Ken Griffin says Trump won the election by promising lower inflation—so he needs to think ‘long and hard’ about how to protect Americans’ standard of living

Citadel founder Ken Griffin added that Americans may not even want the jobs that rebalancing the trade deficit may open up.

- Ken Griffin argues that while many voters supported Donald Trump expecting lower inflation and improved living standards, Trump's tariff policies risk causing price hikes and undermining that goal. He urges Trump to reconsider his foreign policy and warns that reshoring manufacturing could be inherently inflationary, putting further pressure on Fed Chair Jerome Powell's already difficult role in managing interest rates amid economic uncertainty.

Ken Griffin believes that when voters backed Donald Trump to the Oval Office, one of their main motivations was the belief that he would lower inflation and improve their standard of living.

Yet a couple of months after Trump's inauguration, consumer confidence is suffering as they eye potential price hikes because of Trump's tariff regime.

As a result, the Citadel founder and CEO has encouraged Trump to think "long and hard" about his foreign policy strategy moving forward.

"Ultimately, any effort to force manufacturing back onshore in the United States is going to be inflationary," Griffin told a Bloomberg podcast in an episode released today.

"There's no doubt about it. And what frustrates me on this is that one of the reasons that Trump won the election was the American people had had enough of inflation.

"They wanted a break from seeing their standard of living deteriorate by the ever-increasing price of goods and services."

Since the campaign trail when the president first began floating tariffs as a way to rebalance trade with the rest of the world's economies, experts have been concerned.

Their caution has covered American isolation through to fear of trade wars, and also price rises which would be expected to be passed back to consumers.

There is some debate over how inflationary tariffs may prove to be—after all, the sharpest end of the policy hasn't yet been felt. President Trump's 'Liberation Day' tariffs were paused a little over a week later, and reduced to 10% for the 90-day interim.

Likewise, while tariffs on nations like Canada and Mexico went ahead—and for a brief period, the 145% hike on Chinese imports—some reprieve can now be found in the further breather from tariffs announced by Treasury Secretary Scott Bessent on Monday.

Yet even with the tariff levels coming down, a 10% blanket raise on all imports will likely still raise prices.

"I really think that the president needs to think long and hard about ... protect[ing] the standard of living of the American people," Griffin added.

A Navigator survey of more than 5,000 voters in November found that the top reasons people backed the Republican candidate were that he would bring down inflation and improve the state of the national economy.

Likewise, in the weeks before the election, a New York Times and Siena College poll found 52% of people trusted Trump to lead the economy over Kamala Harris, who scored 45%.

Griffin added that Americans may not even want the jobs that rebalancing the trade deficit may open up: "I don't understand why we think it's a virtue to bring back to America low-skilled jobs in manufacturing. I complete agree with the president, we need the ability to ramp up our manufacturing base to strengthen our national defense—spot on.

"I don't think the American people are looking for a return to low-skilled, low-paying manufacturing jobs in our country. I don't think they want those jobs."

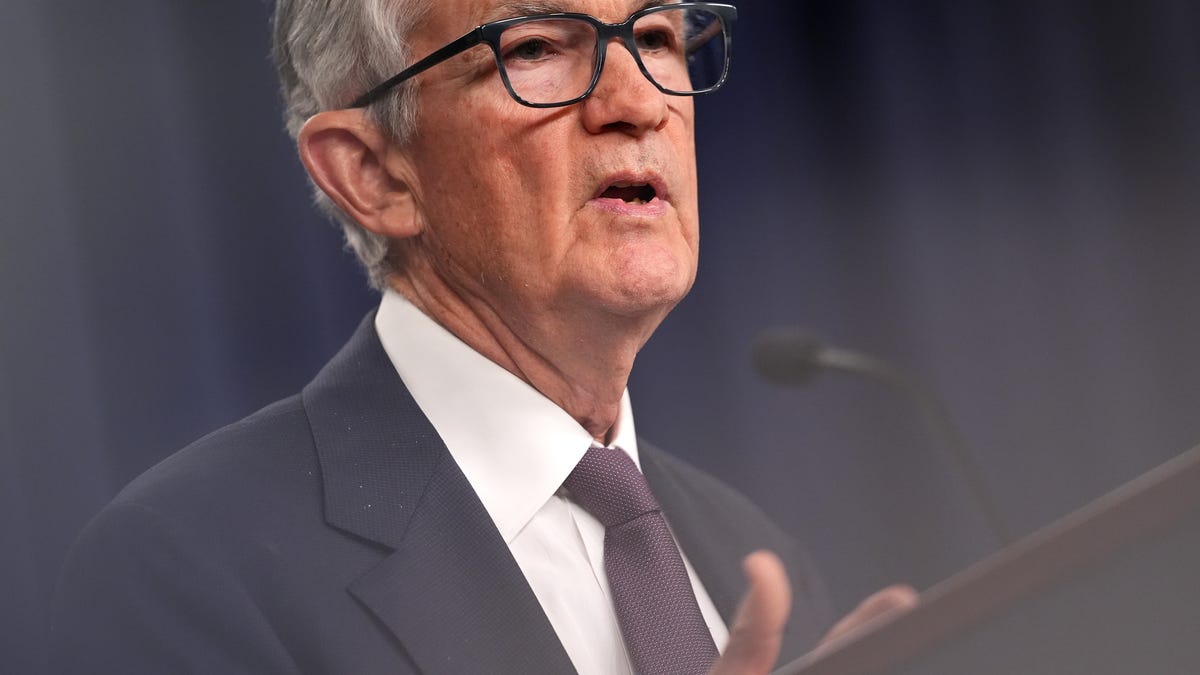

Powell's impossible task

Griffin, worth $43 billion according to Forbes, added that Fed chairman Jerome Powell's job is not one he would relish in the current environment.

Powell has been criticized by fellow economists and President Trump directly, who even suggested he would remove Powell from his post if he didn't cut the base rate.

Opinions are divided on whether Powell and the Federal Open Market Committee should normalize the base rate further to offset any economic slowdown or whether they are right to hold out for more data in an uncertain environment.

"I'm really happy not to have [Powell's] job," Griffin told the 'Bullish' podcast. "He has the biggest no-win job in the country because, through the lens of hindsight, we will always be able to second-guess every single decision he makes.

"Right here, right now, he's grappling with how do you cut rates as the labor market shows ever so slightly signs of softening? Or do you hold the course because of the risk of an inflationary spike coming from tariff increases? He's going to have to make that decision based upon evolving policies over the weeks ahead—it's a really tough predicament he's in."

This story was originally featured on Fortune.com