Saylor holding 10M BTC won’t ‘threaten the protocol,’ says author

Key TakeawaysBitcoin Standard author Saifedean Ammous says that even if one entity owned a huge amount of Bitcoin, it wouldn’t hurt the protocolAmmous reiterated major companies like BlackRock and Strategy don’t own the Bitcoin they hold since it belongs to the investorsAmmous said if these companies ever abused their position, people would likely pull their money and invest somewhere else. Michael Saylor’s Strategy hypothetically hoarding nearly 48% of Bitcoin’s total supply wouldn’t pose any risk to the Bitcoin protocol or its price, says Bitcoin Standard author Saifedean Ammous.“If Michael Saylor ends up with 10 million Bitcoin, what is he going to do? He’s likely just going to leverage them to buy more Bitcoin,” Ammous said during an April 25 interview with crypto entrepreneur Anthony Pompliano.Ammous dismisses Bitcoin hoarders posing risks“Ultimately, I don’t see how it would threaten the protocol in the serious sense,” Ammous said.Ammous said if Saylor managed to accumulate 10 million Bitcoin (BTC), he would be unlikely to “wake up one day and say let’s try and hard fork this so we can make another 5 million Bitcoin supply so that I can have 15.” He reiterated it would diminish the value of his existing 10 million Bitcoin.Bitcoin is trading at $93,250 at the time of publication. Source: CoinMarketCapSeveral crypto market participants have previously raised concerns about Bitcoin whales and at what point their holdings could lead to risks like market manipulation, centralization, or liquidity issues.At the time of publication, Saylor’s firm Strategy holds 538,200 Bitcoin, worth approximately $50.18 billion, according to Saylor Tracker. Meanwhile, the BlackRock iShares spot Bitcoin ETF has net assets worth $54.48 billion, which equates to roughly 585,000 Bitcoin, according to BlackRock data.Strategy paid an average of $67,793 per Bitcoin. Source: Saylor TrackerCollectively, the two firms hold approximately 5.3% of the total Bitcoin supply. However, Ammous said this is not a cause for concern. “It’s not like Michael Saylor or Larry Fink owns all those Bitcoins. They have shareholders who own all those Bitcoins, or ETF holders that own those Bitcoins.”“To the extent that BlackRock and Strategy hold those, they hold those because they are doing their fiduciary share of duties to their shareholders and the ETF holders in a satisfactory way,” Ammous added.Related: ARK Invest ups its 2030 Bitcoin bull case prediction to $2.4MAmmous explained that if BlackRock or Strategy ever started to manage their holdings in a way that’s harmful to shareholders or ETF holders, or starts abusing their position, that’s when investors would sell and look for other ways to gain exposure to Bitcoin.On April 24, Cointelegraph reported that Twenty One Capital, a new Bitcoin treasury company led by Strike founder Jack Mallers with the support of Tether, SoftBank and Cantor Fitzgerald, is looking to supplant Strategy to become the “superior vehicle for investors seeking capital-efficient Bitcoin exposure.”Magazine: Crypto AI tokens surge 34%, why ChatGPT is such a kiss-ass: AI EyeThis article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Key Takeaways

Bitcoin Standard author Saifedean Ammous says that even if one entity owned a huge amount of Bitcoin, it wouldn’t hurt the protocol

Ammous reiterated major companies like BlackRock and Strategy don’t own the Bitcoin they hold since it belongs to the investors

Ammous said if these companies ever abused their position, people would likely pull their money and invest somewhere else.

Michael Saylor’s Strategy hypothetically hoarding nearly 48% of Bitcoin’s total supply wouldn’t pose any risk to the Bitcoin protocol or its price, says Bitcoin Standard author Saifedean Ammous.

“If Michael Saylor ends up with 10 million Bitcoin, what is he going to do? He’s likely just going to leverage them to buy more Bitcoin,” Ammous said during an April 25 interview with crypto entrepreneur Anthony Pompliano.

Ammous dismisses Bitcoin hoarders posing risks

“Ultimately, I don’t see how it would threaten the protocol in the serious sense,” Ammous said.

Ammous said if Saylor managed to accumulate 10 million Bitcoin (BTC), he would be unlikely to “wake up one day and say let’s try and hard fork this so we can make another 5 million Bitcoin supply so that I can have 15.” He reiterated it would diminish the value of his existing 10 million Bitcoin.

Several crypto market participants have previously raised concerns about Bitcoin whales and at what point their holdings could lead to risks like market manipulation, centralization, or liquidity issues.

At the time of publication, Saylor’s firm Strategy holds 538,200 Bitcoin, worth approximately $50.18 billion, according to Saylor Tracker. Meanwhile, the BlackRock iShares spot Bitcoin ETF has net assets worth $54.48 billion, which equates to roughly 585,000 Bitcoin, according to BlackRock data.

Collectively, the two firms hold approximately 5.3% of the total Bitcoin supply. However, Ammous said this is not a cause for concern.

