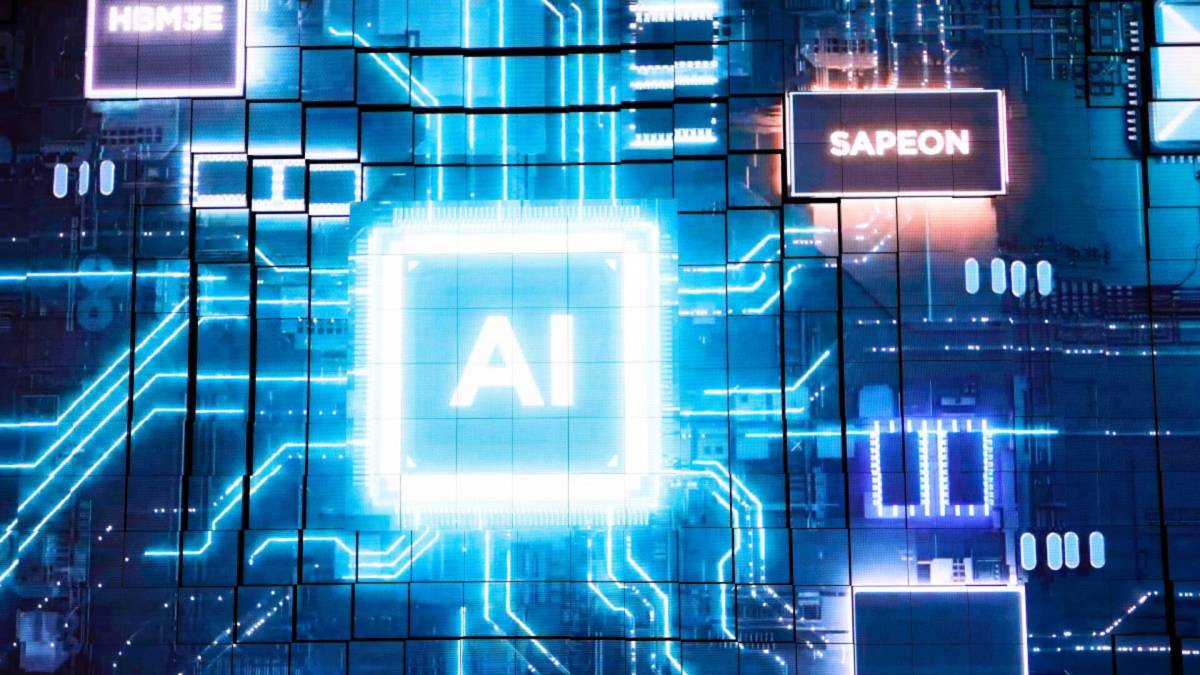

Think AMD Stock Is Expensive? This Chart Might Change Your Mind

Investors may struggle to figure out what to make of the valuation of Advanced Micro Devices (NASDAQ: AMD). Though its market capitalization has fallen by about half since last March, based on its trailing P/E ratio of 109, the stock still appears expensive.Yet a deeper look suggests it may be one of the cheapest semiconductor stocks on the market right now, and a bargain that investors won't want to overlook.The value proposition of AMD becomes apparent when one looks beyond its pricey trailing P/E ratio. Based on its growth expectations, its forward P/E ratio is 23. That's a two-year low for that metric. Additionally, the contrast with rival Nvidia is apparent when comparing their price-to-sales (P/S) ratios. AMD's sales multiple of around 7 -- far below Nvidia's -- seems to confirm the stock is a bargain.Continue reading

Investors may struggle to figure out what to make of the valuation of Advanced Micro Devices (NASDAQ: AMD). Though its market capitalization has fallen by about half since last March, based on its trailing P/E ratio of 109, the stock still appears expensive.

Yet a deeper look suggests it may be one of the cheapest semiconductor stocks on the market right now, and a bargain that investors won't want to overlook.

The value proposition of AMD becomes apparent when one looks beyond its pricey trailing P/E ratio. Based on its growth expectations, its forward P/E ratio is 23. That's a two-year low for that metric. Additionally, the contrast with rival Nvidia is apparent when comparing their price-to-sales (P/S) ratios. AMD's sales multiple of around 7 -- far below Nvidia's -- seems to confirm the stock is a bargain.