Suze Orman warns Americans of a Social Security, Medicare mistake

The personal finance personality has surprising practical advice for retirement.

The vast majority of working Americans understand that during their future retirement years, Social Security and Medicare are federal programs upon which they will rely for financial assistance to cover everyday costs and health care expenses.

Suze Orman, the personal finance author and media personality, warns U.S. workers about a few specific retirement lifestyle details they will need to comprehend and plan for in their post-working lives.

Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter

Many workers are able to take advantage of employer-sponsored 401(k) plans and also have other savings, such as investments in tax-advantaged Roth Individual Retirement Accounts (IRAs).

Related: Dave Ramsey warns Americans about a major Medicare problem

This is important because the average Social Security monthly paycheck of about $1,900 is not intended to be enough, on its own, to entirely fund a recipient's preferred way of life.

In addition to daily living costs, a major retirement expense people are often concerned about is health care. People can automatically enroll in Medicare at age 65, but premiums, prescription drug costs, deductibles and long-term care insurance — frequently a retiree's largest expenditure — can be significant financial burdens.

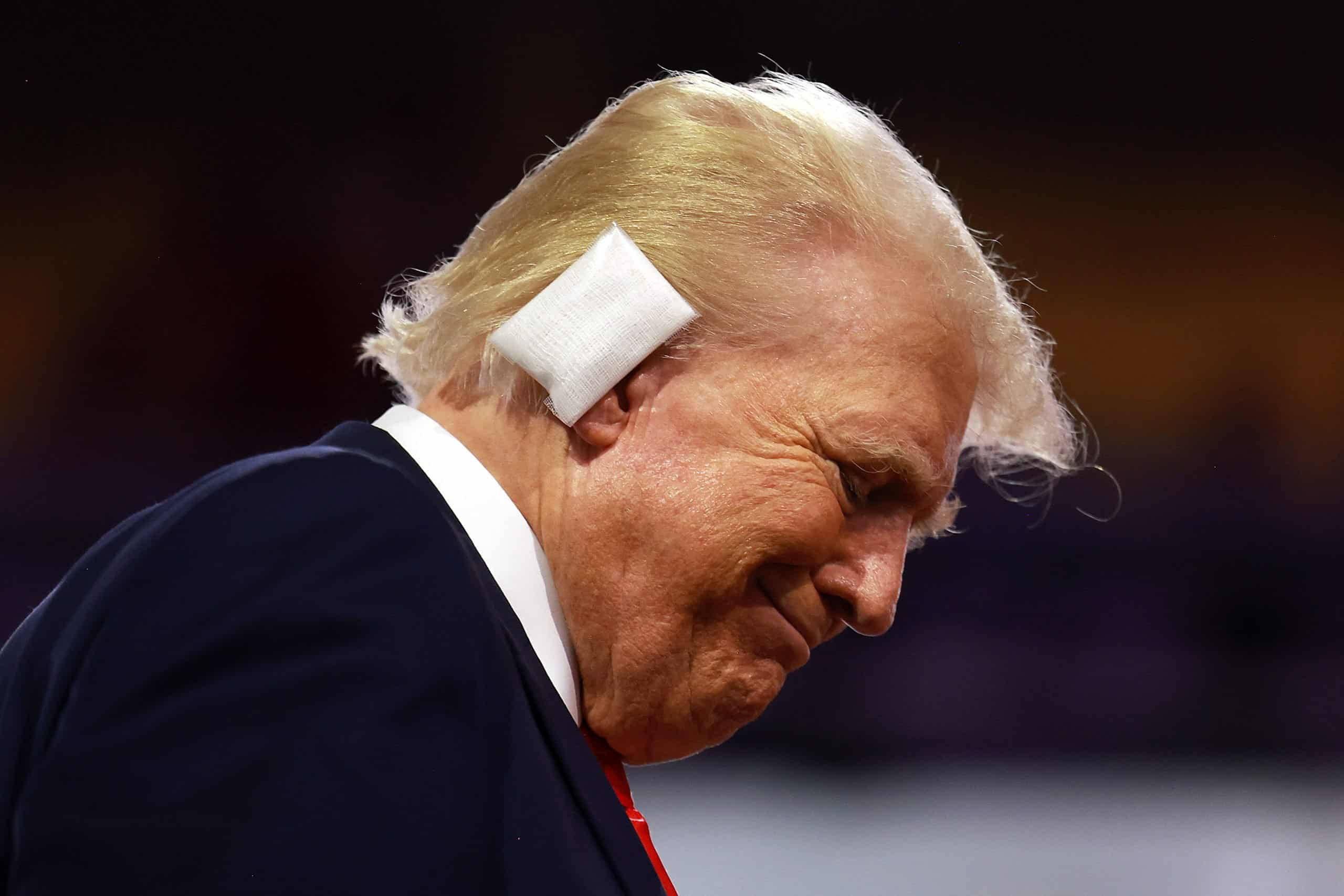

Taking these and other retirement worries into account, Orman offers a caution— and some surprising advice — to people doing their best to get a handle on these money challenges. Shutterstock

Suze Orman explains one Social Security mistake not to make

Current Social Security recipients will likely have noticed by now that in January 2025 they received a small increase in their monthly benefits.

This 2.5% cost of living adjustment (COLA) reflects an annual assessment by the Social Security Administration (SSA) of the amount needed to account for inflation. It is an effort to provide beneficiaries with some money to help keep up with rising costs.

