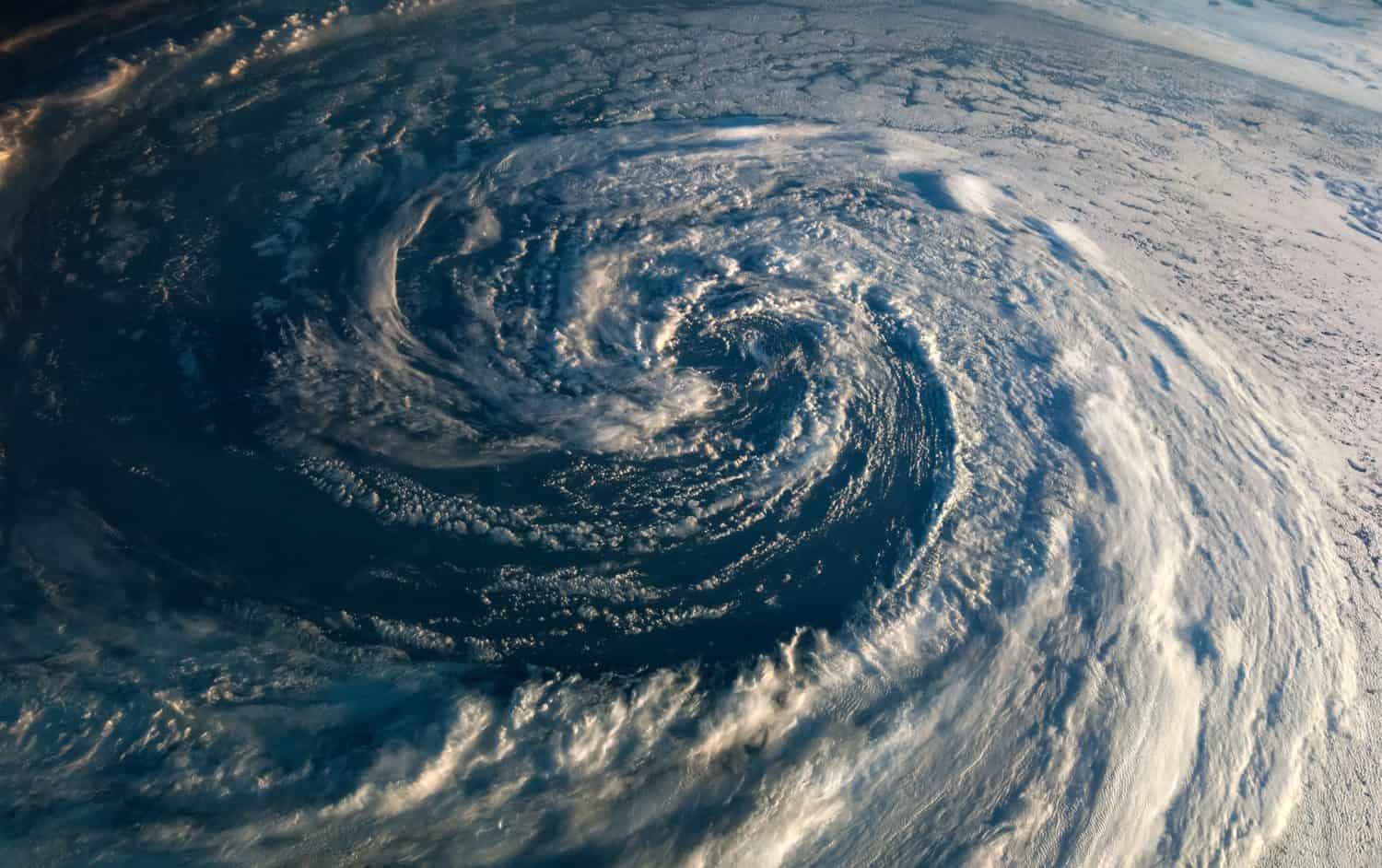

S&P 500 (NYSEARCA: SPY) Live: NEM (NYSE: NEM) and DFS (NYSE: DFS) Rise in Eye of Storm

Live Updates Live Coverage Updates appear automatically as they are published. Fanning the Flames 10:43 am by Gerelyn Terzo The markets remain volatile, with each of the major stock market indices down about 2% on the day. After losing ground last week, the S&P 500 is starting this week on a down note, pressured by […] The post S&P 500 (NYSEARCA: SPY) Live: NEM (NYSE: NEM) and DFS (NYSE: DFS) Rise in Eye of Storm appeared first on 24/7 Wall St..

Live Updates

Fanning the Flames

The markets remain volatile, with each of the major stock market indices down about 2% on the day. After losing ground last week, the S&P 500 is starting this week on a down note, pressured by stocks like Universal Health (NYSE: UHS), Tesla (Nasdaq: TSLA) and Blackstone (NYSE: BX.) While earnings season continues to unfold, the markets are fixated on the trade wars and are looking for closure before turning around. President Trump is calling on the Federal Reserve to lower interest rates immediately as he seeks the removal of Chairman Powell, adding fuel to the markets fire.

