Take These Financial Planning Steps if You’re Concerned About Social Security’s Future

One of the most important questions in the US right now is what will happen to Social Security in the next 10 years. The current belief is that the combined trust funds that assist 70 million Americans with benefits will be exhausted by 2035, leading directly to a question about what will happen next. While […] The post Take These Financial Planning Steps if You’re Concerned About Social Security’s Future appeared first on 24/7 Wall St..

One of the most important questions in the US right now is what will happen to Social Security in the next 10 years. The current belief is that the combined trust funds that assist 70 million Americans with benefits will be exhausted by 2035, leading directly to a question about what will happen next.

The unfortunate reality is that Social Security benefits could look very different in the next 10 years.

It’s important to understand where your benefits could be affected so you can plan accordingly.

Talk with a financial advisor about how to diversify your investments.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. If you’ve saved and built a substantial nest egg for you and your family; get started by clicking here.(Sponsor)

Key Points

While it’s easy to point fingers about who is responsible for Social Security’s lack of a solid future, and there is no question that policymakers have to act, but until they do, individuals and families must prepare. This means looking at alternative retirement income sources to prepare for shortfalls.

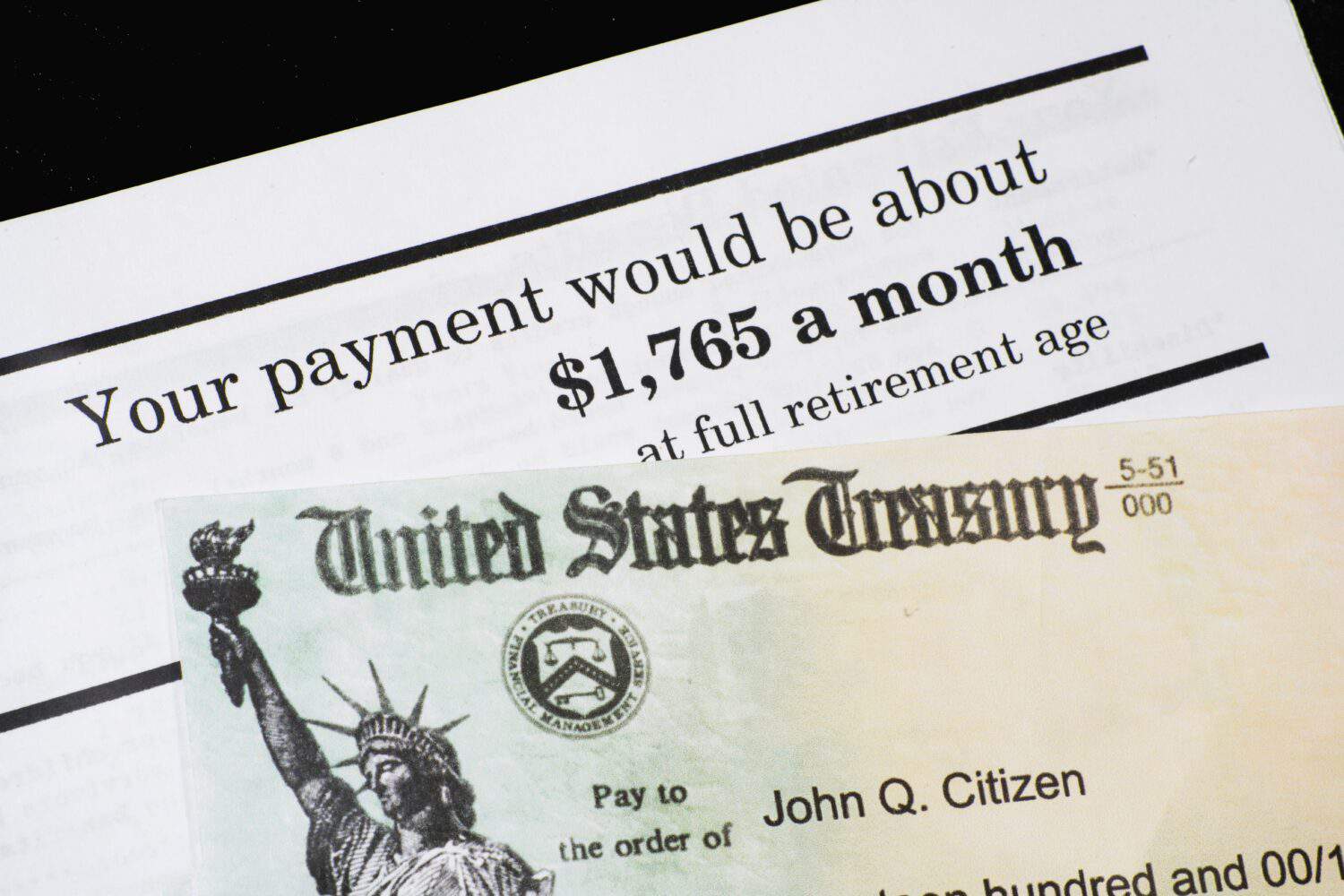

5. Understand Your Projected Benefits