But Orman has a warning for people that might be thinking of the 2025 COLA as a reason to change their current plans for claiming Social Security benefits.

More on Suze Orman

- Suze Orman has blunt words on Social Security for retired Americans

- Finance author delivers blunt advice on delaying Social Security benefits

- Orman explains how everyone can tame a big money fear now

"The COLA is not a reason to claim early," wrote Orman.

She explained that people can begin collecting Social Security paychecks when they turn 62, but that if they delay making their initial claim by a few years — or even until age 70 — they will receive a much larger monthly benefit.

"There’s no reason to consider claiming early because of the COLA," Orman wrote. "Once you turn 62, Social Security will credit your account with each year’s COLA even if you haven’t started taking your benefit."

Related: Tony Robbins warns Americans on Roth IRA, 401(k) obvious problem

Suze Orman has a surprising thought on Medicare expenses

Orman emphasizes the fact that health care costs in retirement (many of which, but not all, are covered by Medicare) are somewhat a matter of luck. Some people suffer from diseases and accidents that can come out of nowhere and are beyond people's control.

But she also has a warning and some unexpected advice that directly affects health care and retirement finances simultaneously.

"Here’s what we all also know deep down," Orman wrote. "Committing to healthy behaviors, or just reducing our unhealthy behaviors, is something we can do today that has two potential payoffs — we’re bound to feel better today, and it may help us maintain our health longer."

Obviously, maintaining better health is not only smart behavior from a quality-of-life perspective. It also cuts down on concerns and stress about Medicare and other health insurance bills during retirement.

"So here’s some non-financial retirement advice," Orman wrote. "Start addressing this retirement fear by taking a walk in the park, or whatever is nearby, as often as possible."

"That’s doable, right?"

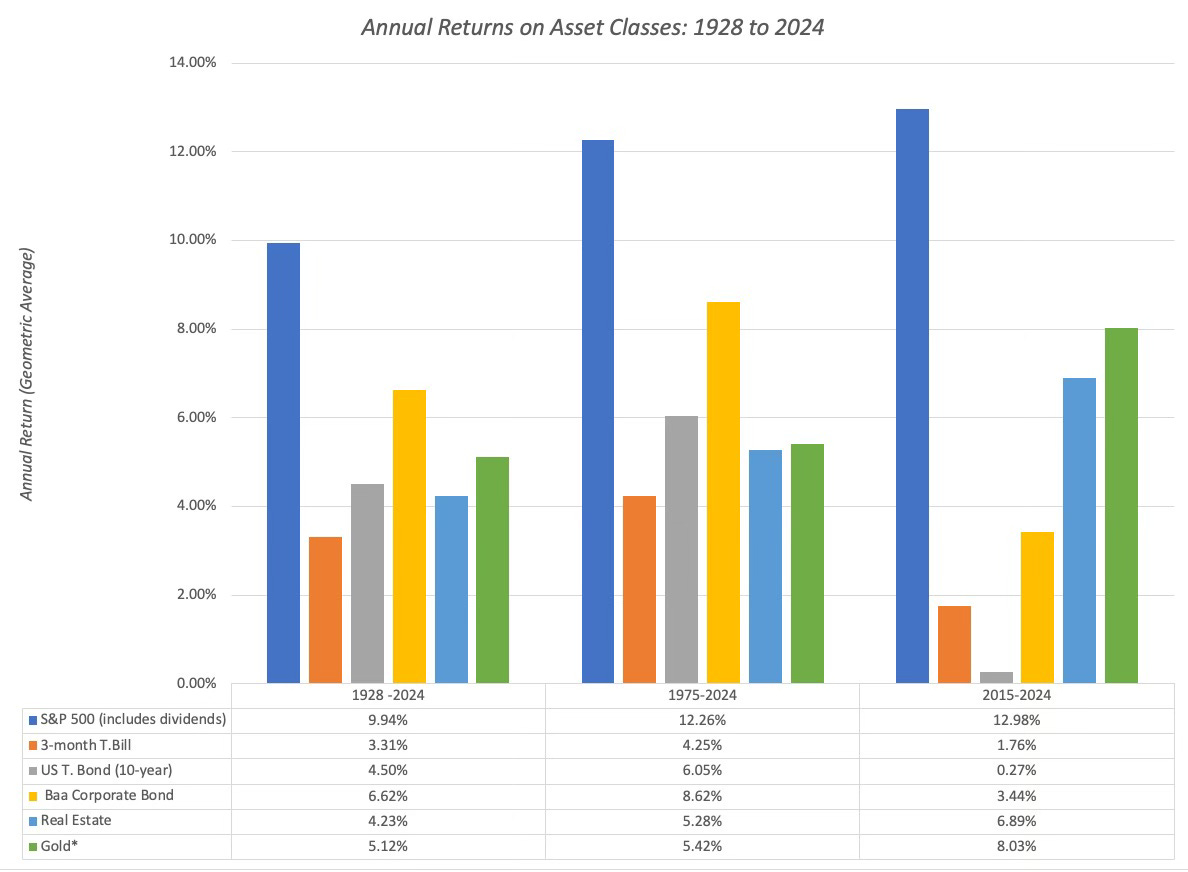

Related: Veteran fund manager issues dire S&P 500 warning for 2025