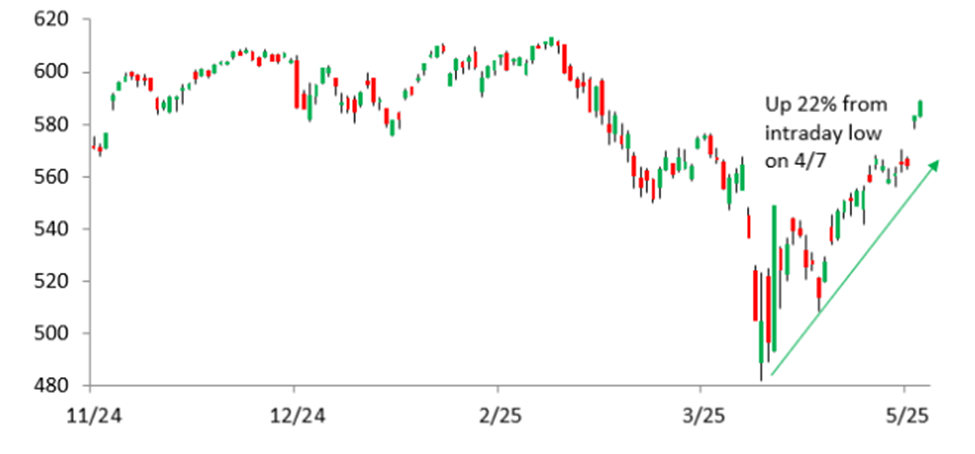

S&P 500 INDEX (SPX) Live: Market Gains Unleashed on EU Tariff Tailwinds

Live Updates Live Coverage Updates appear automatically as they are published. Boeing Weighs on Business Orders 10:02 am by Gerelyn Terzo Durable goods orders fell 6.3% last month, a softer drop than economists had predicted. However, this dip follows four consecutive months of increases, painting a mixed picture for business spending amid ongoing tariff discussions. […] The post S&P 500 INDEX (SPX) Live: Market Gains Unleashed on EU Tariff Tailwinds appeared first on 24/7 Wall St..

Live Updates

Updates appear automatically as they are published.

Boeing Weighs on Business Orders

Durable goods orders fell 6.3% last month, a softer drop than economists had predicted. However, this dip follows four consecutive months of increases, painting a mixed picture for business spending amid ongoing tariff discussions. Boeing (NYSE: BA) weighed on the overall figures amid a 51% drop in April orders.

This article will be updated throughout the day, so check back often for more daily updates.

Market sentiment is refreshingly bullish, with all three major stock averages widening their lead as the morning unfolds. President Trump’s agreement to delay proposed EU tariffs until July 9 propelled the Dow Jones Industrial Average up as much as 500 points. Further buoying stocks is the latest economic data: May’s Consumer Confidence reading came in stronger than expected at 98, a 12.3-point monthly jump that defied economists’ calls for 86 amid tariff concerns.

The S&P 500 Index ETF (SPX) is currently up 1.5%.

Technology stocks are powering both the Nasdaq Composite and S&P 500 up by 2% and 1.6%, respectively. Despite the nearness of the looming 50% EU import tariff, markets are clearly satisfied with the interim relief, viewing the Trump administration’s EU deal as a promising sign for future trade progress.

On Wall Street, Piper Sandler has reiterated its “overweight” rating on Nvidia (Nasdaq: NVDA) ahead of the AI darling’s crucial quarterly results tomorrow. The firm suggests investors stay long, believing the most challenging period is behind the company.

Other “Magnificent Seven” members are also enjoying gains, with Meta Platforms (Nasdaq: META) and Amazon (Nasdaq: AMZN) both up 1%. Tesla (Nasdaq: TSLA) stands out with a 3.5% rally after Wedbush analysts elevated the EV maker to an AI “pure play” and boosted its price target to $500 per share.

Here’s a look at the performance as of morning trading:

Dow Jones Industrial Average: Up 517.91 (+1.2%)

Nasdaq Composite: Up 372.56 (+1.9%)

S&P 500: Up 91.51 (+1.6%)

Market Movers

UBS has upgraded LifeStance Health (Nasdaq: LFST) to a “buy” from “neutral” on a positive long-term forecast, sending its stock up 4%.

Data analytics software specialist Palantir Technologies (Nasdaq: PLTR) is also up 2% today, riding the broader tariff-driven rally.

In airline news, Southwest Airlines (NYSE: LUV) will soon begin charging customers $35 for the first checked bag and $45 for the second, abandoning its signature “bags fly free” policy. This strategic shift is being rewarded by investors, with LUV stock gaining 3%.

Cruise stock Carnival Corp (NYSE: CCL) is rising 5.6% today.

The post S&P 500 INDEX (SPX) Live: Market Gains Unleashed on EU Tariff Tailwinds appeared first on 24/7 Wall St..