Should You Follow Nvidia and Buy This Hidden Data Center Stock?

When Nvidia (NASDAQ:NVDA) revealed last year that it had taken a stake in SoundHound AI (NASDAQ:SOUN), it sparked a four-fold increase in the stock price of the AI voice recognition expert. Shares that traded for around $2 a stub were suddenly worth over $8 a share. Investors subsequently learned this wasn’t a new investment at […] The post Should You Follow Nvidia and Buy This Hidden Data Center Stock? appeared first on 24/7 Wall St..

When Nvidia (NASDAQ:NVDA) revealed last year that it had taken a stake in SoundHound AI (NASDAQ:SOUN), it sparked a four-fold increase in the stock price of the AI voice recognition expert. Shares that traded for around $2 a stub were suddenly worth over $8 a share.

24/7 Wall St. Insights:

-

Nvidia (NVDA) has become a tech investor to watch as the market reacts to where it is placing bets.

-

Its latest investment is in AI data center stock, Nebius Group (NBIS), a spinoff from the former Russian search giant Yandex.

-

Nebius is experiencing rapid growth and expansion, but that has generated significantly larger than expected losses, causing its stock to fall.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Investors subsequently learned this wasn’t a new investment at all, but one that had been made several years prior when SoundHound was still privately held. They realized they should watch Nvidia’s investment arm more closely to see where it placed bets.

That’s why the 13F report the AI chipmaker filed last month created such a stir. Not only did it reveal Nvidia dumped its entire position in SoundHound, but that it had taken entirely new ones in several other companies. One of the more intriguing ones is data center stock Nebius Group (NASDAQ:NBIS), an AI play you didn’t realize you already knew but one that should be on your radar.

Back with a vengeance

Nebius Group’s roots extend back to the Russian search engine Yandex, which was forced to break up following Russia’s invasion of Ukraine. Trading was halted on the stock, but Yandex was allowed to preserve its Nasdaq listing so long as it restructured and divested its Russian assets.

Following the sale, Yandex reorganized itself as Nebius Group and began trading again last October under the ticker symbol NBIS.

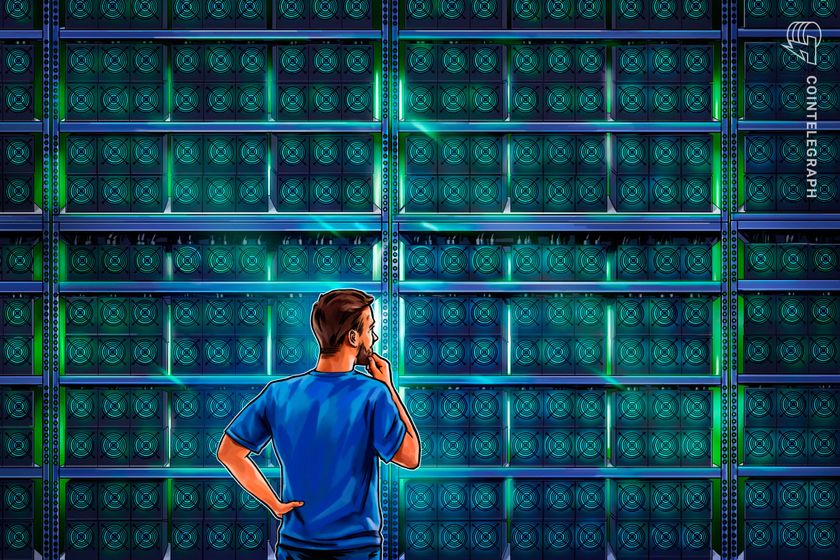

The Amsterdam-based AI infrastructure company received additional support from Nvidia, Accel, and Orbis Investments in a $700 million private placement in December to build clusters of graphics processing units (GPUs), cloud platforms, and other tools for AI developers faster and on a larger scale.

Nebius is positioning itself as a key player in the exploding AI ecosystem that is being driven by insatiable demand for computing power to train and run AI models. Estimates peg the AI hardware market will grow from $21.5 billion in 2023 to $394.5 billion by 2030, a 51.5% compound annual growth rate.

Nebius targets the GPU-as-a-service and AI cloud segment, which it projects will grow from $33 billion in 2023 to over $260 billion by 2030. This boom stems from industries like healthcare, automotive, and tech leaning on AI, creating a fertile landscape for Nebius’s offerings.

Rapidly scaling up

Fourth-quarter revenue hit $37.9 million, a 466% jump from the year-ago period, driven primarily by it core AI infrastructure business, which grew 602% year-over-year. While operating losses widened by 62% to $151 million, it was the result of expanding its business into new verticals.

Nebius is tripling its Finland data center capacity, launching a 5 megawatt (MW) Kansas City GPU cluster that is expandable to 40 MW with 35,000 GPUs, and is planning a 300 MW New Jersey facility. Partnerships with Nvidia and Uber Technologies (NYSE:UBER) through its Avride autonomous driving arm enhance its ecosystem play. Its Toloka AI training and evaluation unit and the edtech division TripleTen add diversification.

Despite the potential, Nebius is not without risk. It ended 2024 with a net loss of $645 million versus a $246 million profit the year before. High cash burn for data center expansion could strain its available cash if revenue growth lags. Yet at current burn rates, it has about five quarters of cash available, which should give it the time it needs.

Competition, though, is fierce. Hyperscalers like Amazon‘s (NASDAQ:AMZN) AWS, Microsoft (NASDAQ:MSFT) Azure, and Google Cloud dominate, while rivals like CoreWeave (another Nvidia-backed company) outpace Nebius’s scale.

Why did Nvidia invest

Nvidia’s investment as part of the $700 million round reflects a strategic bet on Nebius’s potential. As a preferred Nvidia Partner Network member, Nebius deploys Nvidia’s cutting-edge GPUs in its clusters — both the popular H100 and newest Blackwell accelerators — enhancing Nvidia’s market penetration in AI cloud services.

With Nvidia facing GPU supply constraints, backing Nebius ensures a steady customer scaling capacity, potentially easing pressure on its own production. It’s also a low-risk diversification play for Nvidia as the private placement is a fraction of its $2.6 trillion market cap. It offers the chipmaker significant upside if Nebius hits its annualized run-rate revenue (ARR) of between $750 million and $1 billion by the end of 2025.

Should you follow Nvidia’s lead?

NBIS stock is tempting as it builds on existing AI market tailwinds, expands into new verticals like edtech, and has Nvidia’s stamp of approval. However, at $25 per share, it’s been cut in half since the chipmaker’s stake was revealed, though it is up over 30% since the stock began trading again.

Nebius is valued at $6 billion and is arguably cheaper at its projected 2025 ARR than CoreWeave’s expected valuation as it has filed for an IPO. Investors with an appetite for risk could enjoy significant returns if Nebius is able to execute on its growth plans this year, though the risks are real. It is producing losses and faces more competitive pressure, making NBIS more speculative than it otherwise might be.

Certainly Nvidia’s backing validates the AI stock, but it’s not a lifeline. Its bet on SoundHound didn’t really pay off. Nebius is a rising star with potential, but it is a stock best for risk-tolerant investors.

The post Should You Follow Nvidia and Buy This Hidden Data Center Stock? appeared first on 24/7 Wall St..