Why Shares in Data Center Equipment Company Vertiv Surged This Week

Shares in data center equipment company Vertiv (NYSE: VRT) rose by 14% in the week ending Friday morning. This is an excellent performance, but the stock is still down more than 40% this year. This week's positive move helps to shed light on the key driver of the stock at the moment -- sentiment over the trade tariff skirmish and what it's likely to do to spending on data centers.It's no secret that companies usually cut back on capital spending in a slowdown. This is particularly true when growth spending (rather than maintenance capital spending) has driven data center investment over the last couple of years. This leaves Vertiv exposed to the market's views on the current round of trade disputes between the U.S. and its trading partners.The rise this week came as news broke of a 90-day pause in tariffs above 10%, with the exception of China, whose tariff now stands at 145%. The pause, plus some conciliatory commentary indicating a willingness to do trade deals, indicates to the market that the tariffs might be more tactical than strategic in nature.Continue reading

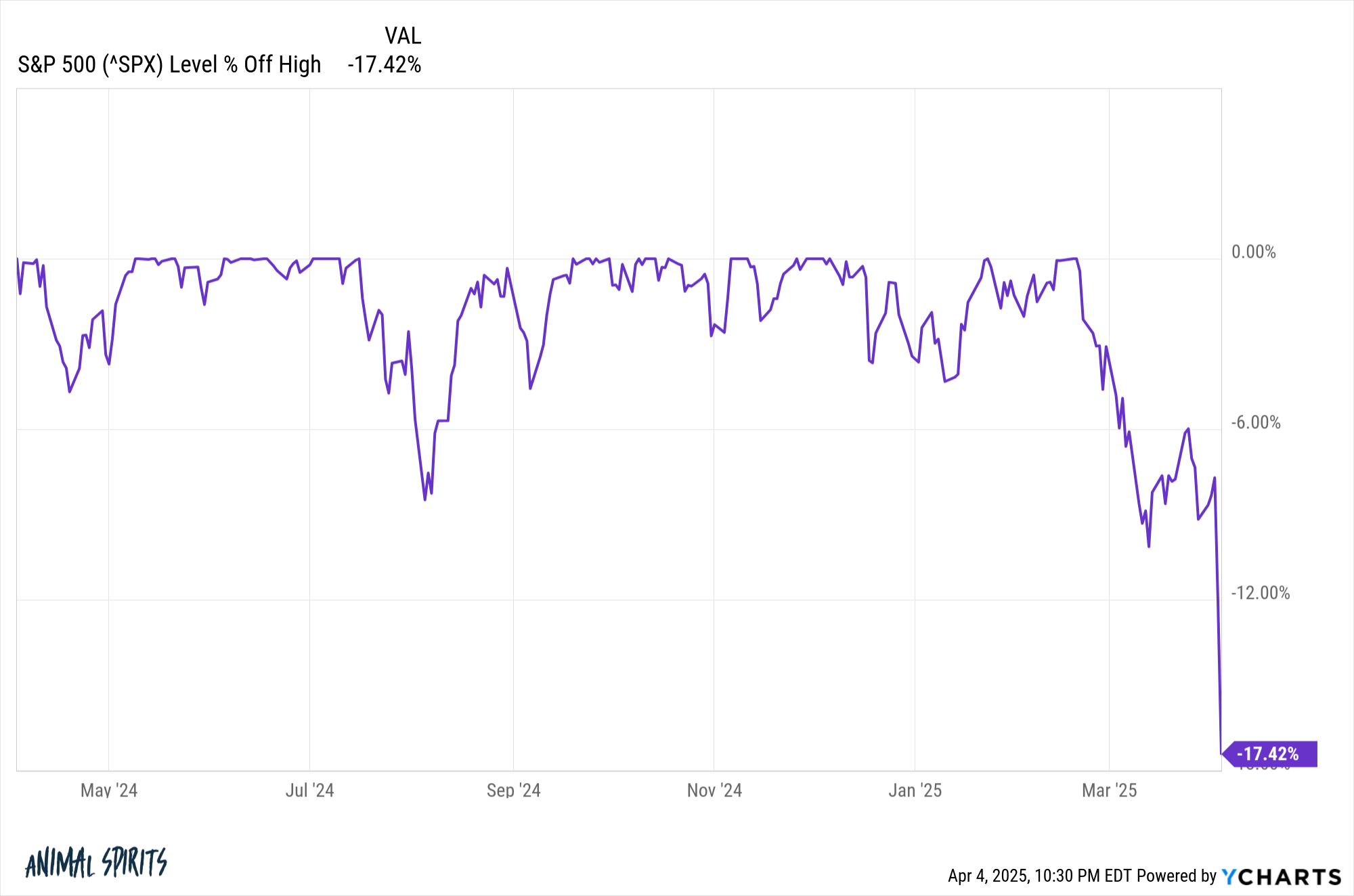

Shares in data center equipment company Vertiv (NYSE: VRT) rose by 14% in the week ending Friday morning. This is an excellent performance, but the stock is still down more than 40% this year. This week's positive move helps to shed light on the key driver of the stock at the moment -- sentiment over the trade tariff skirmish and what it's likely to do to spending on data centers.

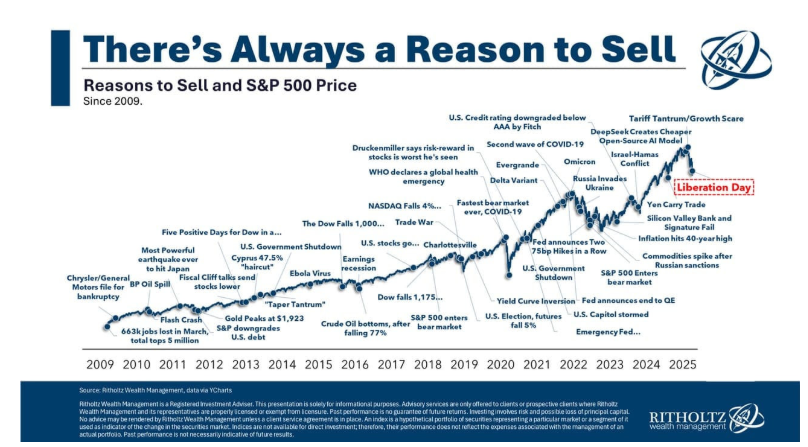

It's no secret that companies usually cut back on capital spending in a slowdown. This is particularly true when growth spending (rather than maintenance capital spending) has driven data center investment over the last couple of years. This leaves Vertiv exposed to the market's views on the current round of trade disputes between the U.S. and its trading partners.

The rise this week came as news broke of a 90-day pause in tariffs above 10%, with the exception of China, whose tariff now stands at 145%. The pause, plus some conciliatory commentary indicating a willingness to do trade deals, indicates to the market that the tariffs might be more tactical than strategic in nature.