Regeneron is buying 23andMe out of bankruptcy for $256 million

The deal still needs court approval.

Biotechnology company Regeneron Pharmaceuticals is buying 23andMe for $256 million, two months after the genetic testing company filed for Chapter 11 bankruptcy protection.

In March 23andMe said that it was looking to sell “substantially all of its assets” through a court-approved reorganization plan. Its co-founder and CEO Anne Wojcicki also resigned from the top post, but remained as a board member.

23andMe has faced an uncertain future for some time. Beyond battles to go private, the company struggled to find a profitable business model since going public in 2021. Privacy concerns related to customers’ genetic information have also emerged, notably spanning from a 2023 data breach — along with questions around what new ownership could mean for users’ data.

The proposed transaction with Regeneron includes 23andMe's personal genome service and total health and research services. It does not include the Lemonaid Health subsidiary, a telehealth services provider which 23andMe plans to wind down.

"We believe we can help 23andMe deliver and build upon its mission to help people learn about their own DNA and how to improve their personal health, while furthering Regeneron’s efforts to improve the health and wellness of many,” Regeneron co-founder, board co-chair and Chief Scientific Officer George Yancopoulos said in a statement.

Regeneron said Monday that it will comply with 23andMe's privacy policies and applicable law, process all customer personal data in accordance with the consents, privacy policies and statements, terms of service, and notices currently in effect and have security controls in place designed to protect such data.

“We are pleased to have reached a transaction that maximizes the value of the business and enables the mission of 23andMe to live on, while maintaining critical protections around customer privacy, choice and consent with respect to their genetic data,” said Mark Jensen, chair and member of the special committee of 23andMe's board.

Regeneron will be keeping all of 23andMe's employees, Jensen added.

As part of the court-supervised sale process, 23andMe required all bidders to guarantee that they will comply with its privacy policies and applicable law.

Regeneron said that its proposed deal aligns with 23andMe’s privacy statement, but that a court-appointed, independent consumer privacy ombudsman will also examine the transaction and any potential impact on consumers’ privacy. The ombudsman will present a report to the court by June 10.

A court hearing to consider approval of the transaction is currently scheduled for June 17. The deal, which still needs approval from the U.S. Bankruptcy Court for the Eastern District of Missouri, is expected to close in the third quarter.

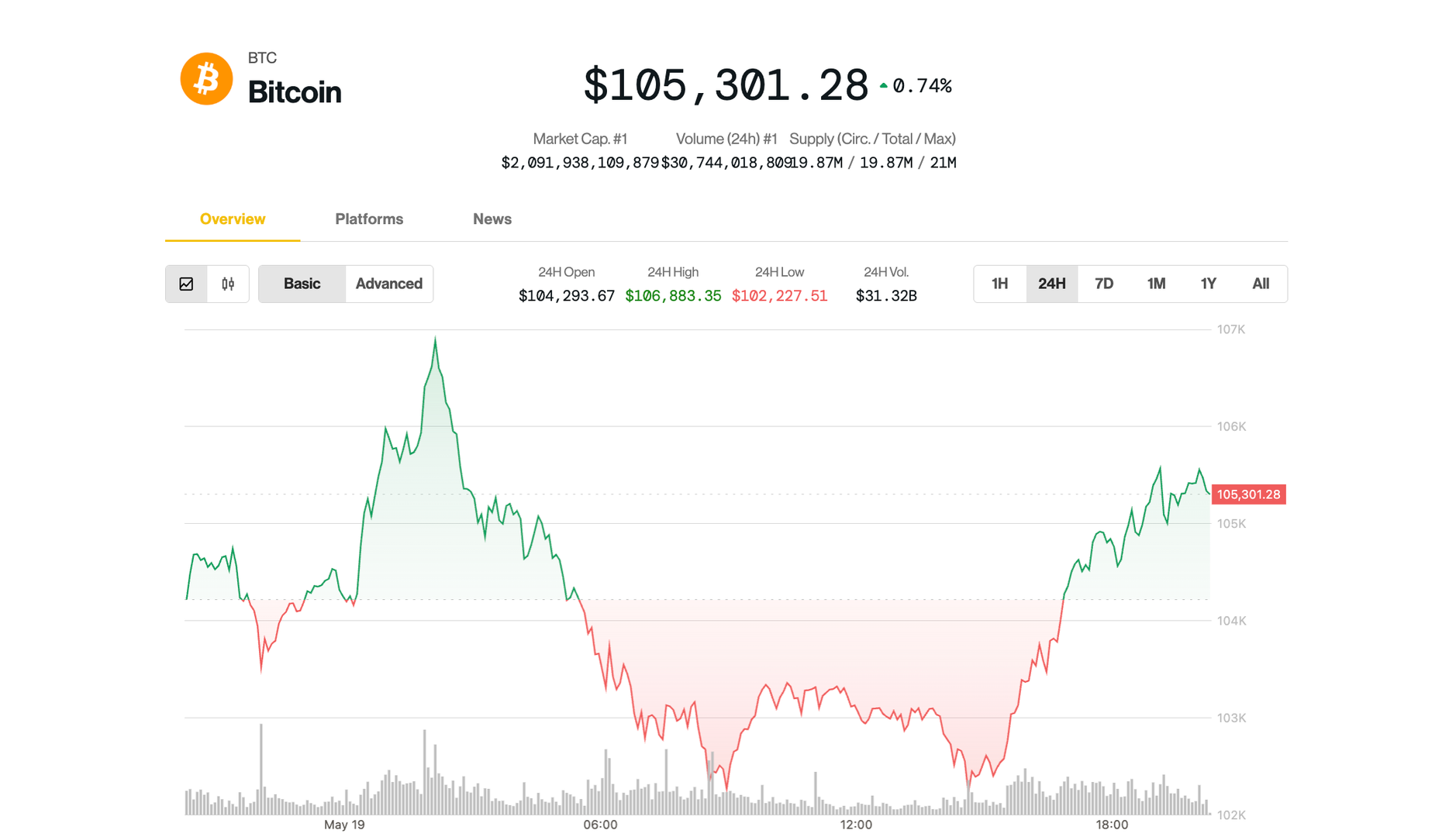

Shares of Regeneron fell slightly before the market open.

This story was originally featured on Fortune.com