Nvidia stock active amid report OpenAI plans to develop AI chips

Microsoft-backed OpenAI is looking to reshape the global market for AI-powering chips and processors.

Updated at 9:37 AM EST

Nvidia shares bumped higher in early Monday trading, but remain in negative territory for the year, following a report that suggested that OpenAI, the Microsoft-backed creator of ChatGPT, is looking to design its own AI-powering chips as it plans its next phase of expansion.

Hyperscalers, the major providers of cloud services and infrastructure, and chatbot creators are looking to spend billions over the next two to three years developing data centers and training and deploying large-language model systems with new AI technologies.

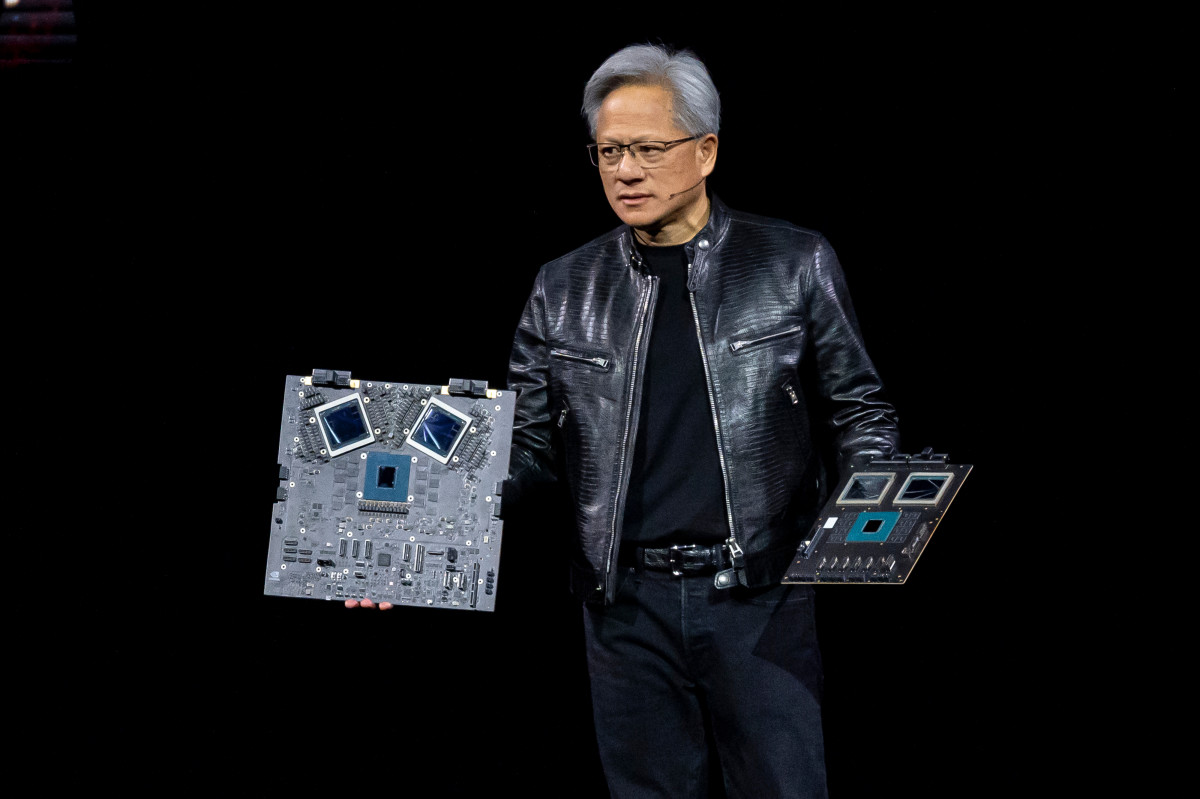

That gold rush has put Nvidia (NVDA) , which holds a commanding lead over its rivals in AI chips and processors, in pole position to both reap the benefits but also to control pricing in one of the tech sector's most important markets.

However, the emergence of the China-based DeepSeek as an AI player, with what it claimed to be cheaper, lower-end chips and a focus on more efficient 'distillation' techniques, has raised questions about the tech sector's reliance on Nvidia products.

Capacity issues tied to the surge in AI demand also have held back gains at Microsoft's (MSFT) Azure, its flagship cloud division, as well as Amazon's (AMZN) Amazon Web Services.

Related: Analyst revisits Microsoft stock price target as DeepSeek tests OpenAI

Both companies have been investing in in-house alternatives, with Amazon developing the next generation of Trainium chips and Microsoft building its own silicon for Azure using technology from Arm Holdings (ARM) .

