S&P 500 (NYSEARCA: SPY) Live: Cooling Inflation Data Buoys Wall Street’s Market Outlook

Live Updates Live Coverage Updates appear automatically as they are published. S&P 500 Upward Revision 10:45 am by Gerelyn Terzo The S&P 500 full-year 2025 target revisions are rolling in. Most recently, Wall Street firm Goldman Sachs has tweaked its 2025 stock market performance outlook upward. Goldman Sachs Chief U.S. Equity Strategist David Kostin increased […] The post S&P 500 (NYSEARCA: SPY) Live: Cooling Inflation Data Buoys Wall Street’s Market Outlook appeared first on 24/7 Wall St..

Live Updates

S&P 500 Upward Revision

The S&P 500 full-year 2025 target revisions are rolling in. Most recently, Wall Street firm Goldman Sachs has tweaked its 2025 stock market performance outlook upward. Goldman Sachs Chief U.S. Equity Strategist David Kostin increased his 2025 S&P 500 prediction to 6,100, up from a former 5,900, reflecting upside potential of roughly 4% from current levels. Kostin wrote: “We raise our S&P 500 return and earnings forecasts to incorporate lower tariff rates, better economic growth, and less recession risk than we previously expected.”

This article will be updated throughout the day, so check back often for more daily updates.

The markets are showing little direction or conviction despite better-than-expected inflation data and the recent trade agreement between the U.S. and Beijing. Stocks are stalling even as the U.S. economy further distances itself from a recession. The annual inflation rate fell to 2.3% in April, its lowest level since 2021. For the month, the Consumer Price Index (CPI) increased by a slight 0.2%, while prices for eggs, a common grocery item, declined by just over 12% in April. The inflation data was a welcome surprise considering April followed a period of heightened trade tensions, with an agreement and tariff reductions announced in May.

The SPY ETF is gaining 0.75% as of mid-morning trading alongside fractional gains in the S&P 500 index. Nvidia (Nasdaq: NVDA) is tacking on about 5% today on a bullish outlook for the chip sector, while Microsoft (Nasdaq: MSFT) and Apple (Nasdaq: AAPL) are off fractionally. Microsoft announced that it will reduce its workforce by 3%.

Ed Yardeni, of the research firm that bears his name, has lowered the chances of a U.S. recession and raised his S&P 500 year-end target to 6,500, citing progress in U.S. trade deals.

Here’s a look at the performance as of morning trading:

Dow Jones Industrial Average: Down 135.36 (-0.32%)

Nasdaq Composite: Up 225.16 (+1.2%)

S&P 500: Up 36.05 (+0.62%)

Market Movers

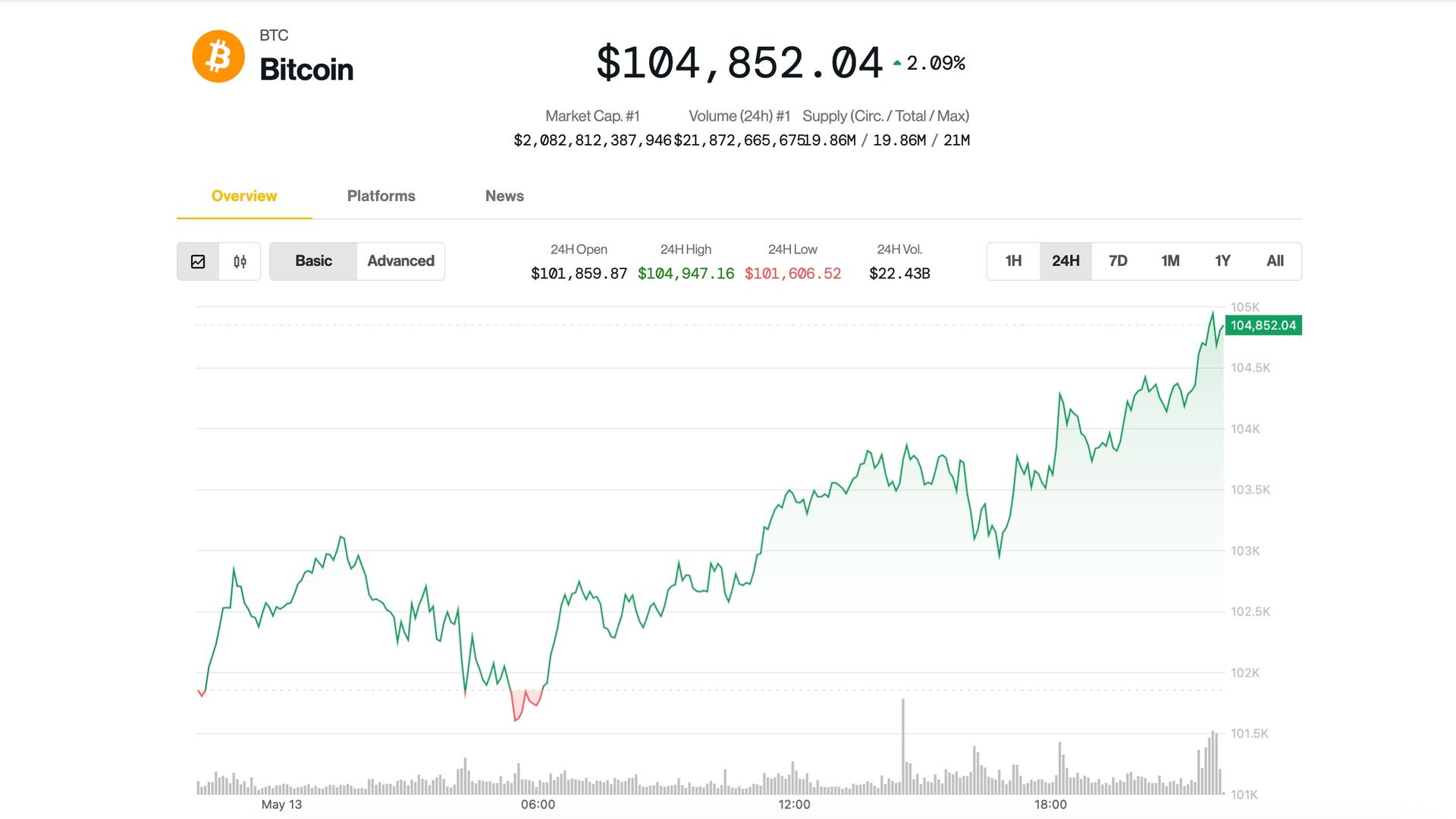

Coinbase (Nasdaq: COIN) is soaring by 15% after further validating the cryptocurrency industry by clinching a spot in the S&P 500.

Builders FirstSource (NYSE: BLDR) is a winner in the S&P 500 index, gaining 5% on the day.

UnitedHealth Group (NYSE: UNH) is suffering a 12% decline amid further turmoil in the C-Suite. The healthcare giant announced CEO Andrew Witty would be leaving his post, owing to personal reasons. The company has named Stephen Hemsley as Witty’s successor. UnitedHealth has suspended its 2025 outlook.

Raymond James has started coverage of Super Micro (Nasdaq: SMCI) with an “outperform” rating, calling it a “nearly pure AI play.” The stock is up close to 12% today.

Goldman Sachs upgrades shares of Valero Energy (NYSE: VLO) from “neutral” to “buy” with a price target of $154 attached, reflecting upside potential of 15%.

The post S&P 500 (NYSEARCA: SPY) Live: Cooling Inflation Data Buoys Wall Street’s Market Outlook appeared first on 24/7 Wall St..