Why Alexandria Real Estate Stock Tumbled on Tuesday

Investors were bearish on the equity of Alexandria Real Estate Equities (NYSE: ARE) throughout Tuesday's trading session. After the office space-focused real estate investment trust (REIT) reported its latest quarterly results, its stock fell and continued to wallow. It closed the day almost 6% lower in price. Meanwhile, the benchmark S&P 500 (SNPINDEX: ^GSPC) crawled 0.6% higher.For its first quarter of 2025, Alexandria's total revenue came in at just under $758 million. This was down some distance from the $769 million of the same period in 2024. The company's net loss according to generally accepted accounting principles (GAAP) was $11.6 million, or $0.07 per share. That was quite the shift from the first quarter 2024's nearly $167 million profit.However, funds from operations (FFO) is considered a truer yardstick for a REIT's profitability. Alexandria was well in the black on that metric, although it suffered a year-over-year fall to $392 million ($2.30 per share) from almost $404 million.Continue reading

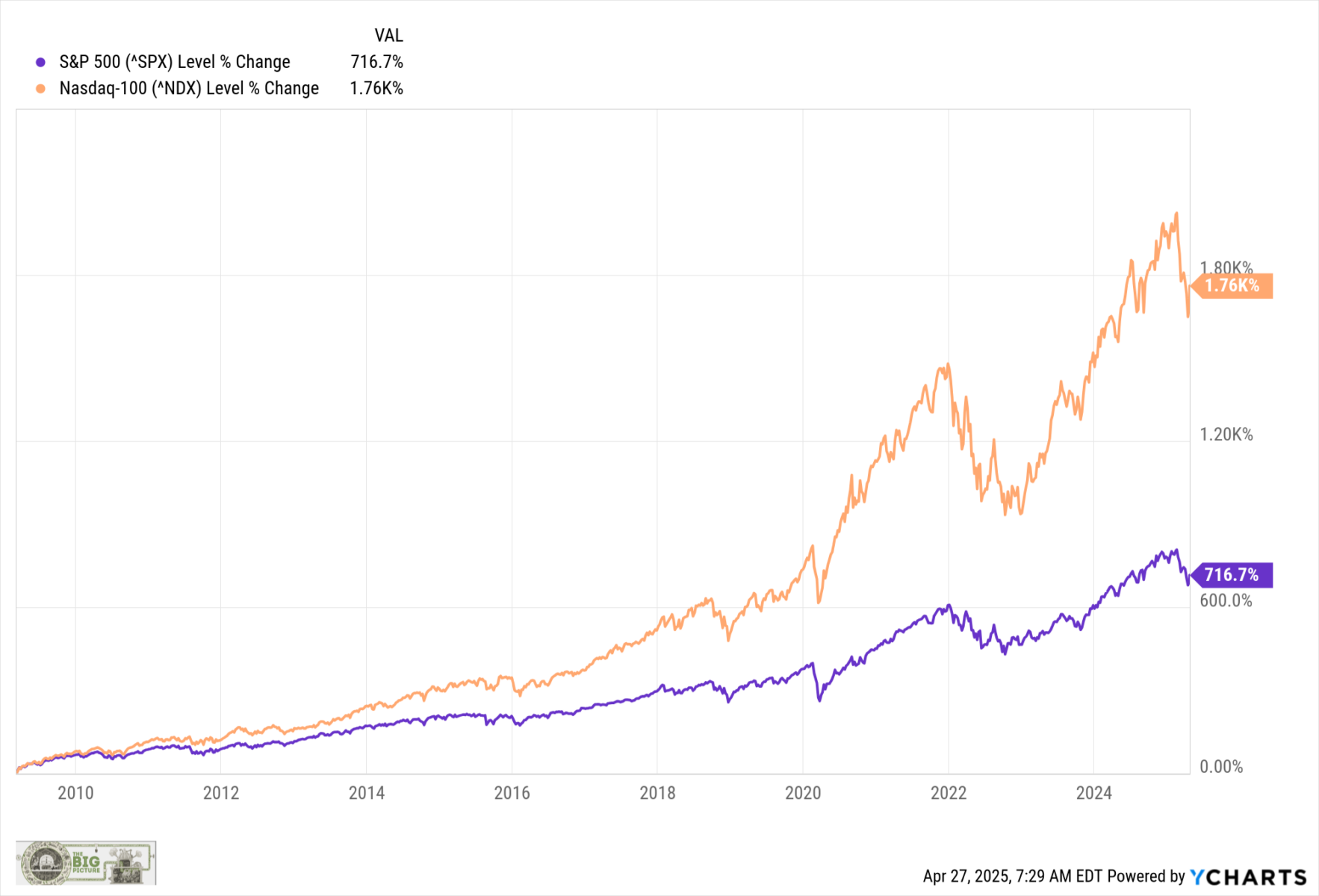

Investors were bearish on the equity of Alexandria Real Estate Equities (NYSE: ARE) throughout Tuesday's trading session. After the office space-focused real estate investment trust (REIT) reported its latest quarterly results, its stock fell and continued to wallow. It closed the day almost 6% lower in price. Meanwhile, the benchmark S&P 500 (SNPINDEX: ^GSPC) crawled 0.6% higher.

For its first quarter of 2025, Alexandria's total revenue came in at just under $758 million. This was down some distance from the $769 million of the same period in 2024. The company's net loss according to generally accepted accounting principles (GAAP) was $11.6 million, or $0.07 per share. That was quite the shift from the first quarter 2024's nearly $167 million profit.

However, funds from operations (FFO) is considered a truer yardstick for a REIT's profitability. Alexandria was well in the black on that metric, although it suffered a year-over-year fall to $392 million ($2.30 per share) from almost $404 million.