anticipating a de-risking of China and now that has happened," said Muse.

"Nvidia is still on track to earn $4.50+ per share in 2025 with strong growth thereafter in 2026 and beyond," he added. "There is no change to our view on Nvidia’s structural positioning as the key enabler of all things AI."

Nvidia shares were marked 5.9% lower in premarket trading to indicate an opening bell price of $105.61 each, a move that would extend the stock's year-to-date decline to around 24%.