Tax agencies will double down on crypto before Bitcoin hits $1M

Opinion by: Robin Singh, CEO of KoinlyIn the race between regulation and Bitcoin (BTC) all-time highs, there is no doubt tax agencies will double down on their crypto-tracking systems well before Bitcoin hits $1 million.Crypto investors shouldn’t become complacent or assume they can skate by until the million-dollar price tag. In addition to their laser focus on the future, they are becoming skilled at scrutinizing the past. Many jurisdictions have the power to backtrack on previous years, and if tax authorities realize how much they’ve missed, they won’t just let it slide…This could spell trouble for misinformed Bitcoiners who have already begun spending their profits.Tax agencies will catch up through automated data-sharingGovernments are still in this weird gray area where crypto tax rules can change anytime. Take the US Internal Revenue Service (IRS), for example. In a shock move, as of 2025, the IRS now mandates that investors use the wallet-by-wallet cost tracking method, no longer allowing the universal wallet method. The latter is far more labor-intensive than the former but hands the IRS more data it craves.Though automated data sharing with tax agencies might not be as extensive as stock market data, it’s only a matter of time before crypto data from centralized exchanges catches up. Several crypto exchanges, including Coinbase and Binance.US, issue Forms 1099-MISC to the IRS for users with more than $600 in rewards in a financial year.An end to the honesty systemThen there’s the global village challenge, with each tax agency worldwide taking its own approach. For instance, the Australian Tax Office (ATO) automates stock cost and sale reporting through pre-filled data for taxpayers. Crypto data isn’t, however, included in the pre-fill. Instead, any activity on a centralized exchange triggers an alert on the taxpayer’s tax return, indicating that the ATO is aware of the crypto activity. This leaves it up to the taxpayer to be honest about whether they’ve made capital gains or losses during the financial year.Whether you’ve made any sales or simply bought crypto, consistent alerts over several years without reporting from the taxpayer will likely increase the risk of an audit.Worldwide, the honesty system is on its deathbed. Once tax authorities have advanced their crypto monitoring systems, they can retroactively review previous years if they choose to. The ATO already has a reasonably intensive data-matching program with centralized exchanges in the jurisdiction.If you value your sanity, a multi-year audit of your crypto portfolio is the last thing you want to deal with. Every tax authority is catching up, and accountants want to protect clients from getting caught out as compliance measures become more sophisticated.Tax authorities to strengthen cooperation in the coming yearsOver the coming years, we should expect to see an increase in global tax data sharing between jurisdictions, something we’re already starting to see. In March 2024, Australia’s and Indonesia’s governments reached an agreement to exchange tax information, with one of the key focuses being the use of crypto.A few months earlier, in November 2023, 47 national governments, including the United Kingdom, Brazil, Germany and Japan, committed to the Crypto-Asset Reporting Framework (CARF) and planned to activate exchange agreements for information sharing by 2027.Recent: Indian crypto holders face 70% tax penalty on undisclosed gainsDon’t operate under the assumption that decentralized finance and non-fungible tokens are flying under the radar, either. Tax authorities are fully aware of the gains made on decentralized exchanges. Agencies like the IRS have already introduced guidance to collect user data from non-custodial brokers, though this has been delayed until 2027. While tracking might be more challenging, and some investors believe their assets are untraceable until they are moved to centralized exchanges, tax authorities are already catching on. It’s not a “crypto industry knows best” situation. Tax authorities are bringing in more experts from the crypto space to help them understand how people might try to bypass the system. Opinion by: Robin Singh, CEO of Koinly.This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Opinion by: Robin Singh, CEO of Koinly

