Is Leaving Your Children Out of Your Will the Right Choice?

Estate planning is no easy task. Yet, as we age, the need to make some truly important decisions looms larger in our minds. Navigating the ins-and-outs of creating a will is difficult enough under the best of circumstances, but it’s especially rough when family relationships are challenging. If you’ve reached the age of retirement, deciding […] The post Is Leaving Your Children Out of Your Will the Right Choice? appeared first on 24/7 Wall St..

Estate planning is no easy task. Yet, as we age, the need to make some truly important decisions looms larger in our minds. Navigating the ins-and-outs of creating a will is difficult enough under the best of circumstances, but it’s especially rough when family relationships are challenging. If you’ve reached the age of retirement, deciding how to divide your estate can bring up feelings of stress and guilt. However, this is the time to make some tough choices.

For most families, the tradition of leaving everything to your children and grandchildren is unquestioned. Yet we should remember that where our estate ends up is always a personal choice and should not be dictated by culture or “what everyone else does.” Choosing to leave a portion of your wealth to a favorite organization is an option. Even famous earners like Warren Buffett have publicly stated that the majority of their wealth will go to charity instead of direct lineage.

Checkout this slideshow to learn about the varying options when it comes to your hard-earned legacy. We cover trusts, conditional giving, and a few other strategies. Take some time to review these options and discover what feels right for you.

Navigating Estate Planning with Confidence

- Estate planning can be emotionally complex, especially with family tension.

- You’re in control of how your assets are distributed.

- Now is the time to think critically about your legacy.

Feeling Disappointed in Family?

- It’s not uncommon to consider excluding family from a will

- Warren Buffett and Bill Gates plan to leave most of their wealth to philanthropy

- You have every right to direct your legacy where you see fit.

Your Legacy, Your Choice

- Legally, you’re not obligated to leave anything to children or grandchildren.

- You can leave assets to anyone, or any cause aligned with your values.

- This includes friends, other relatives, or nonprofits.

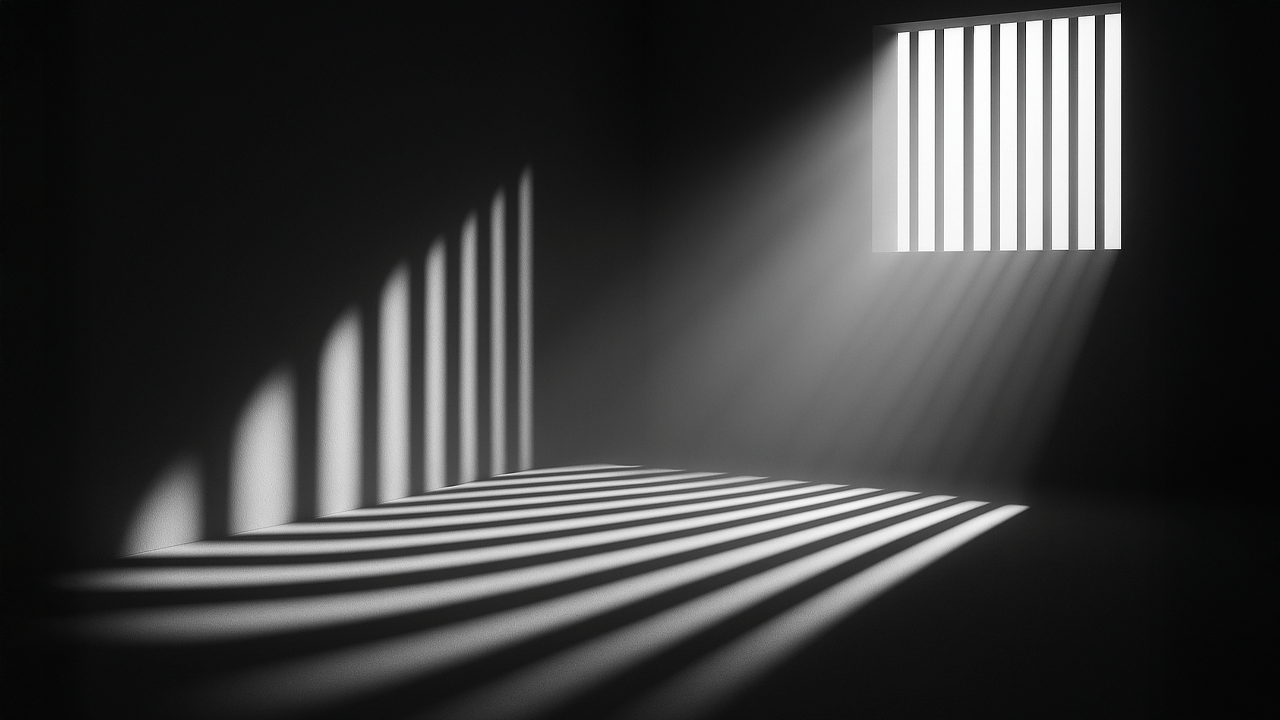

The Danger of Dying Intestate

- Without a will, state laws dictate how assets are divided.

- Courts may appoint administrators who ignore your true wishes.

- Your estate could go to the very people you hoped to exclude.

Why You Need an Estate Attorney

- A professional ensures your estate plan stands up in court.

- Difficult families may challenge wills—airtight planning prevents that.

- Trusts, wills, and other legal tools offer protection and control.

Time is Still on Your Side

- At 63, the average life expectancy gives you time to reconsider

- Your emotions may evolve—estate planning allows for flexibility.

- Planning now helps reduce stress later, even if you make changes.

Using Trusts for Conditional Giving

- You can set up benchmarks like graduation or savings milestones.

- Trusts allow you to reward maturity and growth without blind giving.

- This keeps you involved in guiding future behavior—even indirectly.

Leaving the Door Open

- Adding conditions lets you remain open to family reconciliation.

- You can choose second chances without giving up control.

- Flexibility can ease the emotional burden of cutting ties.

Philanthropy as Legacy

- Donating your estate to a cause reflects personal values and impact.

- You can support education, environment, health, or social justice.

- Leaving a legacy of giving can be deeply fulfilling.

Get Professional Guidance

- Financial and estate planners bring clarity to complex decisions.

- They help align your wishes with the legal tools available.

- Your legacy deserves the same discipline that built your wealth.

The post Is Leaving Your Children Out of Your Will the Right Choice? appeared first on 24/7 Wall St..