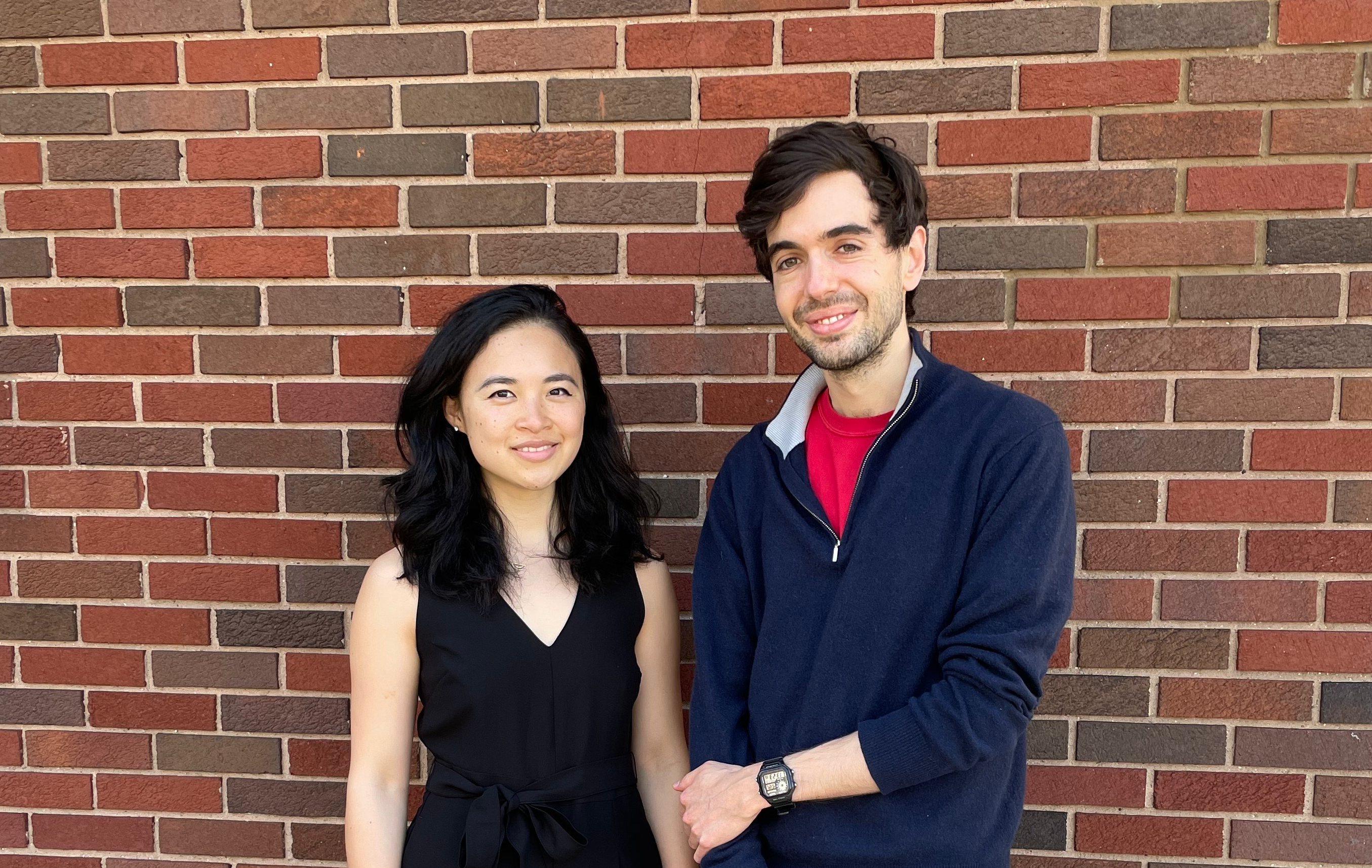

Wiz founders’ bold bet: Rejecting Google’s original offer leads to $32 billion buyout deal—and $9 billion in extra cash

If closed, the-cash Wiz transaction will become Google’s most expensive acquisition in the company’s 25-year history.

Google owner Alphabet will buy cybersecurity firm Wiz for $32 billion — in a deal set to boost the tech giant’s in-house cloud computing amid burgeoning artificial intelligence growth.

If closed, the-cash transaction, announced Tuesday, will become Google’s most expensive acquisition in the company’s 25-year history. The purchase gives Google new momentum in its efforts to compete in the cloud-computing business by offering more security for its services.

“Wiz and Google Cloud are both fueled by the belief that cloud security needs to be easier, more accessible, more intelligent, and democratized, so more organizations can adopt and use cloud and AI securely,” Wiz CEO Assaf Rappaport said in a blog post.

The company says Wiz will join Google Cloud — and that this deal represents a company investment “to accelerate two large and growing trends in the AI era: improved cloud security and the ability to use multiple clouds.”

Together, Google CEO Sundar Pichai said in a statement, Google Cloud and Wiz “will turbocharge improved cloud security and the ability to use multiple clouds.”

Assaf Rappaport, Co-Founder & CEO, added that the deal will “bolster our mission to improve security and prevent breaches by providing additional resources and deep AI expertise.”

Wiz, based in New York, was founded in 2020, makes security tools designed to shield the information stored in remote data centers from intruders.

Google has had its eyes on Wiz for some time. The purchase price announced Tuesday surpasses a reported $23 billion buyout proposal that Wiz rejected last July.

The proposed buyout will get a close look from antitrust regulators. While many expect the Trump administration to be more friendly to business deals, it has also shown skepticism of big tech.

Also, the new Federal Trade Commission Chair Andrew Ferguson has vowed to maintain a tough review process for mergers and acquisitions.

This story was originally featured on Fortune.com