Veteran analyst sends blunt 11-word message on gold stocks

Here's what could happen to gold stocks next.

"All that glitters is gold" seems very true lately. The yellow metal has been one of the only places for investors to make money in 2025 amid a weakening economy, a hesitant Fed, and tariff uncertainty.

Gold hit all-time highs this week as investors, big (central banks) and small (main street investors), sought the relative safety of hard assets.

The precious metal has surged over 25%, including a nearly 15% gain in April after President Trump announced sweeping tariffs on April 2, so-called "Liberation Day."

Gold bugs haven't only flocked to physical gold (coins and bars). They've also rushed into the SPDR Gold Trust (GLD) , an exchange-traded fund, and gold mining stocks. The GLD ETF has over $100 billion in assets, up from $91 billion in March, and gold stocks have shot higher in April. For example, Goliath Newmont Corporation (NEM) is up 16% this month.

Related: Veteran analyst who predicted gold prices would rally offers a blunt new forecast

The rush to own gold stocks has caught the attention of many, including longtime technical analyst Helene Meisler.

Meisler has been tracking stocks professionally since the early 1980s when she worked at Cowen & Co. and Goldman Sachs, so she's seen her share of economically driven gold booms and busts.

This week, Meisler weighed in on gold stocks, offering blunt advice gold bugs ought to consider. Image source: Costaseca/Lucas/AFP via Getty Images

Gold becomes last game in town as markets get rocked, Fed falls behind

A recession looks increasingly likely, given that sticky inflation and weakening jobs growth already suggest we're on the precipice of stagflation.

Cracks in our economic armor have been growing for months, and they've accelerated on the back of tariff uncertainty.

Related: Major analysts revamp gold price targets after historic rally

The jobs market remains arguably strong, given that unemployment is still historically low, but it's not nearly as strong as it was. Layoffs have become more common, with 497,000 losing their jobs in the first quarter, the highest number in Q1 since recession-riddled 2009, according to Challenger, Gray, & Christmas.

And job seekers are having a harder time finding new work, given the Job Openings and Labor Turnover Survey shows unfilled jobs have fallen by 877,000 over the past year.

The deteriorating jobs picture isn't dire yet, but it offers little comfort to workers already struggling under the weight of higher prices.

Inflation has fallen from its sky-high levels in 2022, but prices are still climbing, and when added to those spikes three years ago, it's still taking a big toll on consumer budgets. As a result, retailers like Walmart and Target have been saying for a year that consumers are spending less on discretionary purchases to free up cash for essentials.

The inflation situation may also worsen this year because of the newly instituted tariffs. While he's paused reciprocal tariffs for 90 days, President Donald Trump has slapped a 10% baseline tax on imports, plus 25% taxes on Canada, Mexico, and autos. China, however, is the biggest problem, given that we rely on Chinese imports from clothing to electronics, all of which now face 145% tariffs because of a mounting trade war.

The double whammy of inflation and job losses puts the Fed in an impossible situation. If it cuts rates like it did last fall, it risks adding fuel to the inflation fire even as it's already about to burn brighter because of tariffs. However, if it hikes rates to quell inflation, it risks sending the jobs market into a free fall.

The backdrop is a bad recipe for businesses that were counting on a friendly Fed to finance growth and free trade to keep profits thick, and that's not good for investors, who rely on revenue and profit growth to reward share prices.

Altogether, the setup is near-perfect for gold, and downright bad for almost everything else.

Analyst offers blunt take on gold stocks

Gold's prices have soared to a record, reaching $3,500 this week as investors shunned other 'safe haven' assets, including Treasury bonds and the U.S. dollar.

The weaker U.S. dollar has been particularly supportive of gold, given that gold is purchased with U.S. dollars. Its decline has made the yellow metal more attractive to foreign buyers, including central banks, who are less eager to finance America amid a trade war.

