Filthy Rich Animal Asks: Why Are Ferrari Shares Priced Like Its Cars?

Shares of the Italian luxury-auto maker are priced like a luxury good. Do they deserve the love that investors are giving them?

Are you reading TheStreet Pro’s Filthy Rich Animal?

If not, Filthy Rich Animal is TheStreet Pro’s newsletter for newer investors. We’re here to help you get started and to keep you going as you get closer to retirement, and beyond!

Each week we publish two articles, using as little financial jargon as possible. One article will be actionable: It helps you become a better investor. The other is educational: We call it the Question of the Week, which I’m also sharing below.

So, if you’d like content like this sent directly to your email inbox, subscribe here.

The Question of the Week: Ferrari Is Firing on All Cylinders. Is Its Stock Priced Like Its Cars?

Before we get to this week’s question, close your eyes and pretend that I can give you any car you want. If I could just give you any car in the world, right now, what would you ask for?

Was the first car to pop into your head a Ferrari?

It probably was for many of you. After all, it’s one of the most important and well-known luxury brands in the world.

Sadly, while most of us can’t afford to own a Ferrari, there is a piece of Ferrari that all of us can buy. And that’s ownership in Ferrari itself. That’s right, we can buy the stock!

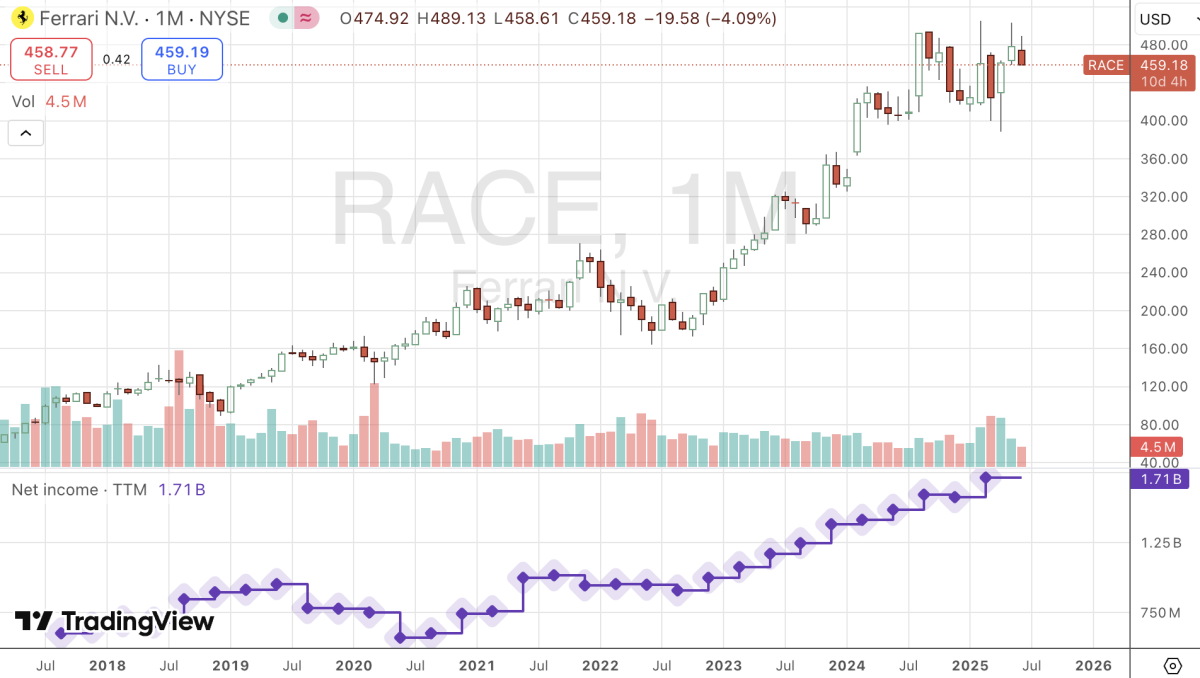

Ferrari (RACE) has been a publicly traded company since late 2015. During that time, its shares have increased from a low of $29.27 to a recent high of more than $500. I’ll admit to having watched the stock for years but have never pulled the trigger to buy it. I’d be driving a Ferrari if I had.

The thing is, at $460 Ferrari stock trades like a luxury good.

It has a price-to-earnings multiple of more than 45!

