Pope Leo XIV may face a six-figure tax bill for his $33,000-a-month paycheck

Filing a tax return is obligatory for all U.S. citizens, no matter where they live.

- As an American citizen, Pope Leo XIV could be required to file a tax return with the U.S. government, and his tax liability may reach six figures. Because the U.S. taxes its citizens on their worldwide income, Leo will need to file a return, with some additional details based on the bank accounts he controls as head of the Vatican, unless the U.S. makes an exception for him or he renounces his citizenship, experts said.

One of the first things Pope Leo XIV may need to do as the newly elected leader of the Catholic Church has nothing to do with religion, but rather finances: finding an accountant.

The U.S. is one of only a handful of countries that taxes citizens living abroad. Thus, thanks to his American passport, the 69-year-old Chicago-born pope, known until last week as Robert Prevost, will likely need to file a tax return to the U.S. government just like any other citizen, experts told Fortune.

As pope, Leo XIV is entitled to a salary of 30,000 euros, or about $33,000 per month, which puts his annual earnings at about $396,000 per year. Unless given an exception, the first American pontiff may have an estimated tax liability of $135,287, which includes both federal and self-employment tax, based on his salary, Washington-based accountant Hector Castaneda told Fortune.

Edward A. David, an assistant professor in the department of theology and religious studies at King’s College London, told the Washington Post it’s hard to know whether the U.S. will insist on collecting the pope’s tax return, and it’s possible the government could exempt him. Still, Timothy Fogarty, an accounting professor at Case Western Reserve University, told Fortune it’s likely the pope would not be exempt.

“Although there is no accounting for the discretion that might be brought to bear, the new pope is unlikely to be exempt from U.S. income taxes. U.S. tax law claims the right to tax all citizens on their worldwide income. There is no blanket exception for religious personnel nor for people who are diplomats/head of state for foreign countries such as the Vatican,” said Fogarty.

The Treasury Department did not immediately respond to Fortune’s question on whether the pope could receive an exemption.

From 2015 to 2023, Leo XIV served as Bishop of Chiclayo, Peru, where he likely already dealt with the far-reaching U.S. tax system. Yet, because of his higher salary, should he accept it, and his control over Vatican financial accounts, filing a tax return may be more complicated than ever.

Filing a tax return is obligatory for all citizens, and if the laws were applied as they would be for every other citizen, Leo XIV may face a hefty tax bill.

"No matter where a religious leader is based, they still have to pay U.S. taxes on their income if they keep their U.S. citizenship,” Castaneda said.

A spokesperson for the IRS declined to comment to Fortune about Pope Francis’ tax liability.

“By law, federal employees are barred from disclosing tax return information,” the spokesperson said.

Still, the pope may have some, but not many, options for reducing his tax bill, Linda Jensen, the founder of Heart Financial Group, told Fortune.

Apart from the $14,600 standard deduction, Leo may be eligible to deduct costs associated with his housing if he receives an allowance or lives in Vatican-provided housing like the papal apartments or the deceased Pope Francis’ preferred residency, Casa Santa Marta.

The IRS allows religious leaders to deduct the lesser of an official housing allowance, actual housing expenses, or the fair rental value of the home (including furnishings and utilities), from their tax bill, said Jensen.

Members of the clergy are considered self-employed for the purposes of Social Security and Medicare taxes, Jensen said, but if Pope Leo previously claimed a conscientious religious objection to public insurance early in his career, he may be off the hook for those taxes.

Usually, Americans who earn money abroad are able to deduct $130,000 of foreign earned income, but it's doubtful this would apply to Leo XIV as the rule excludes income earned from a foreign government, like the Vatican.

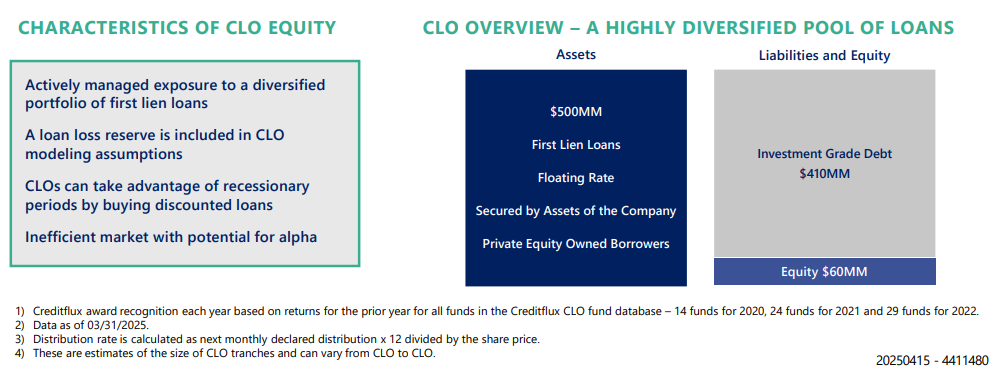

Pope Leo XIV’s American citizenship may have also inadvertently brought a major financial complication to the Vatican. Under the Foreign Account Tax Compliance Act, which was aimed at cracking down on offshore tax evasion, the Vatican is required to report to the IRS the details of Americans’ bank and brokerage accounts, which in theory would include Leo XIV’s accounts, said Jensen. Because of his authority over offshore accounts as head of the Vatican, Pope Leo XIV may also need to file a form 8938 with the IRS.

Finally, U.S. citizens with “signature authority,” or ultimate control of a bank account containing more than $10,000, also have to file a Foreign Bank Account Report to the Treasury Department's Financial Crimes Enforcement Unit. As of 2023, the Vatican Bank had holdings of $6.1 billion.

“As a U.S. citizen abroad with significant foreign ties, he has complex reporting obligations. Even the Pope might need a great CPA,” said Jensen.

This story was originally featured on Fortune.com