I’m a big savings nerd. These are the biggest money mistakes I see people make.

For some people, managing money is a chore. For others, it’s a hobby. In this Reddit post, we have someone who clearly enjoys coming up with ways to better their finances. And they’ve shared some of their top tips to make it easier for people who may be less savvy to improve their financial […] The post I’m a big savings nerd. These are the biggest money mistakes I see people make. appeared first on 24/7 Wall St..

Key Points

-

Some people like to share financial advice to help others.

-

A Reddit user points out that consumers commonly overpay for certain purchases and don’t utilize the right savings accounts.

-

They think working with a financial advisor is also key.

-

Are you ahead, or behind on your financial goals? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

For some people, managing money is a chore. For others, it’s a hobby.

In this Reddit post, we have someone who clearly enjoys coming up with ways to better their finances. And they’ve shared some of their top tips to make it easier for people who may be less savvy to improve their financial pictures, too.

Here are the biggest mistakes the poster thinks people make – and how to avoid them.

1. Overpaying for auto insurance

If you drive a car, auto insurance is an expense you can’t get out of. But that doesn’t mean you can’t get a better rate.

You may want to use a third-party service to compare car insurance rates and see what comes up. But also, you may be able to take steps to lower your auto insurance premiums if you decide to stick with the same insurer. See if there’s a discount for being a low-mileage driver if that applies to you, or for taking a defensive driving course.

2. Paying more than necessary for online purchases

The whole purpose of shopping online is to enjoy the convenience of not having to go to a store. So you may be inclined to buy things online without really comparing prices.

The poster here suggests using a price comparison tool to help you identify the lowest prices online. If you install one of these, the tool will do the legwork for you.

