Stock Market Today: Stocks end mixed, S&P 500 wipes out 2025 losses

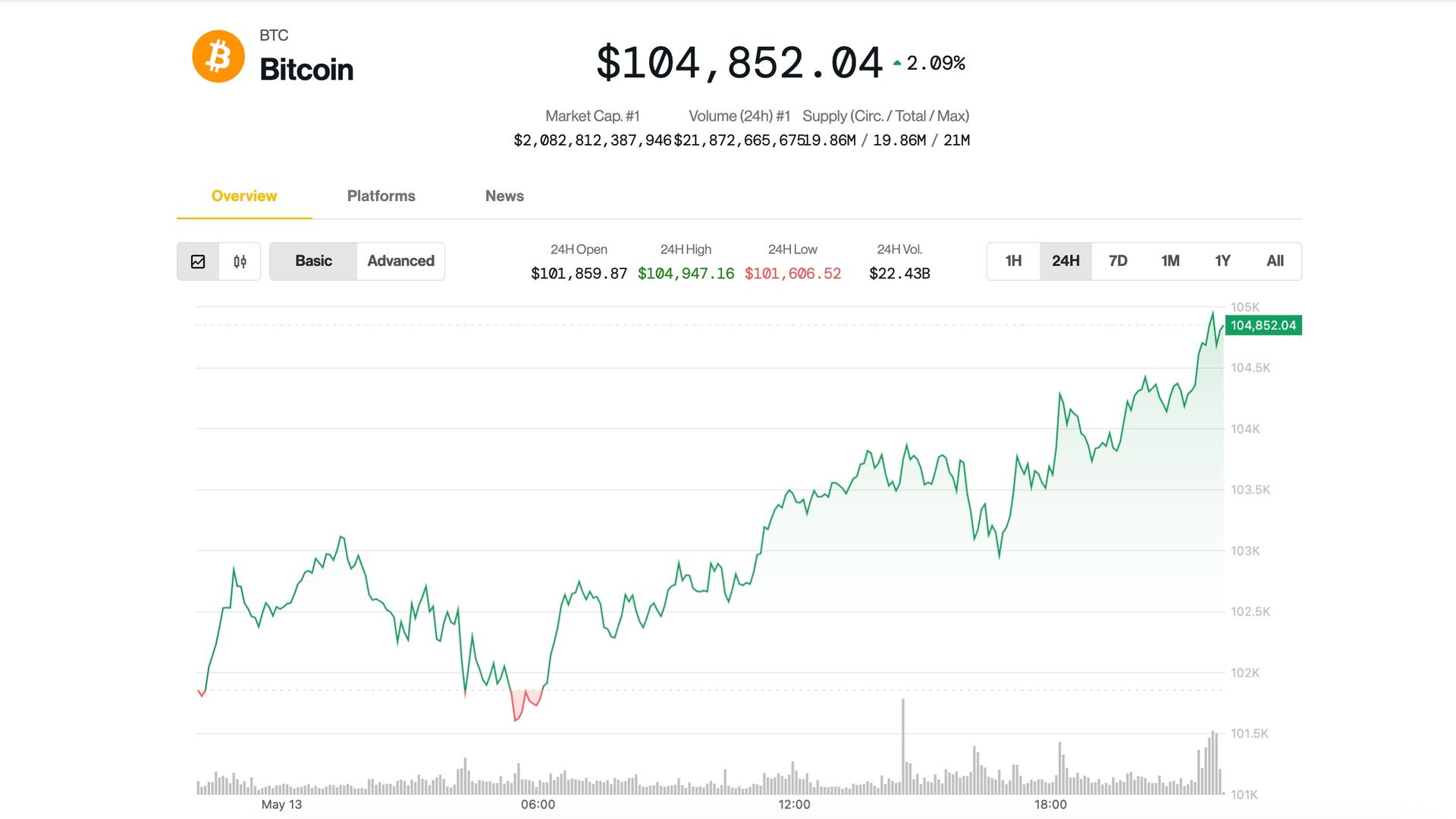

Nvidia leads a tech rally as the S&P 500 stages stunning comeback.

Updated at 4:43 PM EDT by Rob Lenihan

Stocks ended mixed Tuesday, with the S&P 500 surged back into the green as investors reacted to the latest inflation report and an easing in US-trade tensions.

The Dow Jones Industrial Average lost 269.67 points, or 0.64, to finish the session at 42,140.43, the S&P 500 advanced 0.72% to close at 5,886.55 and the tech-heavy Nasdaq jumped 1.61% to end at 19,010.08.

Nvidia gained 5.6% on news that the tech giant would send 18,000 of its top artificial intelligence chips to Saudi Arabia.

“The stock market staged a big relief rally after Treasury Secretary Scott Bessent announced a 90-day reduction in tariffs between China and the U.S.,” said Louis Navellier, chairman and founder of Navellier & Associates. “It will be interesting to see how these 90-day tariff reductions impact trade, since there is an inventory glut after trade “dumping” in the first quarter."

He noted that China’s manufacturing output continues to sputter, "so the U.S. still has leverage in these ongoing trade negotiations.”

Updated at 9:36 AM EDT

Mixed open

The S&P 500 was marked 2 points, or 0.03% higher in the opening minutes of trading, with the Nasdaq rising 40 points, or 0.23%

The Dow fell 150 points while the Russell 2000 gained 12 points, or 0.58% following the softer-than-expected April inflation data.

"The downside surprise in the CPI doesn’t mean tariffs aren’t impacting the economy, it just means they aren’t showing up in the data yet," said Ellen Zenter, chief economic strategist for Morgan Stanley Wealth Management.

"Wait-and-see is still the name of the game, and until that changes, the Fed will remain on the sidelines," she added.

Updated at 8:42 AM EDT

Easing, for now ...

U.S. consumer price inflation eased again last month, suggesting little impact from President Donald Trump's tariff regime heading into the start of the second quarter.

The Commerce Department said its headline Consumer Price Index for April was pegged at an annual rate of 2.3%, down from the 2.4% pace recorded in March and the consensus forecast from analysts on Wall Street.

So-called core inflation, which strips out volatile components like food and energy, held at an annual rate of 2.8%, matching both the Wall Street forecast and March's 2.8% pace.

stocks pared some of their earlier declines following the data release, with futures contracts tied to the S&P 500 indicating an opening-bell gain of around 10 points and the Nasdaq priced for a 90-point gain.

The Dow was called 90 points lower thanks in part to the 9% slump for index heavyweight UnitedHealth Group (UNH) .

CPI +0.2% m/m in April; cooler than consensus estimate of +0.3% … core also up by +0.2% pic.twitter.com/3iII9O2ItS— Kevin Gordon (@KevRGordon) May 13, 2025

Stock Market Today

Stocks ended firmly higher on Monday with the S&P 500 rising 3.26%, its strongest single-day gain in six weeks, following a weekend deal between the U.S. and China to pause reciprocal tariffs for at least three months.

The benchmark also closed north of its 200-day moving average, a key performance indicator, for the first time since March.