S&P 500 (VOO) Live: Trump Administration Blasts Amazon.com, and the S&P 500 Tumbles

Stock markets opened lower on Tuesday, threatening to break the S&P 500’s five-day winning streak, although the market is moving back towards breakeven now. The S&P 500 opened 0.3% lower this morning, and the Vanguard S&P 500 ETF (NYSEMKT: VOO) likewise opened down 0.3%. T In political news, White House press secretary Karoline Leavitt blasted […] The post S&P 500 (VOO) Live: Trump Administration Blasts Amazon.com, and the S&P 500 Tumbles appeared first on 24/7 Wall St..

Stock markets opened lower on Tuesday, threatening to break the S&P 500’s five-day winning streak, although the market is moving back towards breakeven now. The S&P 500 opened 0.3% lower this morning, and the Vanguard S&P 500 ETF (NYSEMKT: VOO) likewise opened down 0.3%.

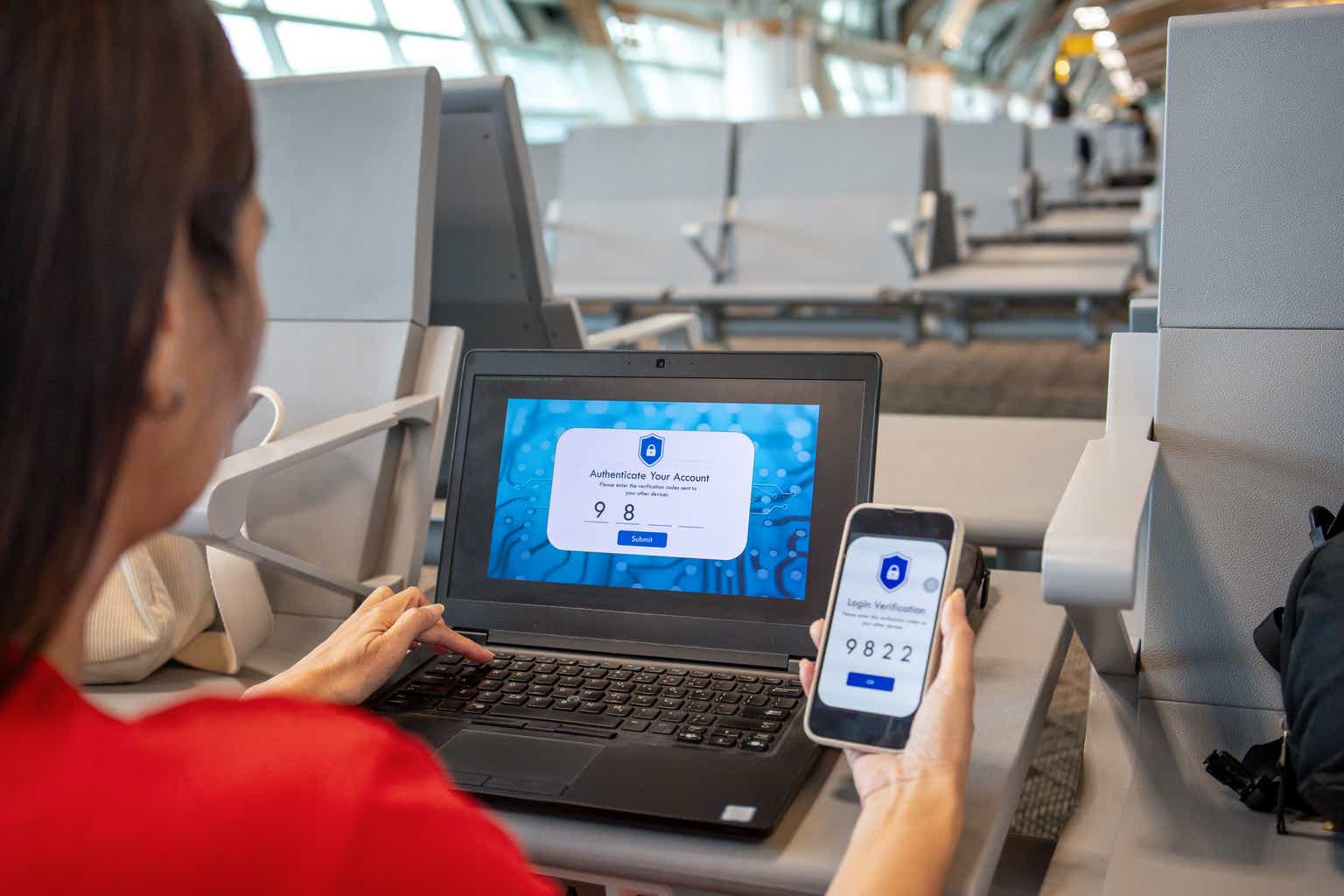

T In political news, White House press secretary Karoline Leavitt blasted a reported plan by Amazon.com (Nasdaq: AMZN), to display the cost of wares on its site next to the amount the cost was inflated by tariffs cost, as a “hostile and political act.”