OpenAI going in-house for chips?

Reuters reported Monday that OpenAI was following suit and would finalize its first in-house design, in collaboration with Broadcom (AVGO) . with fabrication at chipmaker Taiwan Semiconductor set for later this year and mass production targeted for 2026.

OpenAI is also raising billions to fund its share of the Stargate joint venture, recently unveiled by President Donald Trump and agreed to a smaller pact with SoftBank (SFTBY) called SB OpenAI, under which the Tokyo investment firm would pay $3 billion annually to use its AI technology.

Related: Big tech will spend a staggering amount on AI in 2025

SoftBank is also reportedly in talks to lead a $40 billion funding round for OpenAI that would value the group at more than $300 billion.

That could help fund the near $1 billion overall cost tied to developing an successful AI chip and the software and technical gear required to deploy it.

OpenAI CEO Sam Altman, meanwhile, has been seeking to persuade the world's biggest investors, including the United Arab Emirates, to commit potentially trillions of dollars as part of a global effort to reshape the AI landscape by massively expanding production of chips and processors.

Nvidia earnings up soon

Nvidia, which reports its fourth quarter results after the close of trading on Feb. 26., will be certain to address both DeepSeek's impact on the broader AI landscape, its expectations for a share of the $325 billion committed by the biggest hyperscalers, and the growing presence of rivals like Broadcom, Marvell (MRVL) and Advanced Micro Devices (AMD) .

More AI Stocks:

- Analysts overhaul Apple stock price targets after record Q1 earnings

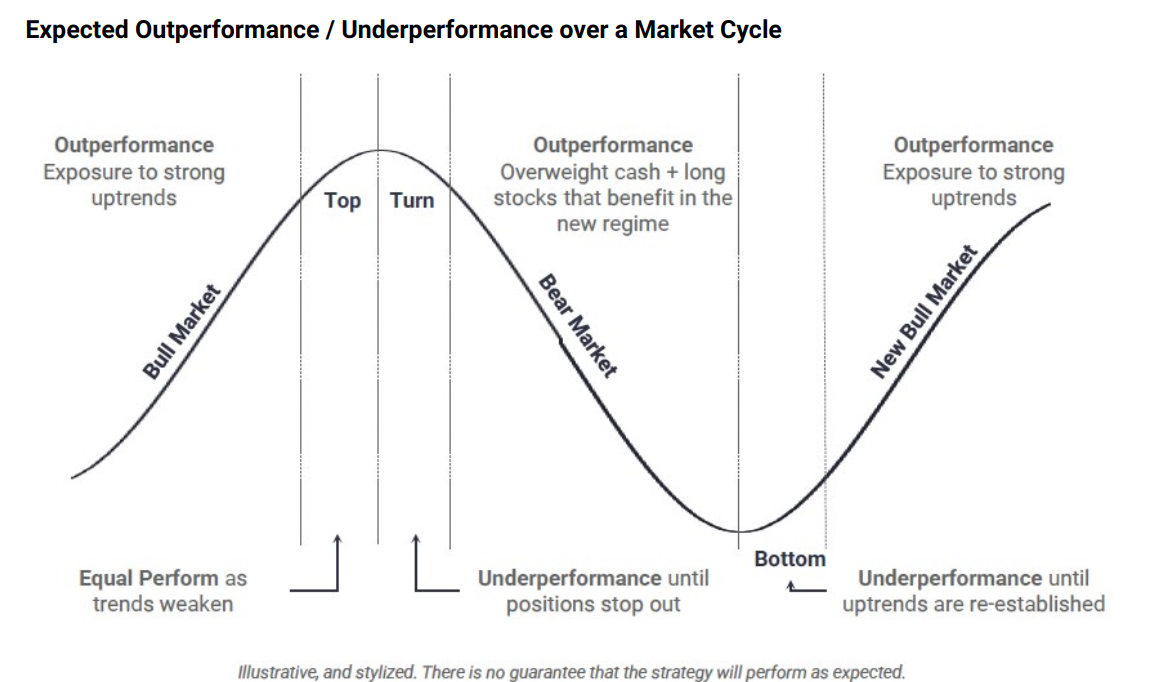

- Veteran fund manager reveals startling AI stocks forecast for 2025

- These agentic AI stocks could soar in 2025

Nvidia shares were last marked 2% higher in early trading and changing hands at $132.60 each. Broadcom shares, meanwhile, jumped 2.15% to $229.66 each while AMD nudged 1.5% higher to $109.17 each..

Related: Veteran fund manager issues dire S&P 500 warning for 2025