One of the first things anyone should do is understand exactly what their project Social Security benefits will look like. Using the Social Security Administration’s website, you can look at a current statement that provides a personalized estimate based on your top earning years of what kind of dollar amount you could receive. This will give you a complete understanding of what shortfall you might need to make up.

Modeling Potential Changes

Once you know exactly what you can expect dollar-wise from Social Security at your earliest withdrawal age of 62, you can start to figure out the next step. In this scenario, working with a financial advisor would be the best option to identify a 10%, 20%, or even 30% drop in benefits compared to your current plan. With concrete numbers available, it then lets you know exactly what kind of shortfall you need to account for, which leads directly to concrete planning.

4. Staying Informed

What far too many people ignore while feeling angst about Social Security is not monitoring any legislative developments as they happen. Social Security is regularly in the news, so you don’t have to look far to understand what annual budget changes by the government look like. It might boost or reduce the existing trust fund that manages Social Security benefits. It’s vital to fully know the political realities between now and 2035.

Consult With Professionals

As previously mentioned, planning for a reduced Social Security benefit alone might lead to incorrect math. All the taxation updates around 401(k), IRAs, and the like are essential to know backward and forward. So, if you don’t, work with a financial advisor or a certified public accountant who can help you understand exactly where you are and how new legislative approaches affect you. The more you know and learn, the quicker you can change your strategy to offset.