“It’s not like Michael Saylor or Larry Fink owns all those Bitcoins. They have shareholders who own all those Bitcoins, or ETF holders that own those Bitcoins.”

“To the extent that BlackRock and Strategy hold those, they hold those because they are doing their fiduciary share of duties to their shareholders and the ETF holders in a satisfactory way,” Ammous added.

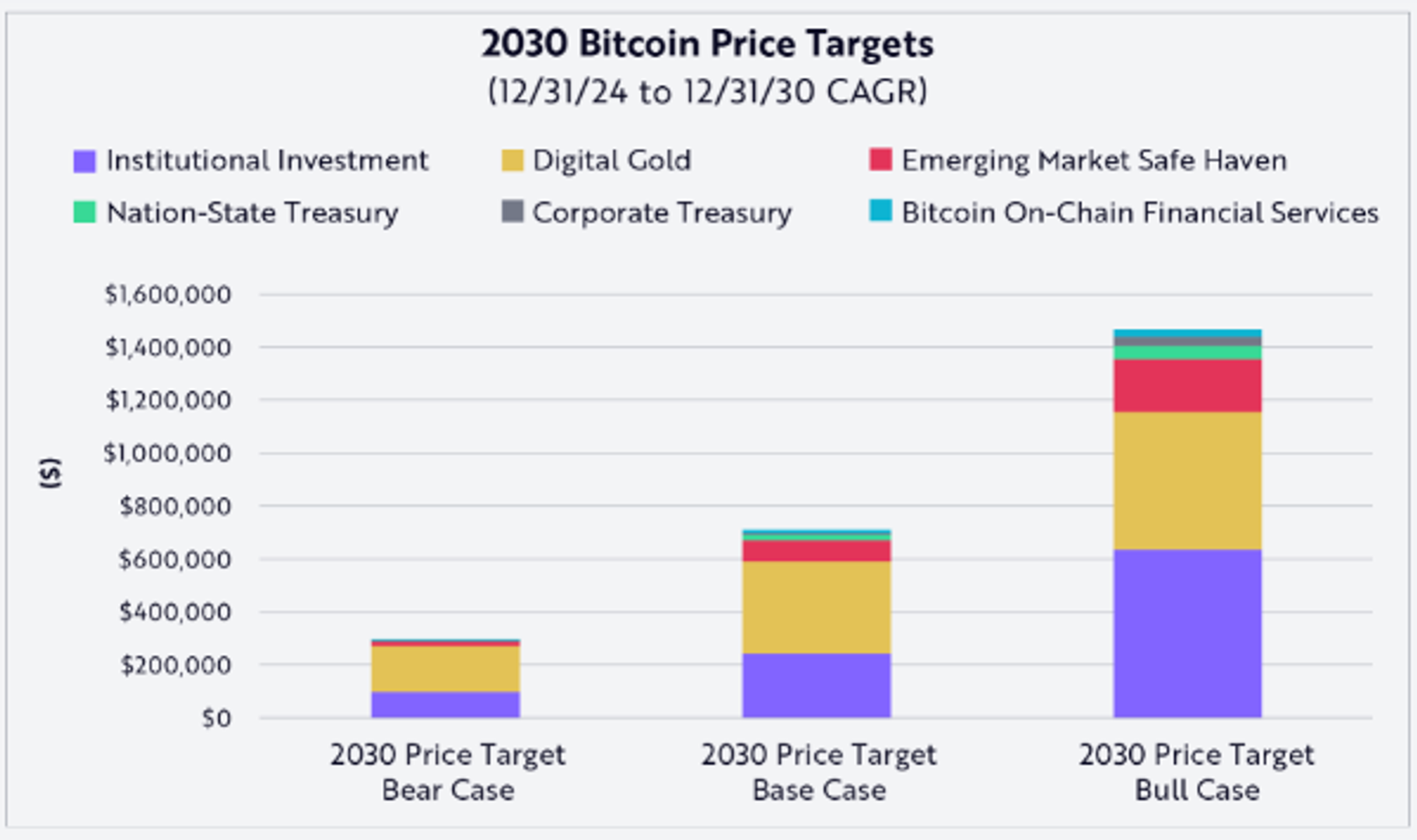

Related: ARK Invest ups its 2030 Bitcoin bull case prediction to $2.4M

Ammous explained that if BlackRock or Strategy ever started to manage their holdings in a way that’s harmful to shareholders or ETF holders, or starts abusing their position, that’s when investors would sell and look for other ways to gain exposure to Bitcoin.

On April 24, Cointelegraph reported that Twenty One Capital, a new Bitcoin treasury company led by Strike founder Jack Mallers with the support of Tether, SoftBank and Cantor Fitzgerald, is looking to supplant Strategy to become the “superior vehicle for investors seeking capital-efficient Bitcoin exposure.”

Magazine: Crypto AI tokens surge 34%, why ChatGPT is such a kiss-ass: AI Eye

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.