How I’m Navigating Financial Uncertainty in a Changing Economy

The FIRE movement is filled with people who aim to accumulate enough money so they can retire early. Some FIRE advocates want to follow the 4% withdrawal rule when they retire, but recent market volatility has added uncertainty to the FIRE promise. One Redditor addressed the elephant in the room and asked the community how they […] The post How I’m Navigating Financial Uncertainty in a Changing Economy appeared first on 24/7 Wall St..

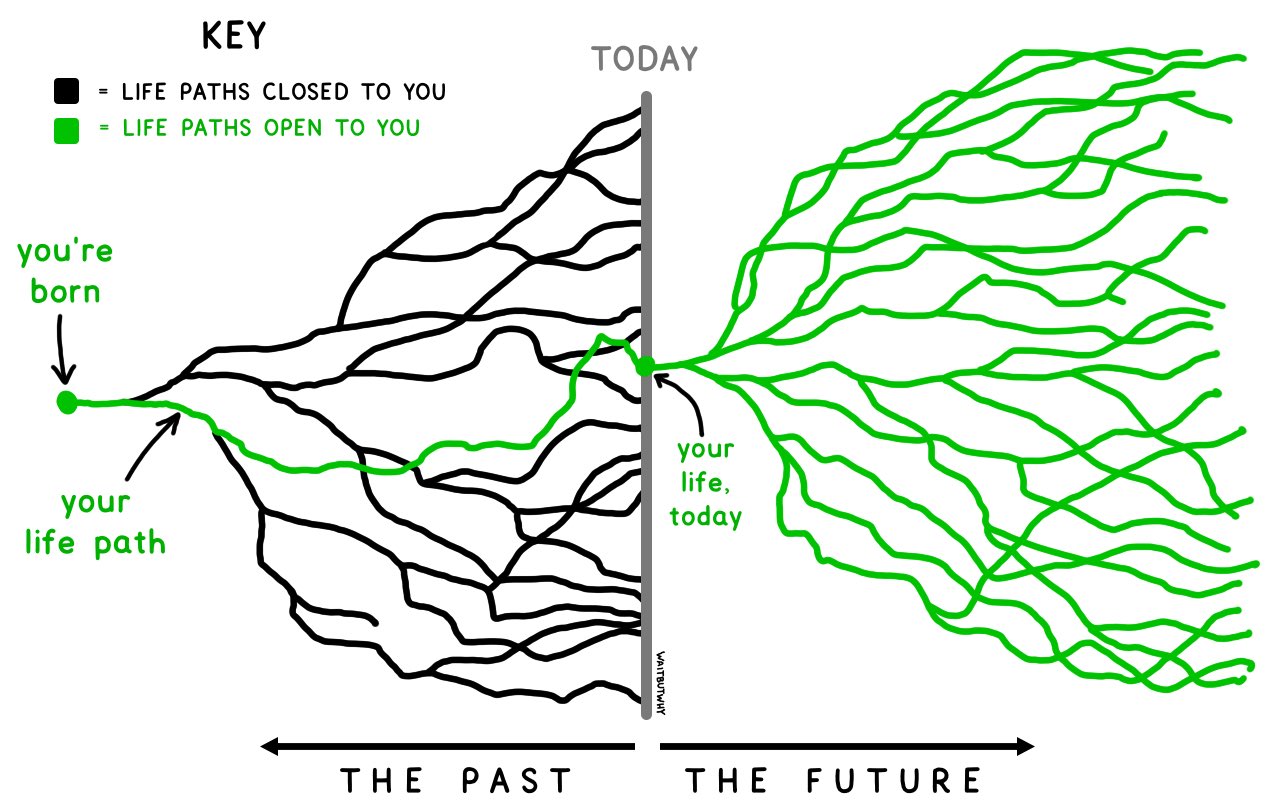

The FIRE movement is filled with people who aim to accumulate enough money so they can retire early. Some FIRE advocates want to follow the 4% withdrawal rule when they retire, but recent market volatility has added uncertainty to the FIRE promise.

One Redditor addressed the elephant in the room and asked the community how they are addressing the current economic uncertainty.

Redditors mostly kept the course, but some of them made adjustments to their long-term plans.

Key Points

-

Redditors in the FIRE community discuss what they’re doing amid market turmoil.