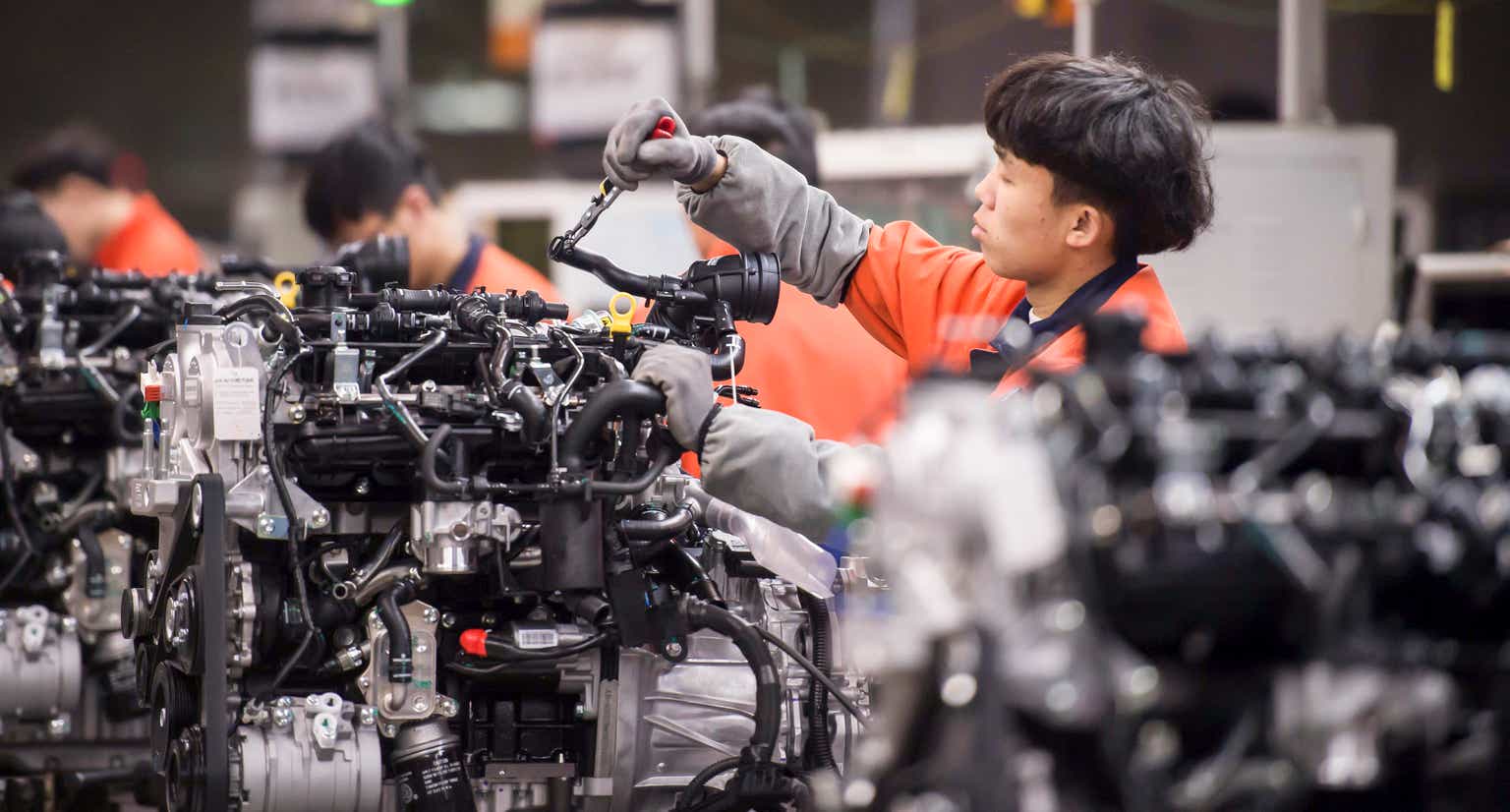

Things could be worse, though. Last night, Commerce Secretary Howard Lutnick promised to “reward … companies who manufacture domestically” by reducing tariffs on foreign auto parts used to manufacture cars in the U.S. General Motors (NYSE: GM) CEO Mary Barra responded to the news by promising to “invest even more in the U.S. economy.” Ford (NYSE: F) CEO agreed that the move “will help mitigate the impact of tariffs on automakers, suppliers and consumers.”

Earnings

Speaking of General Motors, the automotive giant reported this morning that its Q1 profits came in at $2.78, $0.17 ahead of analyst forecasts. Commercial truckmaker Paccar (Nasdaq: PCAR) on the other hand reported profits $0.14 below forecasts.

In housing, we see LGI Homes (Nasdaq: LGIH) miss badly, but paintmaker Sherwin-Williams (NYSE: SHW) beat.

In airlines, Jetblue Airways (Nasdaq: JBLU) reported a $0.59 per share loss, but this was $0.02 better than the $0.61 per share loss it was expected to report.

Analyst Calls

Analyst action is so far muted. Swiss bank UBS upgraded cranemaker Crane (NYSE: CR) to buy. Tariffs war and “market uncertainty” notwithstanding, UBS says it’s “increasingly confident in the long-term earnings outlook and M&A opportunity” for the company.

Not everyone’s so confident, however. Already this morning we’re seeing downgrades outnumber upgrades, with Stifel cutting Builders FirstSource (Nasdaq: BLDR) to neutral, Bank of America lowering ConocoPhillips (NYSE: COP), also to neutral, and TD Cowen downgrading GLP-1 drugs compounder Hims & Hers (NYSE: HIMS) to hold, citing increased competition from Novo Nordisk (NYSE: NVO) and Eli Lilly (NYSE: LLY), and a lack of near-term catalysts to move the stock higher.

The post S&P 500 (VOO) Live: Trump Administration Blasts Amazon.com, and the S&P 500 Tumbles appeared first on 24/7 Wall St..