For the past 12 months the company earned $8.81 a share. That means that when you buy a share of Ferrari today, you’re paying more than 45 times one year’s earnings for that share. To say it another way, if the company were to buy the share back from you, it would take them 45 years to earn enough money to do so.

You could buy other car companies for much less. Mercedes MBGYY trades at just 5.5 times its prior 12-month earnings. GM (GM) trades at 7 times and Ford (F) at just 8.35 times.

Of course, all those are relatively inexpensive compared with Tesla (TSLA) , which trades at 174 times its trailing 12 months’ earnings.

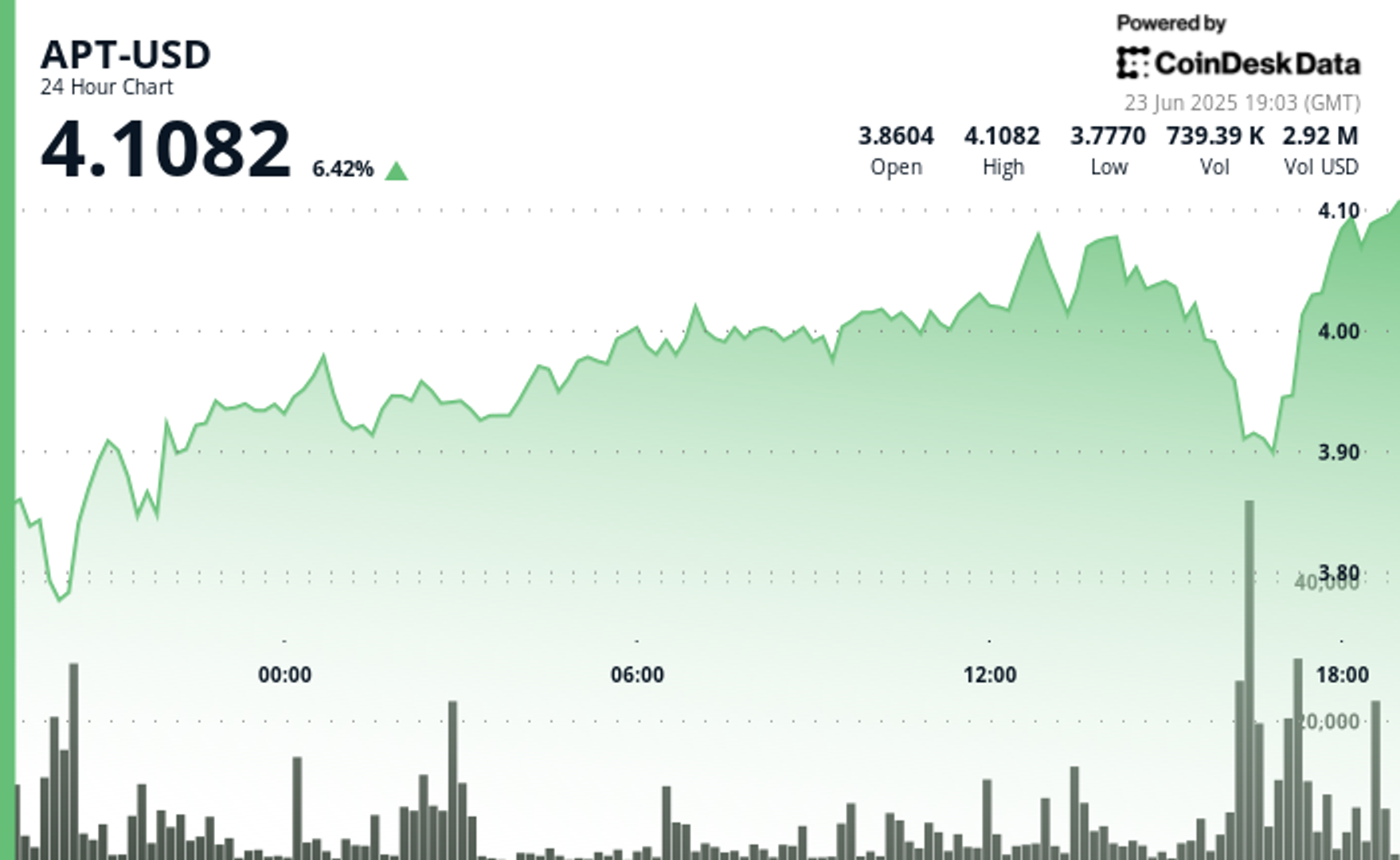

Here’s a table:

Back to Ferrari. Compared with the other car companies, investors definitely see something here. They love the stock!