-

Many Redditors are buying the dip and sticking with their long-term plans. However, others are getting more defensive and adjusting their long-term goals.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Keep Buying

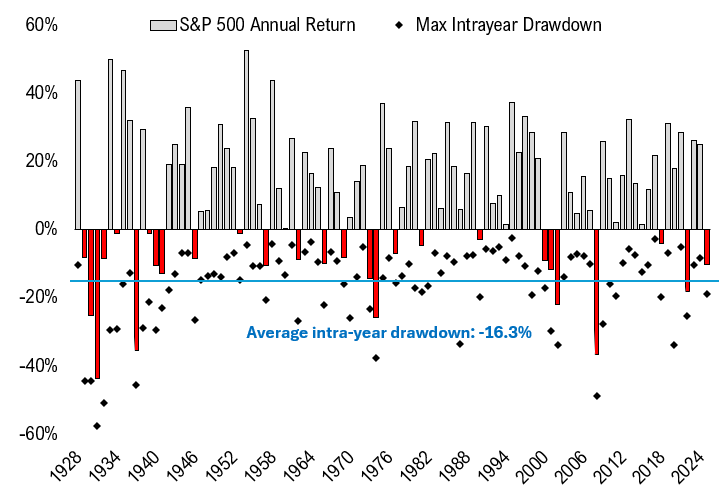

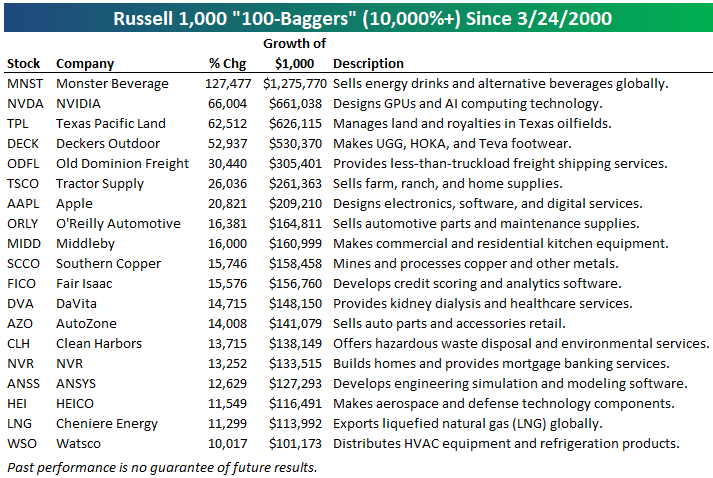

One Redditor views the current stock market turmoil as a buying opportunity. Many investors in the FIRE community have navigated the COVID-19 flash crash and the Great Recession. Some of them have also invested during the Dotcom Bubble.

When stocks go down, your favorite companies become available at discounts. That’s the mentality of “buy the dip” investors, and it’s a popular mentality among the FIRE community.

“I see it as my golden opportunity to buy on the cheap. When I’m ready to retire, I hope to have it recovered, and then some,” one commenter stated.

Long-Term Trends Are Shaking Global Trade

The FIRE community mostly saw this as a buying opportunity, but some people expressed valid concerns. For instance, a Redditor decided to walk back on his FIRE goals and enjoy living in the moment. He recently bought his dream car, and he and his wife were also planning a second trip to Japan before she got pregnant.

“Things are changing, and the world is becoming less open. Policy uncertainty seems to be on the rise, and international trade is being discouraged, and there are signs this is here to stay. But the FIRE community just puts blinders on and says, ‘It’s all noise.’ Like no, guys, this is something very different.”