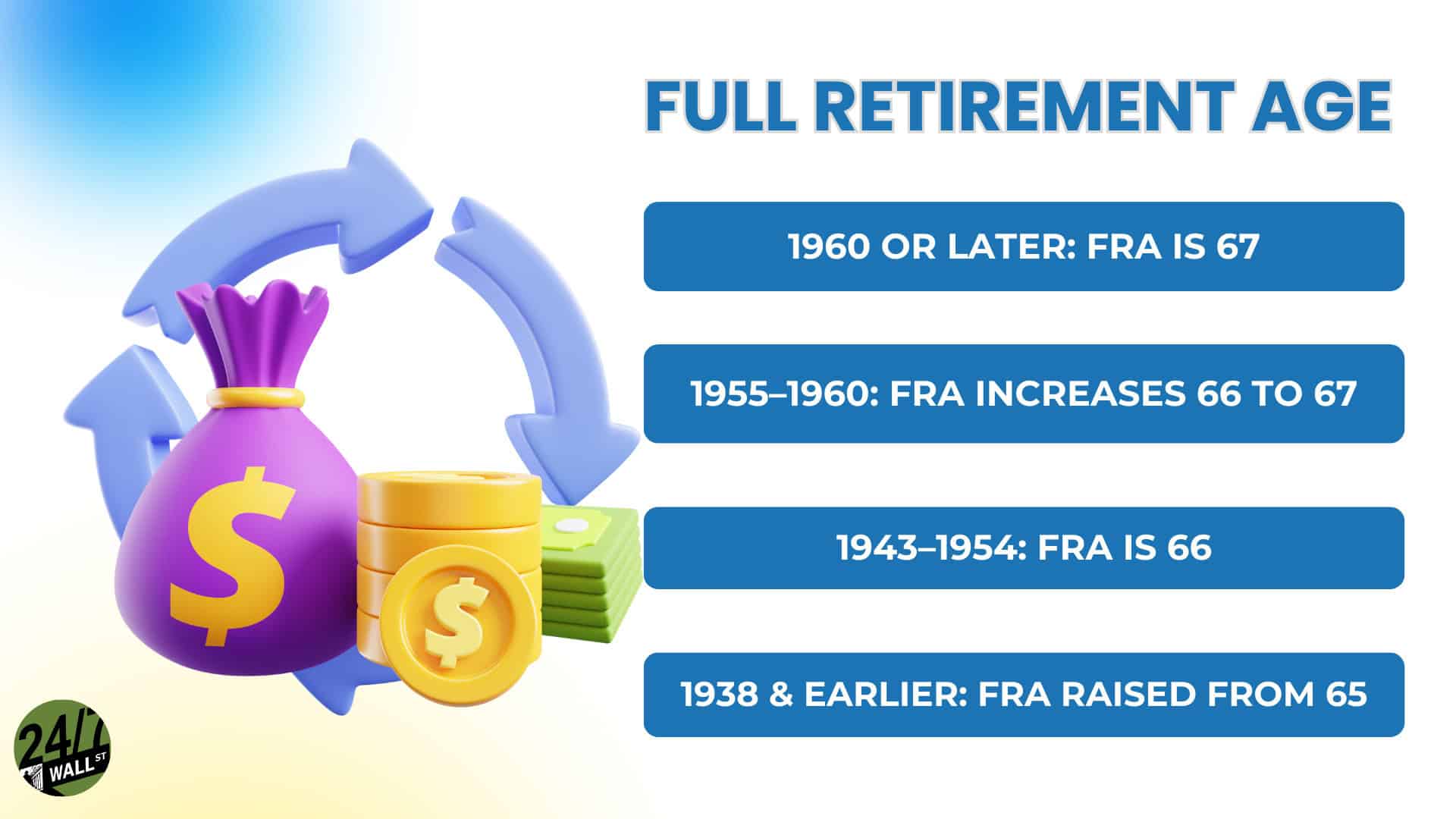

3. Plan for Different Timelines

Far too many people look to create retirement scenarios solely around the time they can start to withdraw Social Security, which is boosted by Full Retirement Age at 67. However, you may need to look at scenarios that don’t just target one retirement date. Instead, model out different scenarios that help you identify when you can step away from the workforce and not have a shortfall of available retirement income.

What If You Stopped Later

Understandably, no one wants to work a little longer, but you have to look at what actions you can take that might let you start sooner and what would occur if you work later. If you retire sooner and lose some Social Security funding, does this mean you would need to reduce your travel budget? If so, you might have to consider working a few extra years, as aggravating as this might be, to better enjoy the time you have while retired.

2. Maximize Retirement Savings

Everyone should already be doing this, but if you are not already maximizing your 401(k) contributions, you should do so as soon as possible. Better yet, you should take advantage of employer matching if you are not doing so, as this is basically “free” money you can put toward retirement. Over time, both contributions compound and can grow significantly.

Catch Up On Savings

In 2025, the 401(k) contribution limit for those under 50 is $23,500, which your employers can match. However, if you are over 50, you can add money to contribute up to $31,000 in total dollars, which means the combined contribution for anyone over 50 can be as high as $77,500. If you take advantage of this between 50 and 60 years of age, this is an additional $775,000 available, and this is before compound interest, which at 6% interest for 10 years, can turn into $1.387 million.

1. Diversified Retirement Portfolio

The first thing anyone should be doing in preparation for a Social Security shortfall is to diversify their income streams. This means looking at anything and everything that could help boost a potential nest egg shortfall, like annuity products or dividend-paying stocks that are often overlooked instead of more stable income opportunities like Social Security.

Incorporate Broad Ideas

For understandable reasons, soon-to-be retirees need to start thinking outside the box to make up for a potential Social Security shortfall. This means looking at things like ETFs, rental properties, and other real estate investments that can provide rental income and even considering part-time work if the need arises. Unfortunately, any scenario where you need to boost returns to make up for a Social Security shortfall also means potentially updating your risk tolerance to be more aggressive.

The post Take These Financial Planning Steps if You’re Concerned About Social Security’s Future appeared first on 24/7 Wall St..