The Question of the Week is, why would investors want to buy Ferrari shares when it has such a high price-to-earnings ratio?

ANSWER

Last weekend Ferrari won the most prestigious and challenging 24-hour endurance racing event. They won the 24 Hours Of LeMans.

It’s a big deal for a couple of reasons. First, it’s one of those great stories of triumph over adversity that we all love.

Ferrari dominated sports car racing from its founding in 1948 pretty much through 1965. Led by Enzo Ferrari, the company won Le Mans six years in a row from 1960 through 1965. And then Ford came on the scene. If you’ve seen Ford vs. Ferrari, you know that Ford won in 1966; in fact, Dearborn took home all the trophies through the 1960s. And then Porsche (POAHY) dominated.

Well, Ford knocked Ferrari off its endurance racing pedestal in 1966 and the Maranello, Italy, company didn’t win at Le Mans again until two years ago. And then it won last year. And this year.

They’re back!

Not only that, one of the drivers, Robert Kubica, had been tapped to drive a Ferrari in F1 competition back in 2012, but had a devastating crash that derailed his career at the top level of motorsports.

Well, Kubica worked his way back, migrating to endurance cars, which perform like F1 cars, but are made to race for up to 24 hours at a clip.

In 2024, Ferrari tapped Kubica to join its endurance racing team. His car failed to finish in that race but was victorious this past weekend.

These two comeback stories showcase how hard it is to succeed in motorsports but also how sweet the victory is.

So, is Ferrari, the stock, as sweet as Ferrari’s motorsports victory this year?

Here’s the thing about Ferrari. It’s not just a car company. It’s a lifestyle brand. Sure, the core of its business is selling cars. But its cars are not transportation. So, Ferrari should not trade like a regular car company.

You could say the same about Tesla, which trades on car sales but also on the reputation of CEO Elon Musk and assumptions about the electric-vehicle company's growth in AI and robotics.

Surely, however, Ferrari should trade like a regular stock? And the S&P 500 has a PE of something more like 28, which is really high historically. Even Alphabet (GOOGL) has a PE below 20. And Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) has a PE below 13!

So why would Ferrari trade for such a high price relative to its earnings?

Ferrari has three qualities that separate it from the competition: a wide moat, strong margins, and leading growth.

MOAT

When Morningstar analysts evaluate a company, they look to see whether the company has a competitive advantage over its peers. They call this a moat, and companies like Ferrari are said to have wide moats because they have strong brand recognition, high pricing power, and strong customer loyalty.

Racing is a part of that moat. and when Ferrari wins its customer loyalty increases. In fact, racing is literally part of Ferrari’s marketing plan. As the old saying goes, win on Sunday, sell on Monday.

MARGINS

Ferrari, with its high pricing power and multiyear customer waiting lists, is able to charge premium prices for its products. The profit that the company makes on each car is higher than that of other car companies, including premium manufacturers like Porsche.

GROWTH

Ferrari has shown consistently stable earnings growth of around 18% annually over the past five years, according to data shown on my Schwab research portal. Analysts expect that to continue for the next five years, too. Even Tesla isn’t expected to grow that quickly.

Summary

So here’s the thing. Ferrari does deserve to trade with a much higher valuation than other car companies. Its wide moat means that other companies can’t easily compete for Ferrari’s customers. The company's customer loyalty means that Ferrari can charge a higher price for its cars and be more profitable. Last, those customers have money to spend and have enabled Ferrari to grow at a pace that’s nearly as fast as its race cars.

You can see this in the price/earnings growth multiple (aka PEG) in the table above. Ferrari trades with a PEG multiple of a little over 4. This multiple takes the PE and divides it by growth.

By comparison, Tesla has a PEG of more than 7. Ferrari is a much better value than Tesla.

I like this multiple because it tells a better story than just the PE. It allows growth companies to have a higher PE because they deserve it — well, they deserve it if they can continue to grow.

Does this mean you should buy Ferrari shares? You’ll have to do your own research. I said that the company deserves to trade at a higher valuation than other car companies — but it's still anything but cheap.