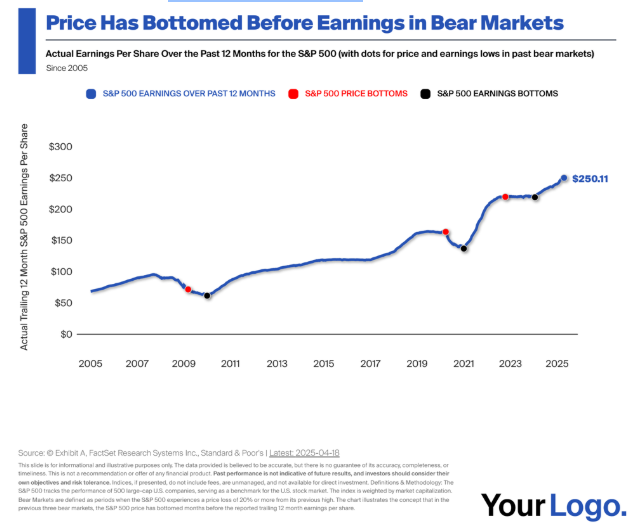

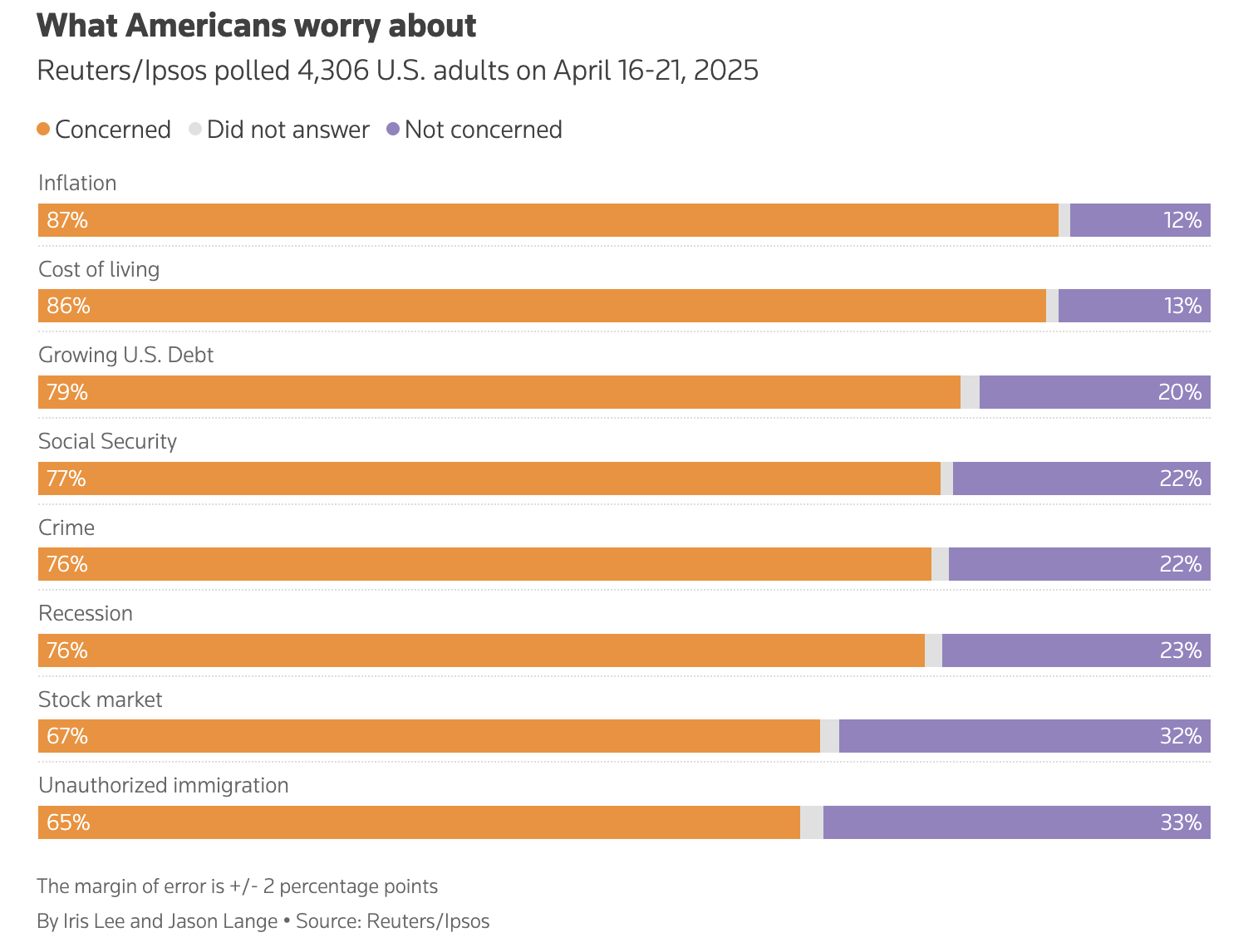

If the U.S. moves further away from international trade, it can have a long-term impact on corporate earnings. Trump also seems less eager to back down on tariffs until he secures favorable deals, and he is confident about bringing manufacturing back to America. These goals suggest that the stock market will face long-term headwinds as the U..S. gradually reduces its exposure to global trade.

