Stock Market Today: Does Iran Even Matter When Tesla's Robotaxi Is on Call?

Stocks are off their best levels of the day while all investor eyes are on Tesla shares.

Update at 11:56 a.m. EDT

Stocks Pare Gains; Tesla in Focus

Check the numbers: Stocks are off their best levels of the day but remain in the plus column.

It's the Nasdaq Composite Index that's strongest today, up 0.43%. The S&P 500 and Dow Industrials are up 0.36% and 0.12%, respectively. Megacap name Tesla (TSLA) is driving the Nasdaq and S&P higher, with shares of the electric-vehicle maker up nearly 10% following the launch of the Robotaxi.

More stocks are up than down today: About 60% of all stocks traded are up, although that number appears to be narrowing.

The heatmap shows that standout performers today, besides Tesla, include select technology stocks, industrials and real estate.

The Energy and Health Care sectors are lower today. All others are higher.

In other markets, bonds have continued to rally, with the long end of the U.S. treasury curve up 0.52%.

Gold is higher as investors indicate some uncertainty. The yellow metal is higher by 0.45% and remains within range of its all-time high.

Crude oil is off more than 1% as the Strait of Hormuz remains open, although many shippers are avoiding the area.

Back to Tesla.

The Austin company has been reporting smooth sailing with the Robotaxi launch and suggests that it will save lives.

Yes https://t.co/rTzW2UXn4t— Elon Musk (@elonmusk) June 23, 2025

Time will tell whether that's the case. That would assume that Tesla's Full-Self-Driving system drives more efficiently than humans do and that it can drive in bad weather, which it currently cannot.

I've used FSD before in my own Model 3 and had to take over control more than once on a lovely, lightly trafficked morning in my town. It's truly amazing technology, but my experience was that at present it's not a lifesaver.

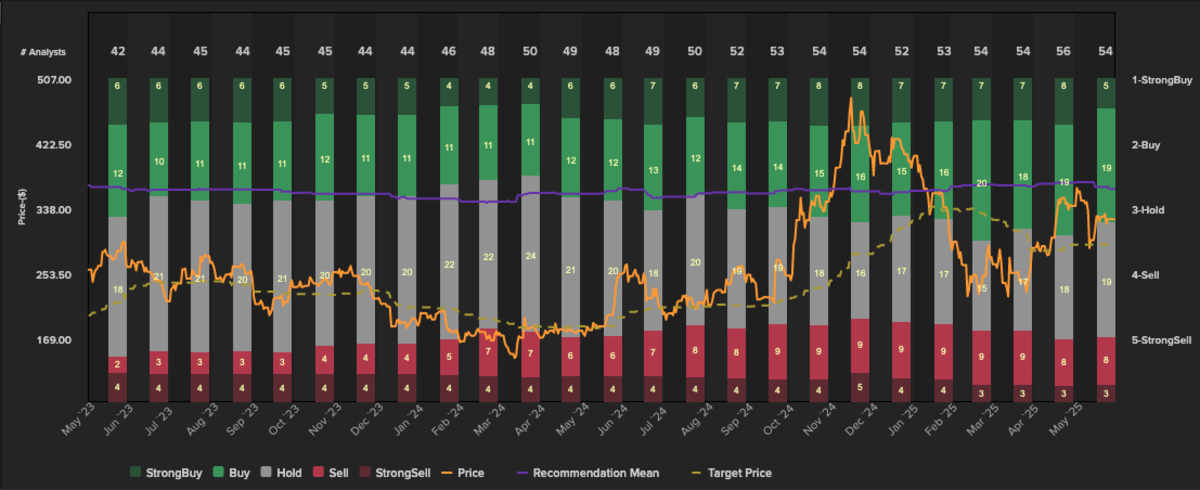

Analysts are mixed on the prospects for the company, and the number of strong buy ratings has declined so far this month.

Refinitiv Workspace shows that just five analysts now rate the stock strong buy, versus eight in May. This is the lowest number of strong-buy ratings in over a year. Sell ratings rose to 19 from 18.

The 54 analysts rating the stock have a collective target price estimate of $289.99, which indicates that shares are currently 18% overvalued.

As I've said before, Tesla shares have been a poor investment since late 2021. They've been in a sideways trend since then, offering excellent trading opportunities but poor returns for investors. See the yellow box in the chart below. Besides, if you own an S&P 500 index fund, you already own Tesla. Do you really need more of a stock that is trading at 153 times trailing earnings?

Stock Market Today

Not exactly the reaction in the markets I'd have expected this morning!

As you've undoubtedly heard, over the weekend the U.S. attacked Iran's nuclear capabilities. It was called Operation Midnight Hammer. While President Trump had telegraphed that it would happen over the next two weeks, this type of entry into a war is rarely met with a yawn by the markets.

But that seems to be what we've got today.

Stock futures are trading slightly lower, bond futures are up modestly, and gold and oil are off by less than half a percent.

What gives?

Well, for one thing, investors appear to believe that the conflict will remain in that region and not spill over to the U.S. Israel has severely weakened Iran's ability to lead an offensive, and other Middle East countries have not stepped in to help the Islamic Republic. I guess it pays not to bully your neighbors and friends.

Whether you think this attack was a good thing or a bad thing, we will know only with the benefit of hindsight. Likely many years from now.

Until then all we have is the market in front of us.

And could that market be weakening?

Helene Meisler notes that stocks are little changed over the past month and that investor sentiment has changed. Bulls now outnumber bears, to the point that could indicate that the market is ready to turn lower. At the same time, market breadth, or the number of stocks going up vs. down, seems to be weakening.

While this isn't a sell signal, it bears attention.

Finally, could we be nearing the point where small caps could outperform?

* The S&P 500 has outperformed the Russell 2000 since March 2021

* Large-cap stocks tend to outperform during late-stage economic expansion

* Small-caps stocks tend to outperform during recessions and early-stage recoveries

* S&P 500 dividend index futures paint a more optimistic… pic.twitter.com/uDDVKdD5Df— Tobias Carlisle (@Greenbackd) June 22, 2025