Bitcoin’s wide price range to continue, no longer a ‘long only’ bet — Analyst

Bitcoin could be heading into another extended consolidation phase, with short-term indicators suggesting a more bearish outlook, contrary to the broader crypto community’s view, according to the head of research at 10x Research.While many crypto analysts predict new Bitcoin (BTC) all-time highs by June, Markus Thielen said in an April 14 markets report that he is skeptical, pointing out that onchain data signals “more of a bear market environment than a bullish one.”Short-term indicators signal potential market topThielen said the Bitcoin stochastic oscillator — which compares a particular closing price to a range of prices over a specific period to determine momentum — shows patterns “more typical of a market top or late-cycle phase rather than the early stages of a new bull run.”Bitcoin is trading at $83,810 at the time of publication. Source: CoinMarketCap“As a result, short-term signals are not aligning with longer-term indicators, highlighting the disconnect in the market outlook,” Thielen said.“Bitcoin is no longer a parabolic ‘Long-Only’ retail-driven market,” he added, explaining it now “demands a more sophisticated, finance-oriented approach.”“Bitcoin’s rally over the past year hasn’t been driven by typical ‘crypto-bro’ speculation but by long-term holders seeking diversification and adopting a buy-and-hold strategy,” Thielen said. Over the past 12 months, Bitcoin is up 32.80% and is trading at around $83,810 at the time of publication, according to CoinMarketCap.Bitcoin price action may repeat 2024 patternThielen reiterated his stance that Bitcoin may consolidate for an extended period, much like it did in 2024. “Despite our cautious optimism, we view Bitcoin as trading within a broad range of $73,000 to $94,000, with a slight upward bias,” he said.In March 2024, Bitcoin reached its then-all-time high of $73,679 before entering a consolidation phase, swinging within a range of around $20,000 until Donald Trump won the US elections in November.Related: Bitcoin price recovery could be capped at $90K — Here’s whyMany crypto analysts are eyeing June as the month when Bitcoin could surpass its current all-time high of $109,000, which it reached in January just before Trump’s inauguration.Swan Bitcoin CEO Cory Klippsten told Cointelegraph in early March that “there’s more than 50% chance we will see all-time highs before the end of June this year.”Sharing a similar view, Bitcoin network economist Timothy Peterson and Real Vision chief crypto analyst Jamie Coutts have also marked June as when Bitcoin could reach a new high.“It is entirely possible Bitcoin could reach a new all-time high before June,” Peterson said.Meanwhile, Coutts said, “The market may be underestimating how quickly Bitcoin could surge – potentially hitting new all-time highs before Q2 is out.”Magazine: Riskiest, most ‘addictive’ crypto game of 2025, PIXEL goes multi-game: Web3 GamerThis article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin could be heading into another extended consolidation phase, with short-term indicators suggesting a more bearish outlook, contrary to the broader crypto community’s view, according to the head of research at 10x Research.

While many crypto analysts predict new Bitcoin (BTC) all-time highs by June, Markus Thielen said in an April 14 markets report that he is skeptical, pointing out that onchain data signals “more of a bear market environment than a bullish one.”

Short-term indicators signal potential market top

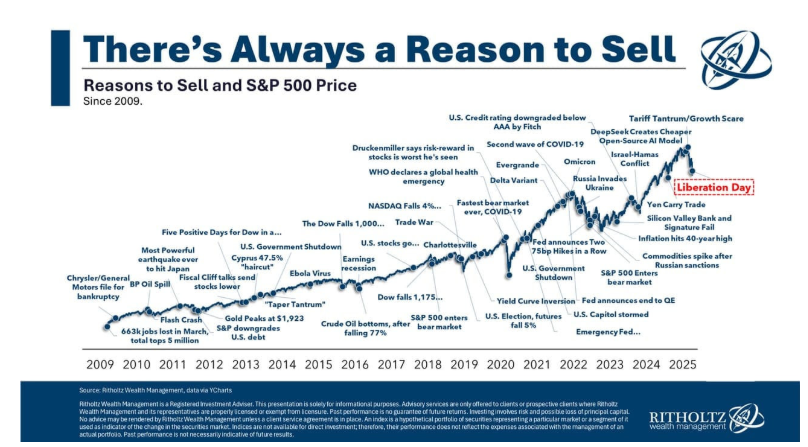

Thielen said the Bitcoin stochastic oscillator — which compares a particular closing price to a range of prices over a specific period to determine momentum — shows patterns “more typical of a market top or late-cycle phase rather than the early stages of a new bull run.” Bitcoin is trading at $83,810 at the time of publication. Source: CoinMarketCap

“As a result, short-term signals are not aligning with longer-term indicators, highlighting the disconnect in the market outlook,” Thielen said.

“Bitcoin is no longer a parabolic ‘Long-Only’ retail-driven market,” he added, explaining it now “demands a more sophisticated, finance-oriented approach.”

“Bitcoin’s rally over the past year hasn’t been driven by typical ‘crypto-bro’ speculation but by long-term holders seeking diversification and adopting a buy-and-hold strategy,” Thielen said.

Over the past 12 months, Bitcoin is up 32.80% and is trading at around $83,810 at the time of publication, according to CoinMarketCap.

Bitcoin price action may repeat 2024 pattern

Thielen reiterated his stance that Bitcoin may consolidate for an extended period, much like it did in 2024.

“Despite our cautious optimism, we view Bitcoin as trading within a broad range of $73,000 to $94,000, with a slight upward bias,” he said.

In March 2024, Bitcoin reached its then-all-time high of $73,679 before entering a consolidation phase, swinging within a range of around $20,000 until Donald Trump won the US elections in November.

Related: Bitcoin price recovery could be capped at $90K — Here’s why

Many crypto analysts are eyeing June as the month when Bitcoin could surpass its current all-time high of $109,000, which it reached in January just before Trump’s inauguration.

Swan Bitcoin CEO Cory Klippsten told Cointelegraph in early March that “there’s more than 50% chance we will see all-time highs before the end of June this year.”

Sharing a similar view, Bitcoin network economist Timothy Peterson and Real Vision chief crypto analyst Jamie Coutts have also marked June as when Bitcoin could reach a new high.

“It is entirely possible Bitcoin could reach a new all-time high before June,” Peterson said.

Meanwhile, Coutts said, “The market may be underestimating how quickly Bitcoin could surge – potentially hitting new all-time highs before Q2 is out.”

Magazine: Riskiest, most ‘addictive’ crypto game of 2025, PIXEL goes multi-game: Web3 Gamer

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.