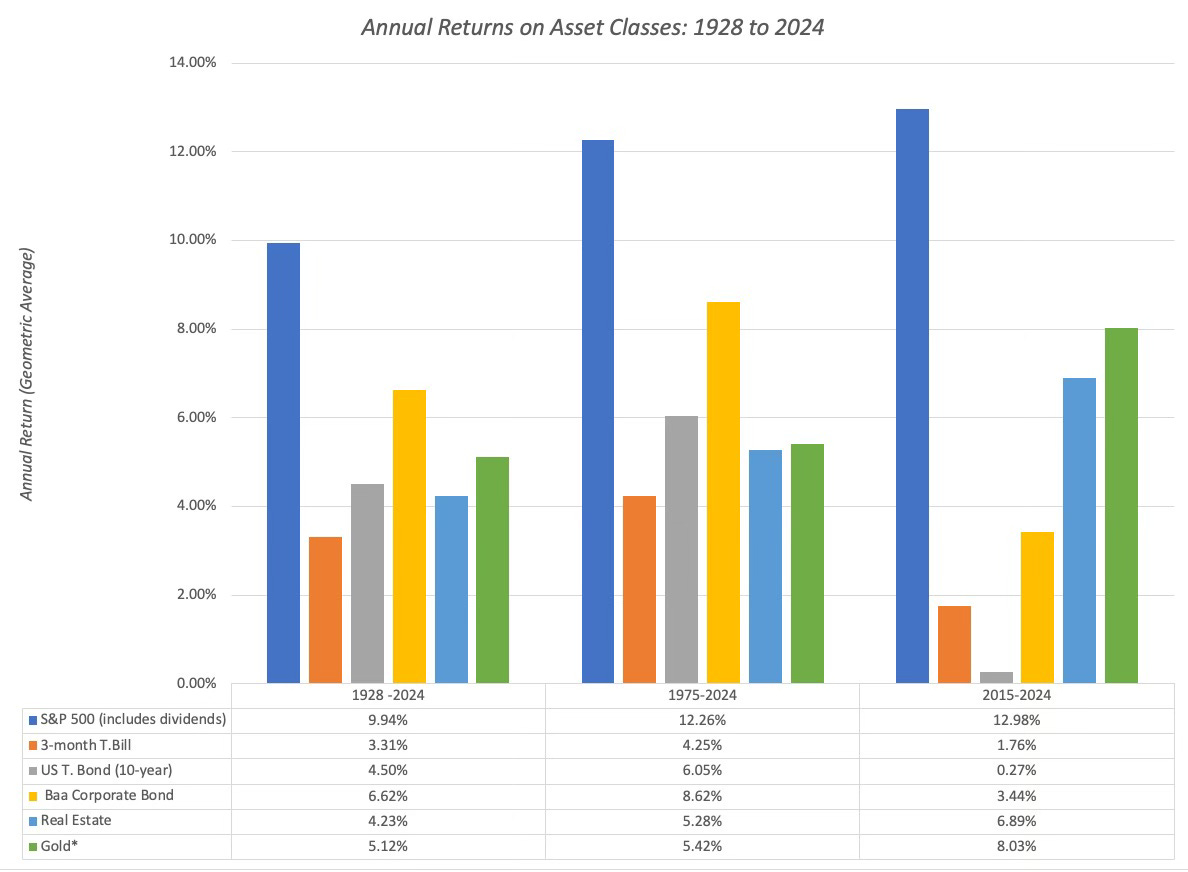

You Can’t Rely On The Stock Market Going Up By 10% Each Year

One commenter explained that people who believe the stock market will keep going up need new plans. Corrections and crashes are a part of the process. While some people will continue to buy, others have to assess what is best for their long-term retirement goals.

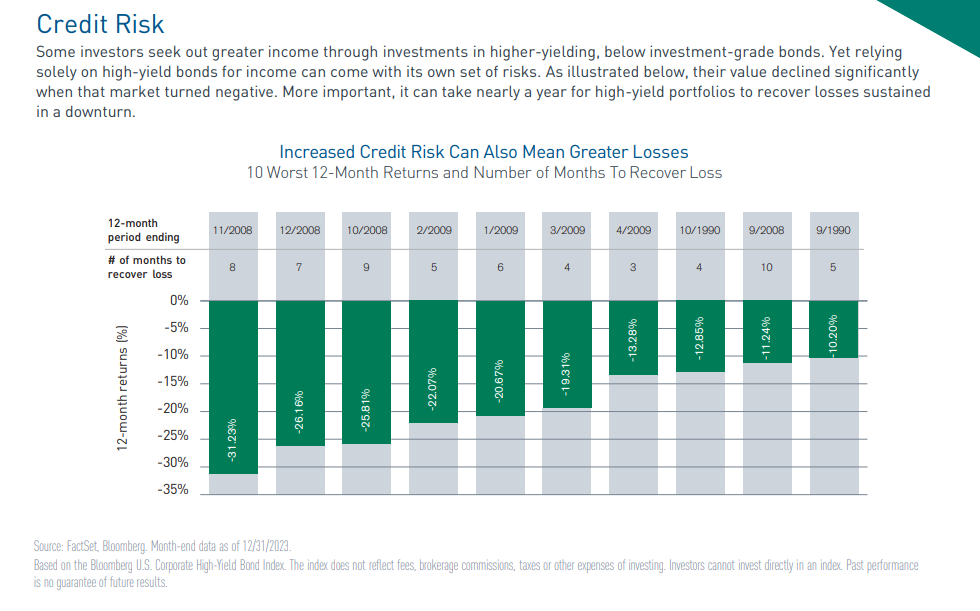

Some people may want to work longer instead of retiring early. Others may want to allocate some money into bonds to minimize their risk. The right path varies for each person, but now is a good time to review your plan.

Younger investors have the least to worry about if they have stable jobs. They can continue to buy the dip if they desire and wait out a long recovery process. Investors who are approaching retirement or who are worried about losing their jobs have to approach the current volatility more cautiously.

The post How I’m Navigating Financial Uncertainty in a Changing Economy appeared first on 24/7 Wall St..