Stock Market Today: Stocks end mixed after CPI inflation shock

Investors reacted to inflation data, Powell testimony, a 10-year auction and potentially new tariffs,

Updated at 5:06 PM EDT by Rob Lenihan

Stocks ended lower Wednesday as investors picked through a hotter-than-expected January inflation report while bracing for another round of tariff announcements from President Donald Trump.

The Dow Jones Industrial Average tumbled 225.09 points, or 0.5%, to finished the session at 44,368.56, while the S&P 500 lost 0.27% to close at 6,051.97 and the tech-heavy Nasdaq squeaked up 0.03% to close at 19,649.95

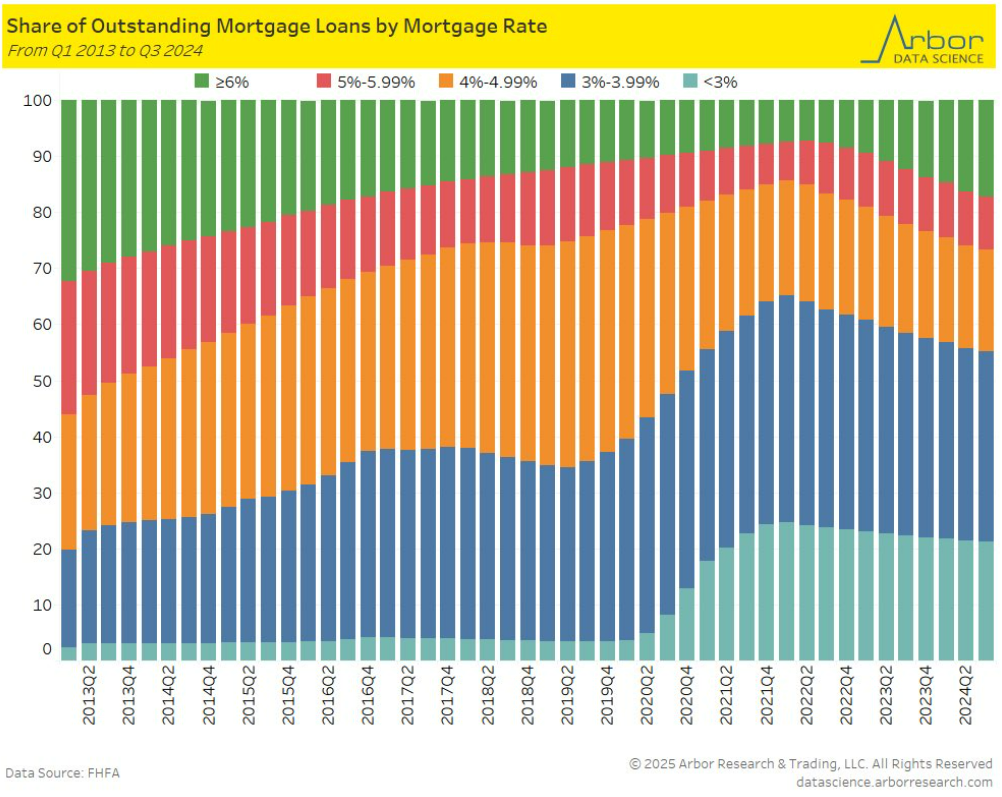

Regarding consumer prices, Jamie Cox, managing partner for Harris Financial Group, said “lack of progress on inflation is the story here—this is not the start of a resurgence in inflation.”

"If these levels of inflation persist, the Fed will be on hold until October," he said. "Food and Energy are big players in the hot reads, so there’s a chance we get a little reprieve in the spring."

.

Updated at 12:33 PM EST

The elephant in the room

Fed Chairman Jerome Powell's second day of testimony on Capitol Hill, this time in front of the House Financial Services Committee, repeated his "higher for longer" message on rates while noting, for the first time, the likely inflationary impact from new tariff announcements.

Powell told lawmakers that the central bank could "possibly" need to change policy rates on the basis of trade policy, adding he and his colleagues were attempting to forecast the impact of tariffs on inflation pressures.

"The Fed has no roll in setting tariffs," Powell said. "It's possible the economy could evolve in ways that because of tariffs...we would need to do something with our policy rate, but we can't know what that is until we actually know what policies are enacted."

J Powell is being much more deferential to Trump and Trumps policies than he was in his first term.

Quote “Trump was elected to enact his policies on tariffs, immigration and fiscal policy. It’s not the Feds job to question the wisdom of congressional action or Trumps…— Kip Herriage (@KHerriage) February 12, 2025

Updated at 10:41 AM EST

Watch the bonds

Treasury yields are holding their recent advance into the morning session, with 10-year notes trading at 4.654% following the hotter-than-expected inflation report and ahead of a $42 billion auction in new benchmark paper later this afternoon.

Benchmark 2-year notes, meanwhile, were last marked at 4.367%, a notable level in that it sits just below the Fed's effective funding rate of 4.375%.

Stocks are paring their earlier slump, however, with the S&P 500 last marked 22 points lower on the session, with the Nasdaq down 31 points.

"Higher-for-longer may have just gotten a little longer," said Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management.

"The Fed has been waiting for clear signs that inflation is trending lower again, and this morning they got the opposite," she added. "Until that changes, the markets are going to have to remain patient about additional rate cuts."

Related: CPI inflation shock hammers Fed rate cut bets for 2025

Updated at 9:32 AM EST

Big slide

The S&P 500 was marked 60 points, or 1% lower in the opening minutes of trading, with the Nasdaq falling 224 points, or 1.12%.

The Dow was marked 396 points lower while the mid-cap Russell 2000 fell 34 points or 1.5% following the hotter-than-expected CPI release.

"The immediate reaction to today’s report will likely weigh on stocks in the short term, as a higher-than-expected print further lowers the odds of rate cuts from the Fed this year and stokes investors’ reflationary fears," said Bret Kenwell, U.S. investment analyst at eToro.

"That said, we do tend to see higher inflation numbers at the start of the year, while investors have to wonder if companies were front-loading their orders to get ahead of potential tariffs that had the potential to go into effect later this quarter," he added. "Ultimately, it will take a few more reports to see how any of these potential trends take shape, which could pave way for near-term uncertainty."

S&P 500 Opening Bell Heatmap (Feb. 12, 2025)$SPY -1.09%