3 Brilliant Dividend Stocks to Buy Now and Hold for the Long Term

Few investors enjoy market uncertainty, so the current state of affairs on Wall Street is probably a little unsettling for you. Buying dividend stocks can help calm your nerves because you can focus on collecting dividend checks instead of price volatility. Here are three brilliant dividend stocks that will serve you well now and are well worth holding for the long term.If you are watching the markets and feeling a little seasick, you might want to look at buying Realty Income (NYSE: O). The company pays monthly dividends, so it provides investors with a steady stream of income. The dividend, notably, has been increased annually for 30 consecutive years and is backed by an investment-grade-rated balance sheet. The real estate investment trust (REIT) is so focused on dividends that it actually trademarked the nickname, "The Monthly Dividend Company."Realty Income is the largest net lease REIT. This means that tenants pay for most property-level operating costs. It is a fairly low-risk approach in the sector when spread across a large portfolio.Continue reading

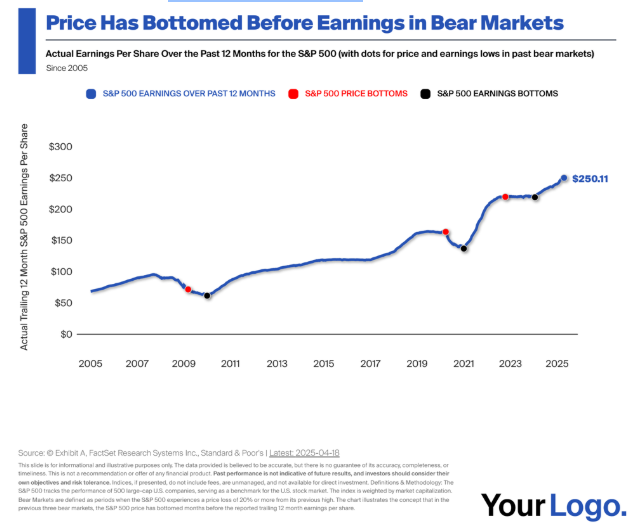

Few investors enjoy market uncertainty, so the current state of affairs on Wall Street is probably a little unsettling for you. Buying dividend stocks can help calm your nerves because you can focus on collecting dividend checks instead of price volatility. Here are three brilliant dividend stocks that will serve you well now and are well worth holding for the long term.

If you are watching the markets and feeling a little seasick, you might want to look at buying Realty Income (NYSE: O). The company pays monthly dividends, so it provides investors with a steady stream of income. The dividend, notably, has been increased annually for 30 consecutive years and is backed by an investment-grade-rated balance sheet. The real estate investment trust (REIT) is so focused on dividends that it actually trademarked the nickname, "The Monthly Dividend Company."

Realty Income is the largest net lease REIT. This means that tenants pay for most property-level operating costs. It is a fairly low-risk approach in the sector when spread across a large portfolio.