More Wall Street Analysts:

- Analyst unveils startling Nvidia stock forecast amid tariffs

- Wall Street sounds alarm on Tesla, Elon Musk problem

- Analysts see challenges for Apple over tariffs

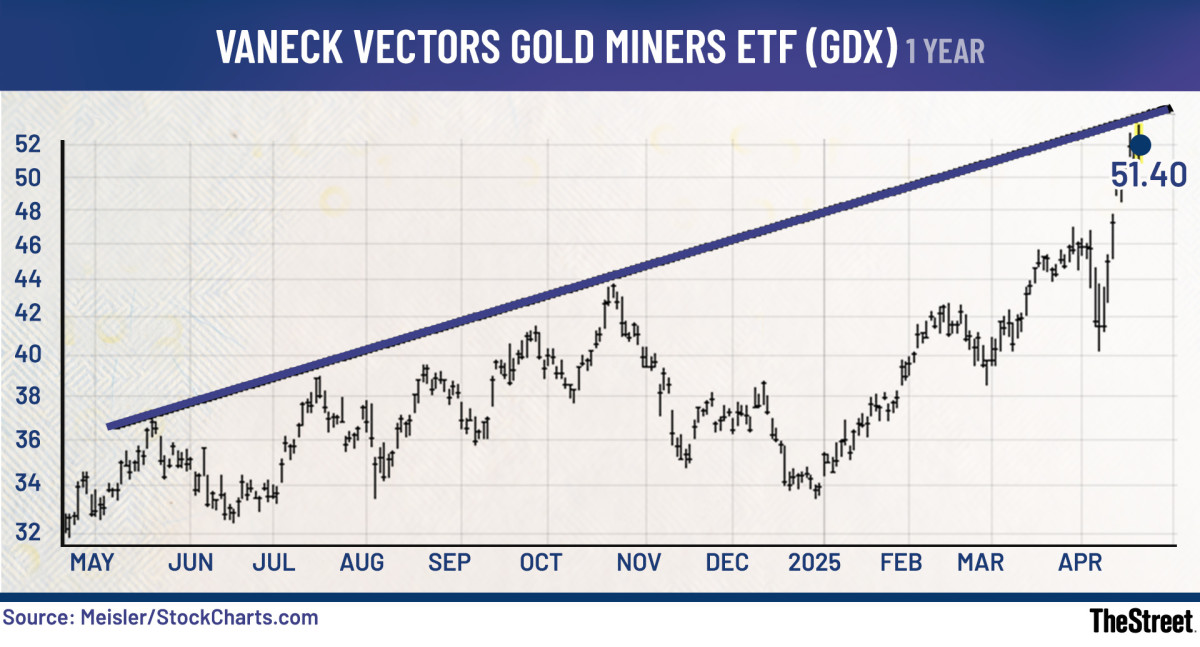

The gains have correspondingly been good for gold stocks, given that the VanEck Gold Miners ETF (GDX) is up 4% in April and a whopping 50% year-to-date.

That gain is downright gaudy given the S&P 500's 10% retreat, but it could be that gold bugs are getting a little too giddy.

Meisler, a technical analyst, was trained under legendary technician Justin Mamis. When the iconic investment bank hired her in the mid-1980s, she was Goldman Sachs' first technician. She's seen her share of gold runs during past crises, and she thinks gold stocks could be due for a breather.

"GDX, an ETF to be long gold stocks, has lagged Gold itself quite a bit, and today was no exception as it tried to make a higher high and gave it up," wrote Meisler in a TheStreet Pro article. "Then there is that resistance line up there as well. There is a measured target in the 54 area, but it got to 53.25 today." Image source: TheStreet/Meisler/StockCharts.com

The fact that the gold mining ETF, which comprises most major gold mining stocks, couldn't hold its high as it battled resistance could be a warning sign that profit takers are emerging into strength, signaling a retreat, at least in the short term.

It's not the only sign flashing a warning, though.

"Keep in mind the DSI keeps knocking on the door of 90," said Meisler.

The Daily Sentiment Index is an overbought and oversold measure that can signal when the tides are about to turn. A reading above 90 suggests that the market is overheated and due for a break, while a single-digit reading is a buy signal.

The combination of a rally that may be stalling near resistance and a DSI reading that's overbought leads Meisler to a blunt conclusion:

"Take a little off the table and wait for a correction," said Meisler.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast