3 Growth ETFs With Big Upside Potential

Given the significant turmoil that continues to affect most parts of the market, many investors may take the view that now is not the time to invest in growth stocks. After all, in protracted downturns, growth stocks tend to perform the worst relative to their so-called value counterparts. Investors who are concerned with what tomorrow […] The post 3 Growth ETFs With Big Upside Potential appeared first on 24/7 Wall St..

Key Points

-

While growth stocks may look risky in the near-term, over the long-term they tend to outperform. With that in mind, here are three top growth ETFs to consider buying.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

After all, in protracted downturns, growth stocks tend to perform the worst relative to their so-called value counterparts. Investors who are concerned with what tomorrow will bring will want to reduce exposure to the most recession-prone stocks, and look for places for safer investments. Whether that’s money market funds (cash), bonds (Treasury’s or otherwise) or real estate, there are plenty of safer places to park capital during downturns that in high-beta stocks.

While that’s true, it’s also true that investors who have remained exposed to growth stocks through the Great Recession and pandemic have come out the other side much further ahead than those investors who stayed over-exposed to value stocks.

This time could be different (it always can). But for investors who want to retain exposure to growth stocks in the most thoughtful way possible, here are three growth ETFs I think could pass muster for most in the market right now.

Vanguard Russell 1000 Growth Index Fund ETF (VONG)

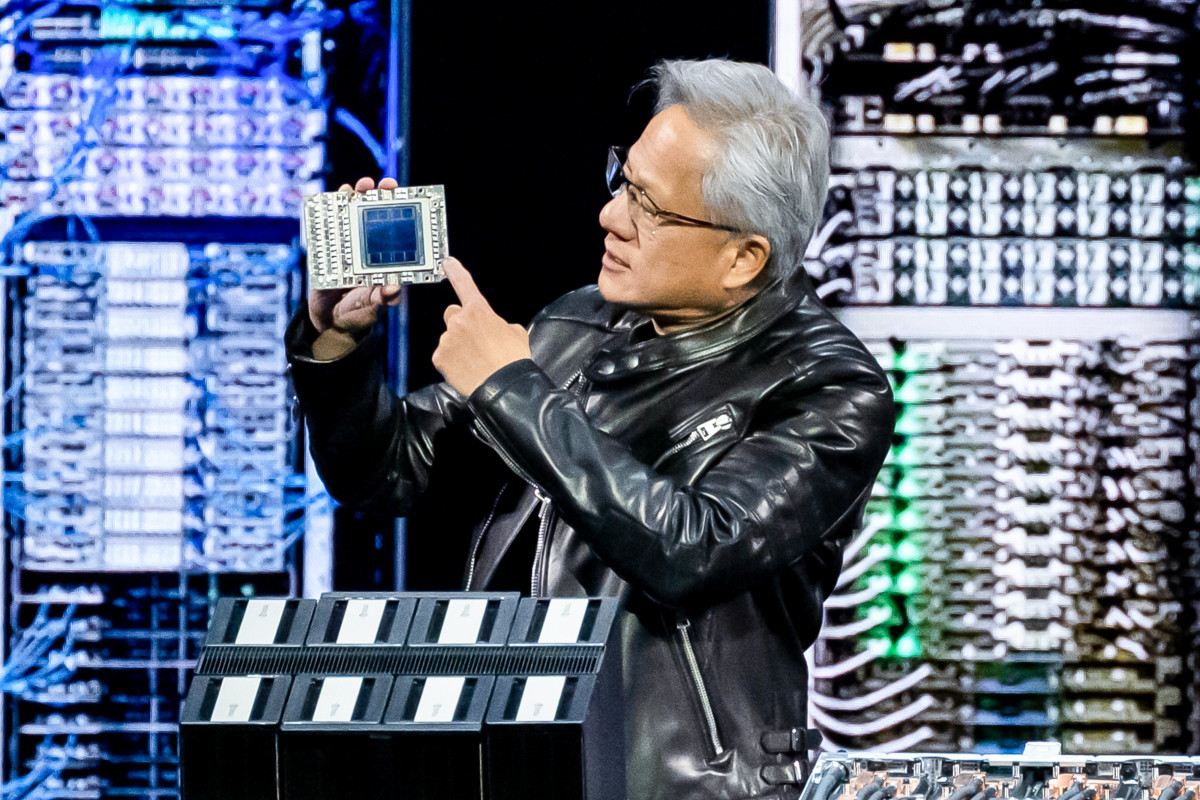

The Vanguard Russell 1000 Growth Index Fund ETF (VONG) is among the best low-cost ETFs aimed at growth investors seeking to match the largest companies in the U.S. The Russell 1000 Growth Index forms the basis for this fund, and is very tech-heavy. For investors who believe that technology will continue to form the foundation upon where most of the growth in the U.S. market will continue to come from, this is a top ETF that could suit those with a truly long-term investing time horizon.

Over the past three years, this ETF has outperformed its category benchmark by roughly 3%. That’s a large divergence, and is a testament to the quality of the companies held within this large-cap growth ETF.

With an expense ratio of just 0.07% (which has actually come down over time), the fund mangers and team at Vanguard are clearly continuing to work to ensure that investors get the lowest-cost exposure to some of the best stocks in the market over time. Indeed, the market for high-growth equities is likely to continue to grow over time. So, for investors who take the view that seeking out broadly diversified exposure to the best names in the tech sector (and others), this is a top ETF in my books that’s worth considering right now.

Vanguard Mega Cap Growth ETF (MGK)

For investors seeking very large-cap exposure to the best and highest-quality growth stocks, the Vanguard Mega Cap Growth ETF (MGK) is a top option to consider. This particular fund focuses on only the largest U.S. growth stocks. With a similar focus to VONG, this fund provides even greater weightings to the absolute largest U.S. tech giants. In other words, investing in such an ETF is an implicit bet that antitrust regulation won’t likely rear its head in a meaningful way in the years to come. And with the Trump administration likely requiring significant growth from the biggest and best American companies, that’s a bet that certainly looks intriguing, at least on the surface.

That’s not to say such a strategy isn’t without risk. Regulators are continuing to target the largest U.S. companies both domestically and abroad for various antitrust or monopoly-related concerns, and there does appear to be some fundamental rationale behind such maneuvers.

But over the long-term, these companies have indeed provided market-beating returns. So, for investors who think the future will look a lot like the recent past, this fund’s 7 basis point (0.07%) expense ratio looks relatively attractive compared to the underlying growth this ETF has provided over time.

Invesco S&P 500 GARP ETF (SPGP)

Finding companies that represent growth at a reasonable price (GARP) is an investing strategy I think most long-term investors can get behind. In this vein, the Invesco S&P 500 GARP ETF (SPGP) should be a top option for investors looking for growth, but relative value, in this current environment.

The SPGP ETF is one that is certainly among the more expensive options, at least relative to the two aforementioned low-cost ETFs. This fund comes with an expense ratio of 36 basis points (0.36%), and while that’s a heck of a lot cheaper than many mutual funds and other actively-managed ETFs in the market, it’s an expense ratio that investors need to keep in mind before they jump into this particular name.

What investors get for this relatively high expense ratio is a unique ranking methodology in which this fund screens growth stocks across a number of value metrics to provide a portfolio of stocks with the most robust growth relative to their underlying valuations. In doing so, this fund’s approach does the homework (so to speak) for investors looking to implement this strategy. In my view, such a strategy is worth every penny, but to each their own.

The post 3 Growth ETFs With Big Upside Potential appeared first on 24/7 Wall St..