The broader markets are showing no mercy, with the S&P 500 falling nearly 2% as of mid-morning trading and no sign of relief in sight. Today’s declines are in response to trade war uncertainty as the dealings appear to be one step forward and two steps back. Meanwhile, President Trump wants Fed Chairman Jerome Powell to go, adding to the turbulence in a market that likes certainty.

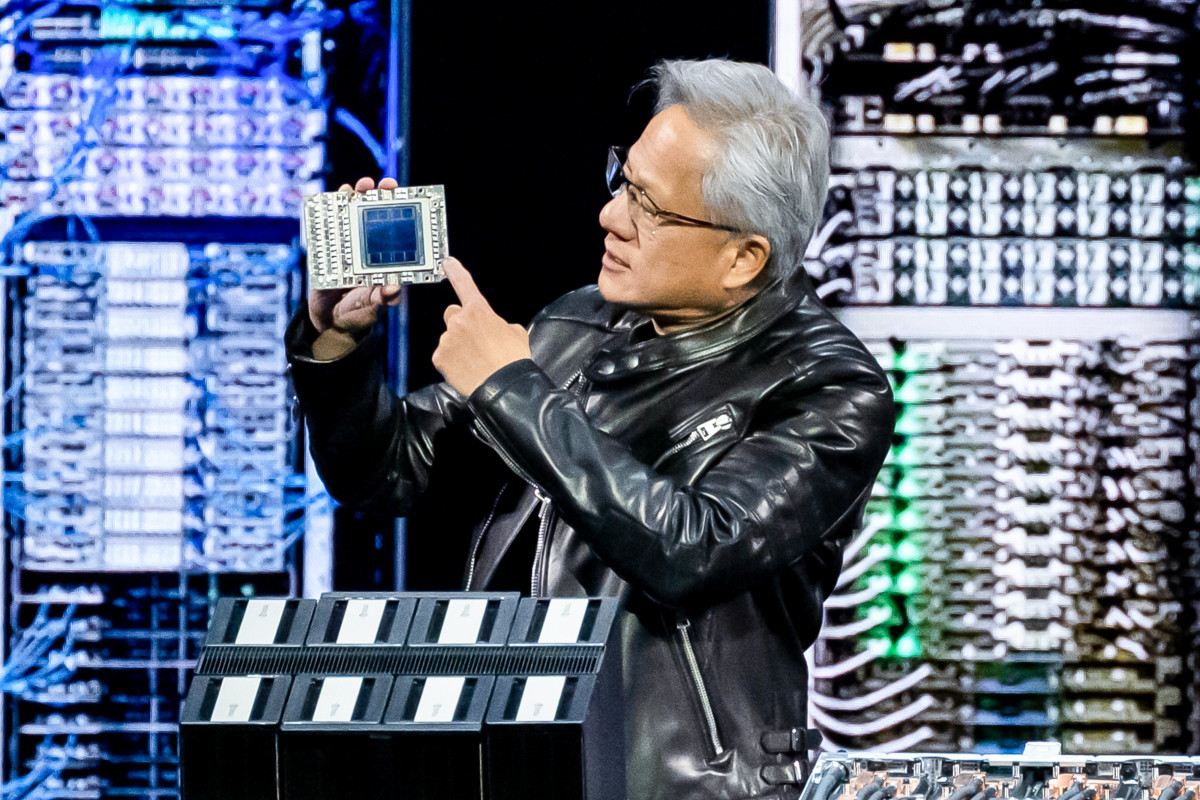

All of the sectors of the economy are in the red this morning, the worst of which is being felt in consumer discretionary, with a 3% drop, and technology stocks, down 2.8% as a group. The Dow Jones Industrial Average’s losses have widened to over 700 points, while the Nasdaq Composite’s losses are in the ballpark of 400 points.

Earnings season is rolling on, with Netflix (Nasdaq: NFLX) surpassing consensus estimates and proving to be a market hero today as a tariff- and recession-resistant stock.

Here’s a look at the performance as of morning trading:

Dow Jones Industrial Average: Down 743.38 (-1.9%)

Nasdaq Composite: Down 432.60 (-2.6%)

S&P 500: Down 112.51 (-2.16%)

Market Movers

As the gold price continues to clinch new highs, gold mining stocks are benefitting, including Newmont (NYSE: NEM), a bright spot in the S&P 500 today. While Newmont is gaining only about 1%, it has found its way into the green in an otherwise sea of red.

Discover Financial Services (NYSE: DFS) is tacking on 2.7% in today’s market after its combination with Capital One received the regulatory green light. Discover is a dividend-paying stock with a dividend yield of 1.75%.

Private equity stock Blackstone (NYSE: BX) is sinking 6.6% on the day after reporting earnings last week.

Cosmetics sock Ulta Beauty (Nasdaq: ULTA) is gaining 1.6% today.

Constellation Energy (NYSE: CEG) is among the biggest losers in today’s market, falling over 6%, likely due to the fallout from tariffs.

The post S&P 500 (NYSEARCA: SPY) Live: NEM (NYSE: NEM) and DFS (NYSE: DFS) Rise in Eye of Storm appeared first on 24/7 Wall St..