3. Not getting help tackling debt

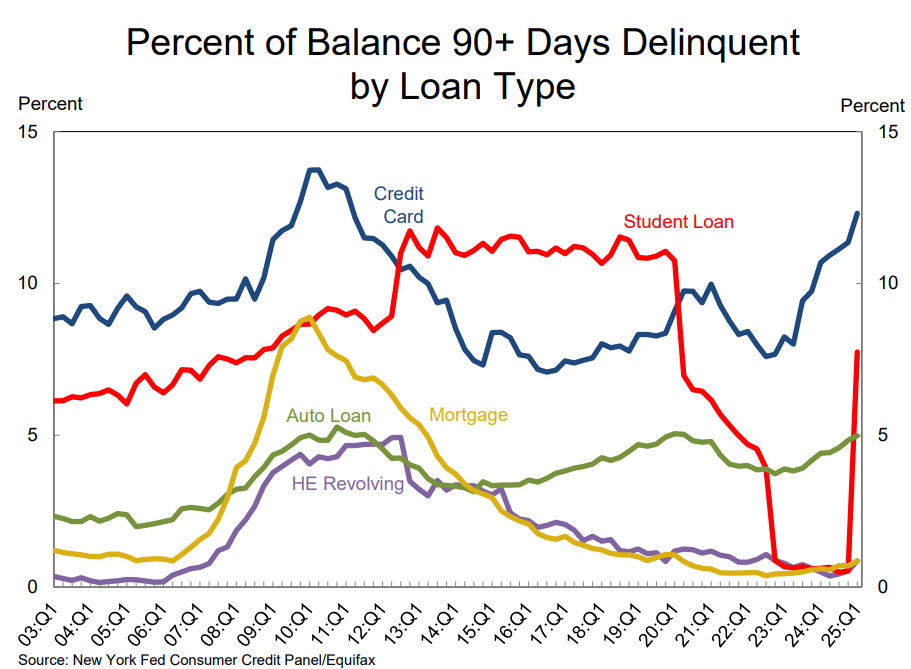

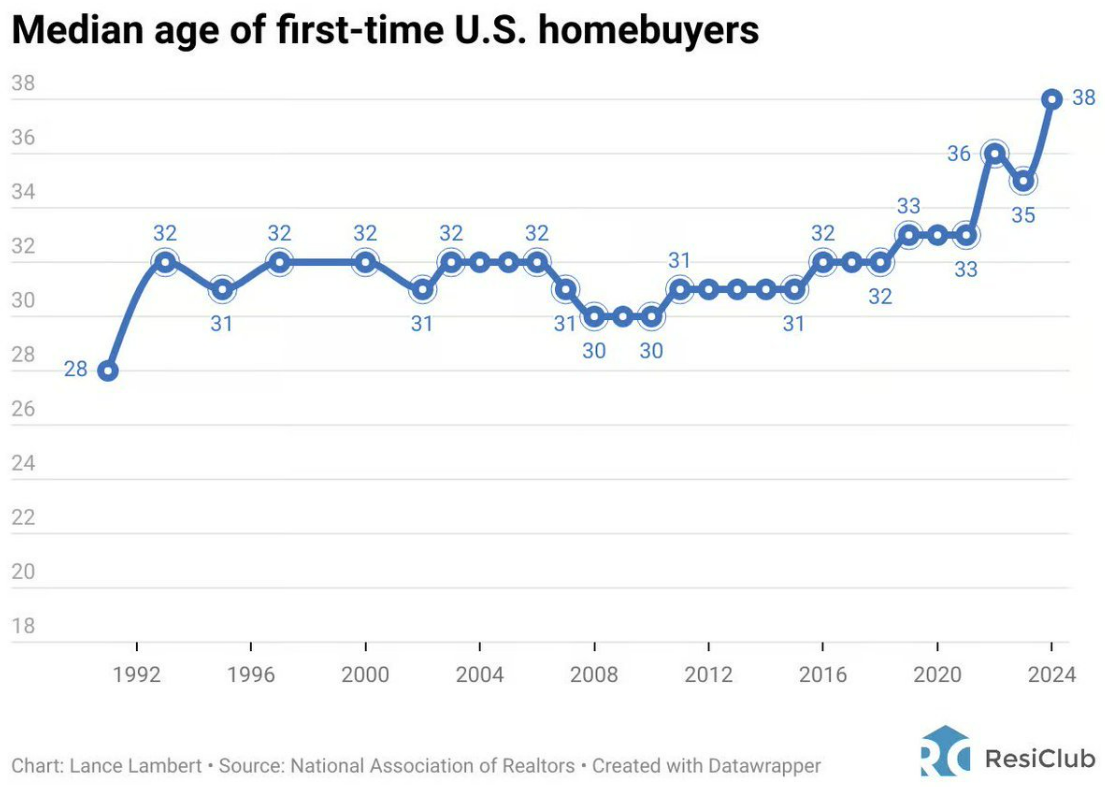

Many people have piles of debt, whether it’s credit card balances or personal loans. There are certain types of debt that are very hard to negotiate, like student loans. But you may be able to negotiate your credit card or personal loan balances if you’re struggling to make payments.

You can negotiate with your lenders and credit card issuers on your own. But you could also look to a debt settlement company for assistance.

However, be mindful of the fact that debt settlement companies aren’t a charity. You’ll pay a fee for that service.

4. Using regular savings accounts

Money you have for emergencies or near-term goals should be kept in a savings account. But you don’t have to settle for a savings account with an interest rate that’s only mediocre.

These days, many high-yield savings accounts are paying generous amounts of interest. So it pays to shop around for rates and put your money someplace where you can earn more on it.

As a general rule, online banks tend to offer better interest rates than physical banks. That’s because they have less overhead.

5. Not using a financial advisor

It’s a big myth that you need to be wealthy for a financial advisor to make sense. Even if you’re just starting out on your financial journey and don’t have a lot of money, a financial advisor can help you work toward various goals so you can feel confident you’re on the right track.

It’s a good idea to talk to various financial advisors to get a sense of who you want to work with. But also, you may want to favor a financial advisor who’s a fiduciary. This means they’re required to put your best interests first at all times.

The post I’m a big savings nerd. These are the biggest money mistakes I see people make. appeared first on 24/7 Wall St..