Why 25 Analysts Think This Growth Stock Is a Screaming Buy Right Now

There are many different methods investors can utilize to identify the best growth stocks to buy right now. Investors can create their own short list of top companies in key growth areas of the economy they want to target, and buy said stocks when they trade below a certain threshold over time. Or, investors can […] The post Why 25 Analysts Think This Growth Stock Is a Screaming Buy Right Now appeared first on 24/7 Wall St..

There are many different methods investors can utilize to identify the best growth stocks to buy right now.

Investors can create their own short list of top companies in key growth areas of the economy they want to target, and buy said stocks when they trade below a certain threshold over time. Or, investors can diversify into a broader basket of growth stocks by buying ETFs tracking certain sectors or growth stocks they like.

Key Points

-

Analyst ratings can be useful as a general tool for investors to determine which direction a stock should be headed over the near-term.

-

It’s rare to find stocks that analysts broadly think are screaming buys, but here’s why DraftKings is one that fits this bill right now.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

But in looking specifically at individual growth stocks, one key metric I continue to watch closely (and would encourage readers to do the same) is analyst ratings. When a particular stock such as DraftKings (NASDAQ:DKNG) has the entire analyst community behind it, it’s time to dive in and see what all the fuss is about.

So, let’s do that and take a look at what this online sports betting company has to offer.

Analysts Are Solidly Bullish on DraftKings

When investors see that 25 analyst cover a given stock, that’s a good sign there’s significant investor interest behind this name. But when all 25 analysts rate a stock like DraftKings a buy or strong buy, that’s a very solid indication that the so-called “smart money” is betting heavily on this name.

What’s particular interesting around the price targets analysts have set for DraftKings is how aggressive these price targets are. For reference, DKNG stock trades around $35 per share at the time of writing. But the lowest target on the Street sits at $45 per share, implying upside of 28% over the next year. That’s certainly not bad for any company, and that’s the current bear case around this name. Bullish analysts see this stock headed toward the $64 per share level (nearly doubling), with the median projection placing DraftKings as a stock that could return more than 56% over the course of the next year.

There’s certainly good reason for this unanimous view that DraftKings will be a long-term winner in the growth category, given the company’s strong revenue and earnings growth in recent years as well as favorable regulatory trends and rising consumer engagement. Let’s dive into the fundamentals these analysts are looking at, and why DraftKings does look like a solid bet at current levels.

Incredibly Strong Fundamentals

Again, there are clear reasons why DraftKings is a top-rated stock analysts continue to pound the table on. The online sports betting giant reported 20% year-over-year revenue growth this past quarter, with overall top-line revenue beating analyst expectations at more than $1.4 billion in Q1. The company’s guidance raise (in a sea of relative uncertainty) is very bullish for the company, given that many similar growth stocks have taken down their guidance or simply maintained guidance, as they wait to see how the macro environment shapes up.

The thing is, DraftKings’ solid growth in terms of its customer base and reach is likely to continue, regardless of what the current trade policy is in the U.S. This is a company that’s relatively insulated from many of the concerns hampering stocks in other tariff-prone sectors. Accordingly, investors an analysts both appear to like the company’s monthly active user growth (up 28%, driving most of this increase), and seem to believe these sorts of metrics will continue, so long as more states jump aboard approving online sports betting over time.

Is This Stock a Solid Long-Term Buy?

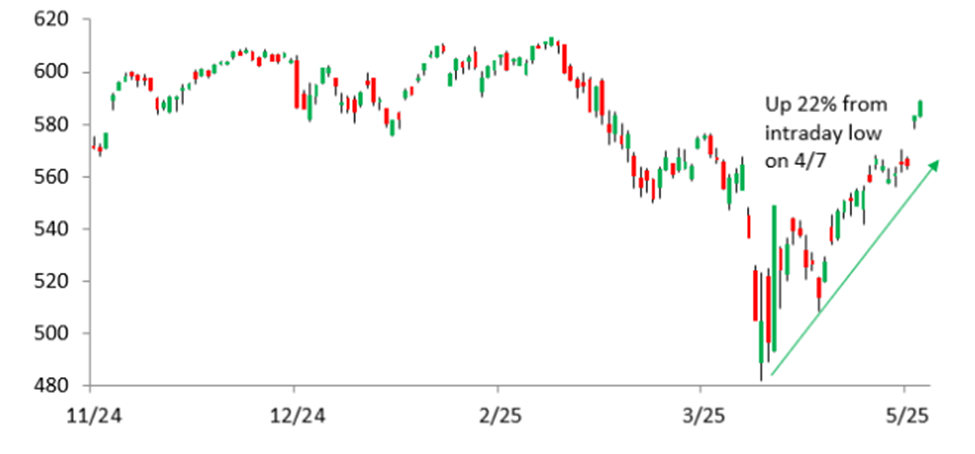

DraftKings is certainly a company that’s not for the faint of heart. This is a stock that’s seen some pretty significant volatility in the past, so if you’re an investor who isn’t willing to strap in for what could be a bumpy ride, then there are other options in the market to consider.

But over the long-term, it does appear there’s a solid bull case to be made around owning DraftKings here. Despite a valuation of around 24-times forward earnings and nearly 4-times sales, this is a stock that has the very concrete potential to grow into its multiple and look cheap in a few years. It’s hard to say the same thing about many of the top Mag 7 stocks so many investors are keen on owning right now, so that’s a big positive.

Additionally, I continue to think that the sports betting space (while still having some detrimental effects on youth and vulnerable groups) will sustain market-beating growth rates for a very long time. Any business model that revolves around getting customers to come back for more is one that long-term investors want to at least consider. And while this stock may not be for everyone, the strong secular growth seen in the U.S. online gambling industry really speaks for itself. To me, the analysts are probably going to be proven right on this one over the long-term.

The post Why 25 Analysts Think This Growth Stock Is a Screaming Buy Right Now appeared first on 24/7 Wall St..