Semler Scientific Settles DOJ Probe, Says Ready to Buy More Bitcoin

In a Tuesday filing, the company said it had reached a loan agreement with crypto exchange Coinbase allowing it to borrow money — using its bitcoin stockpile as collateral — to pay the settlement.

Healthcare technology firm and sizable holder of bitcoin (BTC) Semler Scientific (SMLR) has reached a tentative agreement with the U.S. Department of Justice (DOJ), disclosing in a Tuesday filing that it was prepared to pay a $29.75 million fine in order to settle all claims tied to potential violations of a federal anti-fraud law related to its marketing of QuantaFlo, its flagship product.

Last month, Semler Scientific disclosed that it had received a civil investigative demand, or CID — essentially, a subpoena from a federal agency that typically precedes a lawsuit — from the DOJ back in 2017. The company at that time said it had complied with several subsequent subpoenas over the following years and began initial settlement discussions with the DOJ in February.

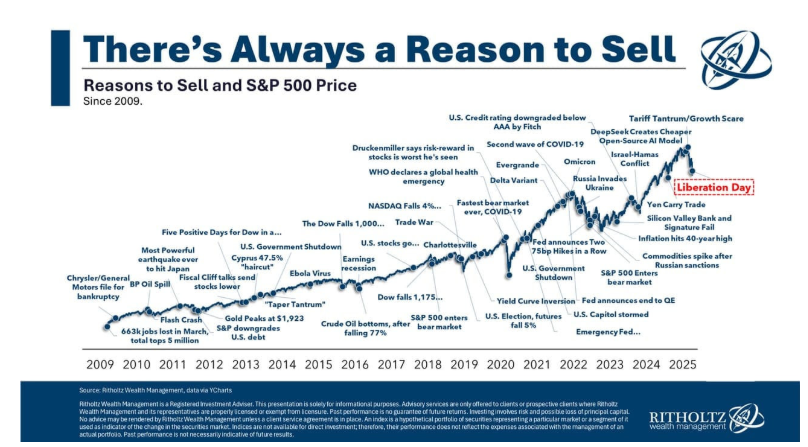

That news, along with the decline in the price of bitcoin, had helped crater SMLR shares, which were lower by 37% year-to-date as of the close of trading on Tuesday.

In today's disclosure, Semler said that it had inked an agreement with crypto exchange Coinbase allowing it to borrow both cash and digital assets, using its bitcoin holdings as collateral. If the company’s settlement agreement with the DOJ is approved, Semler “intends to borrow under the Coinbase master loan agreement and use such proceeds (along with its cash on hand) to pay the proposed settlement with DOJ.”

Semler Scientific’s settlement agreement with the DOJ is in principle, meaning that it is not yet set in stone.

Ready to restart bitcoin purchases

With the DOJ cloud hanging over it, Semler had not added to its 3,192 bitcoin stack for more than two months, but that appears as if it will soon change.

"Excited to buy more bitcoin," tweeted company Chairman Eric Semler as the settlement (in principle) was announced.

To that end, the company Tuesday evening also launched a $500 million at-the-money mixed securities shelf offering with proceeds mostly expected to be used for BTC purchases.