People feel so bad about the economy because of tariffs and inflation that consumer confidence sank to a 13-year low

President Donald Trump’s tariff policies have largely impacted how consumers feel about the economy.

- Consumer confidence fell to its lowest level in 13 years, according to the Conference Board’s most recent survey released Tuesday. Survey respondents were most concerned about President Donald Trump’s tariff policies and how they would impact prices.

Consumer confidence fell for the fifth straight month on the heels of President Donald Trump’s sweeping tariff policies, driving up prices and spooking Americans.

The Conference Board’s most recent survey for its Consumer Confidence Index, published Tuesday, shows confidence dropped nearly eight points in April to 86. Consumers’ expectations for the future are now at a 13-year low, according to the Conference Board.

Stephanie Guichard, senior economist for global indicators at the Conference Board, said three expectation components—business conditions, employment prospects, and future income—all dropped sharply. The share of consumers expecting fewer jobs in the next six months was 32.1%, nearly as high as during the Great Recession.

“In addition, expectations about future income prospects turned clearly negative for the first time in five years, suggesting that concerns about the economy have now spread to consumers worrying about their own personal situations,” she said in a statement.

The Conference Board’s Consumer Confidence Index is based on a survey of all age groups and most income groups, and the sharpest decline in confidence came from consumers between 35 and 55 years old and households earning at least $125,000 per year. A confidence drop was seen among all political affiliations, according to the Conference Board.

Meanwhile, the University of Michigan’s Surveys of Consumers for April also showed consumer sentiment fell for the fourth straight month, dropping 8% from March. Expectations fell 32% since January, which is the steepest three-month percentage decline since the 1990 recession, according to the University of Michigan.

“Consumers perceived risks to multiple aspects of the economy, in large part due to ongoing uncertainty around trade policy and the potential for a resurgence of inflation looming ahead,” the report read. “Labor market expectations remained bleak.”

At the top of mind for consumers who responded to the Conference Board’s survey were concerns about tariffs. They mentioned worries about how tariffs will increase prices and have a negative impact on the economy. Consumers also remained distressed by inflation and high prices, specifically referencing groceries and gas. Waning consumer confidence has tanked Trump’s approval rating, which hit the lowest level among his two terms earlier this month.

Other reports have shown consumers are so concerned about tariffs and inflation they think we’re headed toward a recession. Roughly half of U.S. adults said Trump’s trade policies will increase prices “a lot,” according to a poll by the Associated Press–NORC Center for Public Affairs Research released last week. In fact, Gen Z consumers are so worried about recession odds they’re forgoing discretionary spending—and even resorting to eating kids' meals to save money.

Meanwhile, major companies like GM and Lululemon have pulled back their fiscal outlooks based on consumer confidence and concerns about tariff implications.

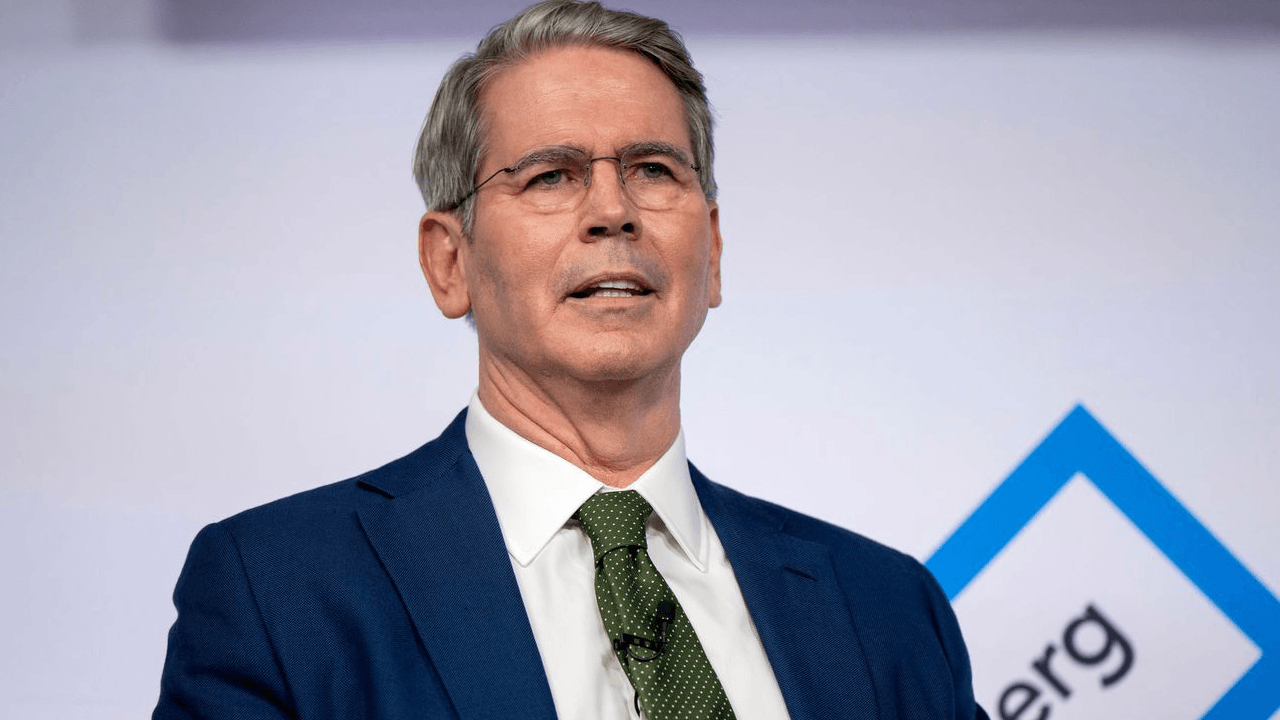

Low consumer confidence is “manifesting itself” into slower foot traffic in the U.S. this quarter, Lululemon CEO Calvin McDonald said during the company’s latest earnings call on March 28, adding that “we are controlling what we can control.”

In turn, CEO confidence about the economy has also waned. Chief Executive’s most recent survey showed 62% of top executives are predicting a slowdown or recession in six months. Even Walmart CEO Doug McMillon admitted during a Feb. 27 talk at the Economic Club of Chicago that “budget-pressured” customers were reducing their spend and exhibiting “stressed behaviors.”

“You can see that the money runs out before the month is gone, you can see that people are buying smaller pack sizes at the end of the month,” McMillon said.

The Conference Board will release its next survey findings on May 27.

This story was originally featured on Fortune.com