Palantir Live: PLTR Up Big As Investors Digest Earnings

Software firm, Palantir (NASDAQ: PLTR) is up more than 8.5% after reporting solid earnings growth on Monday. The company posted first-quarter revenue of $884 million, which was above analyst expectations of $863 million. The company’s EPS of 13 cents per share was in line with expectations. Management also raised its full-year 2025 revenue guidance to […] The post Palantir Live: PLTR Up Big As Investors Digest Earnings appeared first on 24/7 Wall St..

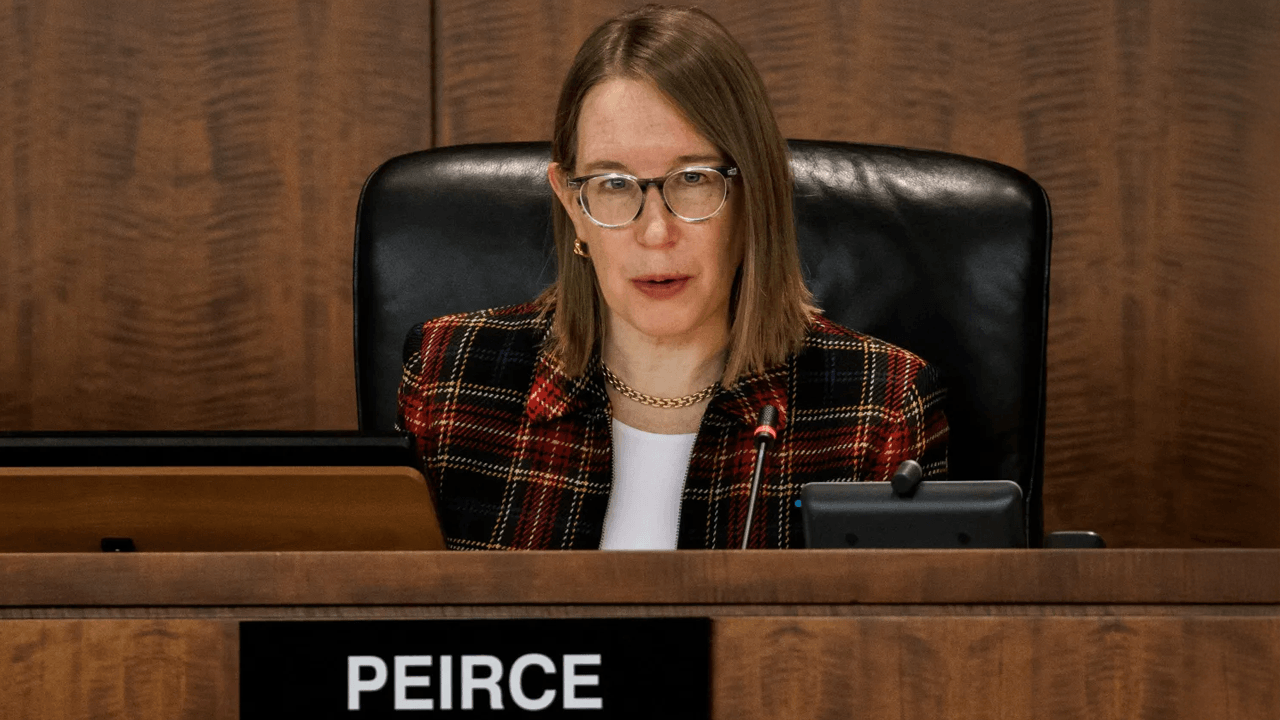

Software firm, Palantir (NASDAQ: PLTR) is up more than 8.5% after reporting solid earnings growth on Monday. The company posted first-quarter revenue of $884 million, which was above analyst expectations of $863 million. The company’s EPS of 13 cents per share was in line with expectations.

Management also raised its full-year 2025 revenue guidance to a range of $3.89 billion to $3.902 billion, with adjusted income from operations expected to be between $1.711 billion and $1.723 billion. Adjusted free cash flow guidance was raised to a new range of between $1.6 billion and $1.8 billion.

“We are delivering the operating system for the modern enterprise in the era of [artificial intelligence],” said CEO Alexander C. Karp, as quoted by Barron’s. “Consequently, we are raising our full-year guidance for total revenue growth to 36% and our guidance for U.S. commercial revenue growth to 68%.”

Analysts at Citi also raised its price target on Palantir to $115 from $110 with a neutral rating. According to the firm, Palantir delivered a “strong beat/raise” and its “robust results further solidifies” its role with artificial intelligence.

Even Wedbush analyst Dan Ives has growing confidence in the stock, noting the company is in a “prime position” for more contracts from the U.S. government — after selling its AI-powered Maven Smart System to NATO.

The post Palantir Live: PLTR Up Big As Investors Digest Earnings appeared first on 24/7 Wall St..