Stock Market Today: Stocks pause U.S.-China rally with inflation on deck

Stocks are set for a muted open with a key April inflation report expected before the start of trading.

U.S. equity futures nudged lower in early Tuesday trading as investors hit pause on one of the strongest rallies of the year heading into a key inflation reading prior to the opening bell.

Stocks ended firmly higher on Monday, with the S&P 500 rising 3.26% for its strongest single-day gain in six weeks following a weekend deal between the U.S. and China to pause reciprocal tariffs for at least three months.

The benchmark also closed north of its 200-day moving average, a key performance indicator, for the first time since March.

The Nasdaq, meanwhile, rose 4.35% to lift the tech-centered index into bull market territory, just a month after it booked a 20% bear market slump from its late December peak.

Global investors cheered the agreement, which could act as a template for U.S. trade talks with other countries over the coming weeks,

"Looking ahead, US-Japan trade negotiations remain stuck as Japan refuses to accept any deal that lacks sector-specific exemptions," said Georeg Vessy, lead FX strategist at London-based Convera.

"South Korea has completely abandoned the prospect of a trade agreement before the country’s presidential election on June 3," he added. "Meanwhile, in the Eurozone, officials are assembling a package of retaliatory tariffs targeting $100 billion worth of US industrial goods. So, this may be as good as trade policy gets, at least for now."

Investors also laid bets that the domestic economy will avoid recession this year as a result, with Goldman Sachs reducing those odds to around 35%.

That lifted U.S. Treasury bond yields, which move in the opposite direction of prices, and put an even greater focus on today's April inflation report from the Commerce Department.

Analysts expect headline price pressures jumped by 0.3% last month, with the annual rate holding at 2.4%, as tariff hikes bled into U.S. consumer goods and offset a pullback in energy costs and tumbling egg prices.

Benchmark 2-year Treasury note yields, which are highly-sensitive to interest rate changes, surged 12 basis points yesterday and were holding at around 3.981% heading into today's April CPI report at 8:30 am Eastern time.

The U.S. dollar index, meanwhile, pared some of yesterday's 1.5% gains and was last marked 0.21% lower at 101.542.

Related: Fed rate cut bets hammered by U.S.-China tariff truce

On Wall Street, stocks are set for a muted open, with futures contracts tied to the S&P 500 indicating a 16 point pullback and the Dow Jones Industrial Average priced for a 60 point decline.

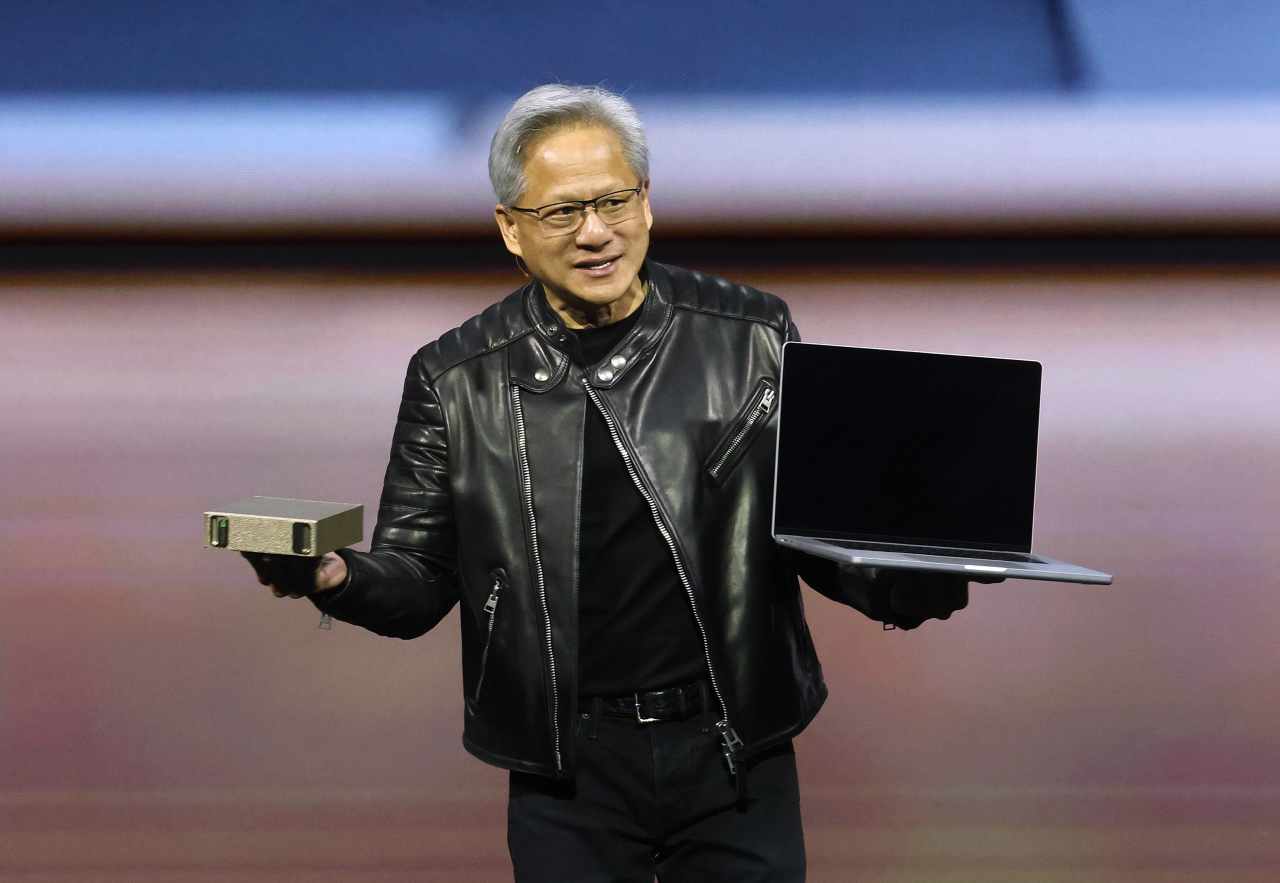

The tech-focused Nasdaq, meanwhile, is called 80 points lower with Nvidia (NVDA) , Tesla (TSLA) and Coinbase (COIN) , which was selected for inclusion into the S&P 500 last night, active in premarket trading.

More Economic Analysis:

- Fed inflation gauge sets up stagflation risks as tariff policies bite

- U.S. recession risk leaps as GDP shrinks

- Like it or not, the bond market rules all

In overseas markets, Europe's Stoxx 600 slipped 0.21% in mid-day Frankfurt trading, with Britain's FTSE 100 edging just a few points higher in a tepid London session.

Overnight in Asia, Japan's Nikkei 225, which missed out of yesterday's China-deal rally, rose 1.43% to close at a three-month high, while profit-taking pulled the regional MSCI ex-Japan benchmark 0.24% lower by the end of the session.