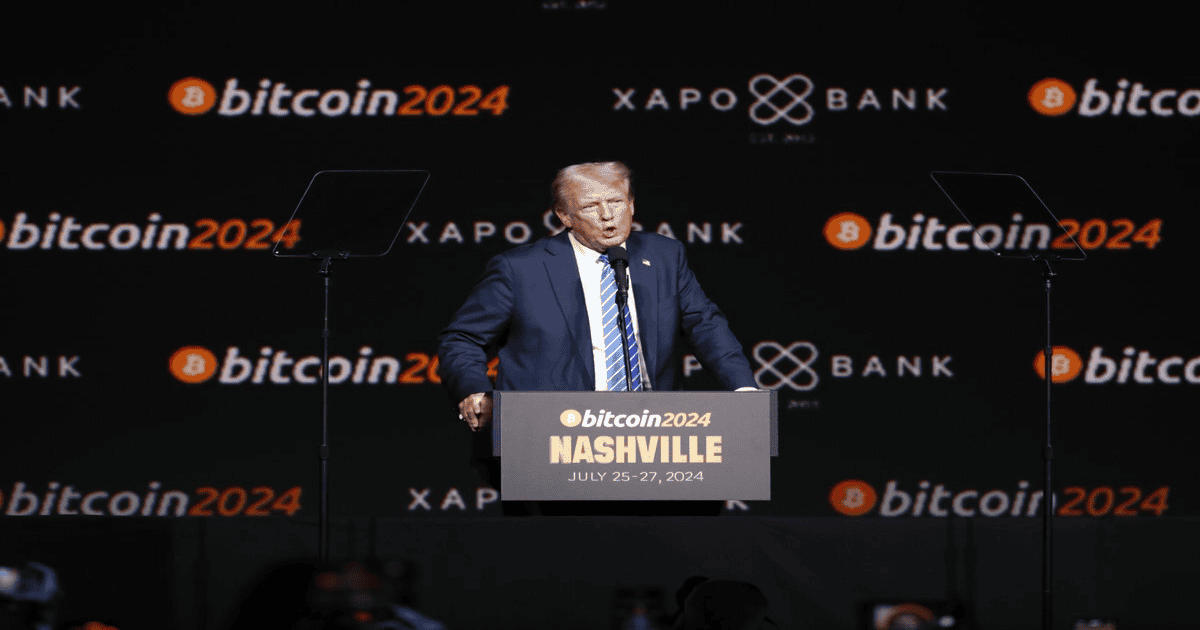

In the race between regulation and Bitcoin (BTC) all-time highs, there is no doubt tax agencies will double down on their crypto-tracking systems well before Bitcoin hits $1 million.

Crypto investors shouldn’t become complacent or assume they can skate by until the million-dollar price tag. In addition to their laser focus on the future, they are becoming skilled at scrutinizing the past. Many jurisdictions have the power to backtrack on previous years, and if tax authorities realize how much they’ve missed, they won’t just let it slide…

This could spell trouble for misinformed Bitcoiners who have already begun spending their profits.

Tax agencies will catch up through automated data-sharing

Governments are still in this weird gray area where crypto tax rules can change anytime. Take the US Internal Revenue Service (IRS), for example. In a shock move, as of 2025, the IRS now mandates that investors use the wallet-by-wallet cost tracking method, no longer allowing the universal wallet method. The latter is far more labor-intensive than the former but hands the IRS more data it craves.

Though automated data sharing with tax agencies might not be as extensive as stock market data, it’s only a matter of time before crypto data from centralized exchanges catches up. Several crypto exchanges, including Coinbase and Binance.US, issue Forms 1099-MISC to the IRS for users with more than $600 in rewards in a financial year.

An end to the honesty system

Then there’s the global village challenge, with each tax agency worldwide taking its own approach. For instance, the Australian Tax Office (ATO) automates stock cost and sale reporting through pre-filled data for taxpayers. Crypto data isn’t, however, included in the pre-fill.

Instead, any activity on a centralized exchange triggers an alert on the taxpayer’s tax return, indicating that the ATO is aware of the crypto activity. This leaves it up to the taxpayer to be honest about whether they’ve made capital gains or losses during the financial year.

Whether you’ve made any sales or simply bought crypto, consistent alerts over several years without reporting from the taxpayer will likely increase the risk of an audit.

Worldwide, the honesty system is on its deathbed. Once tax authorities have advanced their crypto monitoring systems, they can retroactively review previous years if they choose to. The ATO already has a reasonably intensive data-matching program with centralized exchanges in the jurisdiction.

If you value your sanity, a multi-year audit of your crypto portfolio is the last thing you want to deal with. Every tax authority is catching up, and accountants want to protect clients from getting caught out as compliance measures become more sophisticated.

Tax authorities to strengthen cooperation in the coming years

Over the coming years, we should expect to see an increase in global tax data sharing between jurisdictions, something we’re already starting to see. In March 2024, Australia’s and Indonesia’s governments reached an agreement to exchange tax information, with one of the key focuses being the use of crypto.

A few months earlier, in November 2023, 47 national governments, including the United Kingdom, Brazil, Germany and Japan, committed to the Crypto-Asset Reporting Framework (CARF) and planned to activate exchange agreements for information sharing by 2027.

Recent: Indian crypto holders face 70% tax penalty on undisclosed gains

Don’t operate under the assumption that decentralized finance and non-fungible tokens are flying under the radar, either. Tax authorities are fully aware of the gains made on decentralized exchanges. Agencies like the IRS have already introduced guidance to collect user data from non-custodial brokers, though this has been delayed until 2027.

While tracking might be more challenging, and some investors believe their assets are untraceable until they are moved to centralized exchanges, tax authorities are already catching on. It’s not a “crypto industry knows best” situation. Tax authorities are bringing in more experts from the crypto space to help them understand how people might try to bypass the system.

Opinion by: Robin Singh, CEO of Koinly.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.