Nvidia (NVDA) Has Crashed, And Here is What History Says Happens Next

Nvidia (NASDAQ:NVDA) has delivered massive gains for most investors who have held this stock for any meaningful period of time. This is a stock that’s up an incredible 1,819% over the past five years, making many long-term investors very wealthy by doing nothing. However, this is also a top growth stock that’s been beaten […] The post Nvidia (NVDA) Has Crashed, And Here is What History Says Happens Next appeared first on 24/7 Wall St..

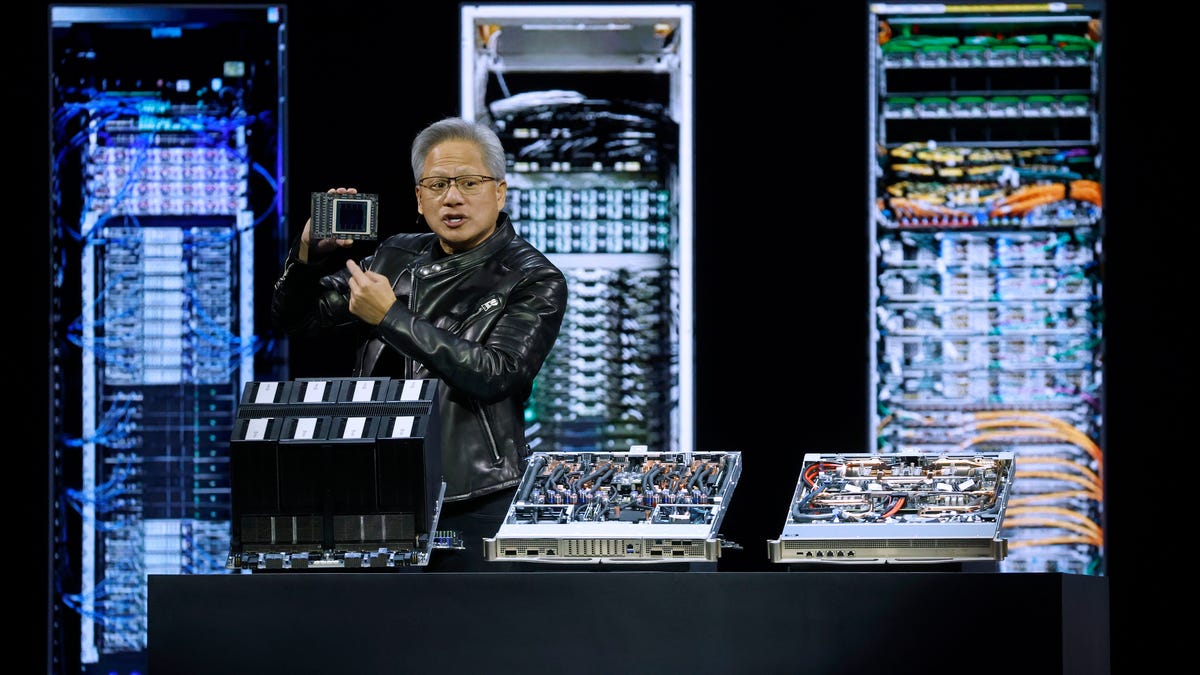

Nvidia (NASDAQ:NVDA) has delivered massive gains for most investors who have held this stock for any meaningful period of time. This is a stock that’s up an incredible 1,819% over the past five years, making many long-term investors very wealthy by doing nothing.

Key Points

-

Nvidia’s rise to become the world’s most valuable company was short-lived, but this is a stock that could be worth considering on its recent dip.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

However, this is also a top growth stock that’s been beaten down by increasing recession concerns in 2025. The high-performance chip maker has seen its share price decline 14% on a year-to-date basis, though the company has bounced more than 10% from its lows seen last week.

In addition to market-wide headwinds tied to expectations of a potential recession (or at least significant slowing in growth) in the U.S. in the years to come, Nvidia’s stock decline stemmed from concerns over AI-driven chip demand, trade conflicts, and other uncertainties around how robust corporate spending will be moving forward. Most notably, the launch of DeepSeek raised doubts about the ultimate requirements for companies to purchase AI chips and in what quantities, while a weakening economy could curb business spending. Given Nvidia’s high valuation and $2.7 trillion market cap, the drop wasn’t unexpected.

That said, let’s dive more into what’s behind this decline, and what history suggests could be the most prudent move for investors moving forward.

What Gives?

Most Magnificent 7 stocks have been hit hard during this recent market-wide sell-off that has rattled U.S. markets. Nvidia, Tesla, Alphabet, Amazon, Meta, Apple, and Microsoft all declined, with Tesla plunging 15% in a single day. Indeed, this selling pressure appears to be rather indiscriminate, and oriented most toward companies with the highest valuation multiples.

On this front, investors can certainly understand at least some of the rationale behind the selling pressure we’re seeing in Nvidia right now. This is a company that trades for 22-times sales, after all. And that’s after this decline – the multiple was higher heading into this move.

But on an earnings basis, there are plenty of analysts who point to Nvidia’s forward price-earnings multiple as being better than, say, Apple (NASDAQ:AAPL). On that basis, the stock is cheap, at around 25-times forward earnings.

So, the question is ultimately who is right in this current environment. Much of what will determine which investor group is right will come down to earnings expectations for the chip maker, and whether Nvidia can continue to beat in the manner it has moving forward.

I’m of the view that so long as broader corporate spending on AI chips declines materially, Nvidia is a stock that’s likely relatively cheap, at least historically at current levels. Thus, this recent selloff is certainly intriguing for investors looking to hold a high-growth stock for a decade or longer.

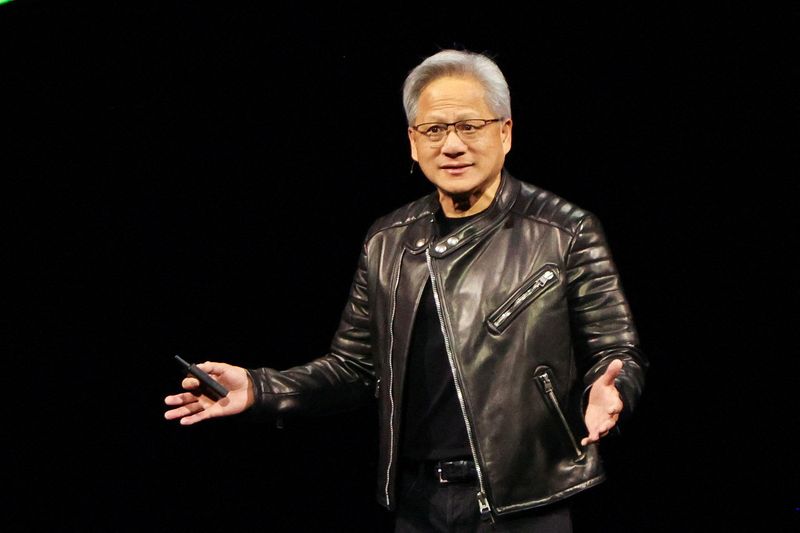

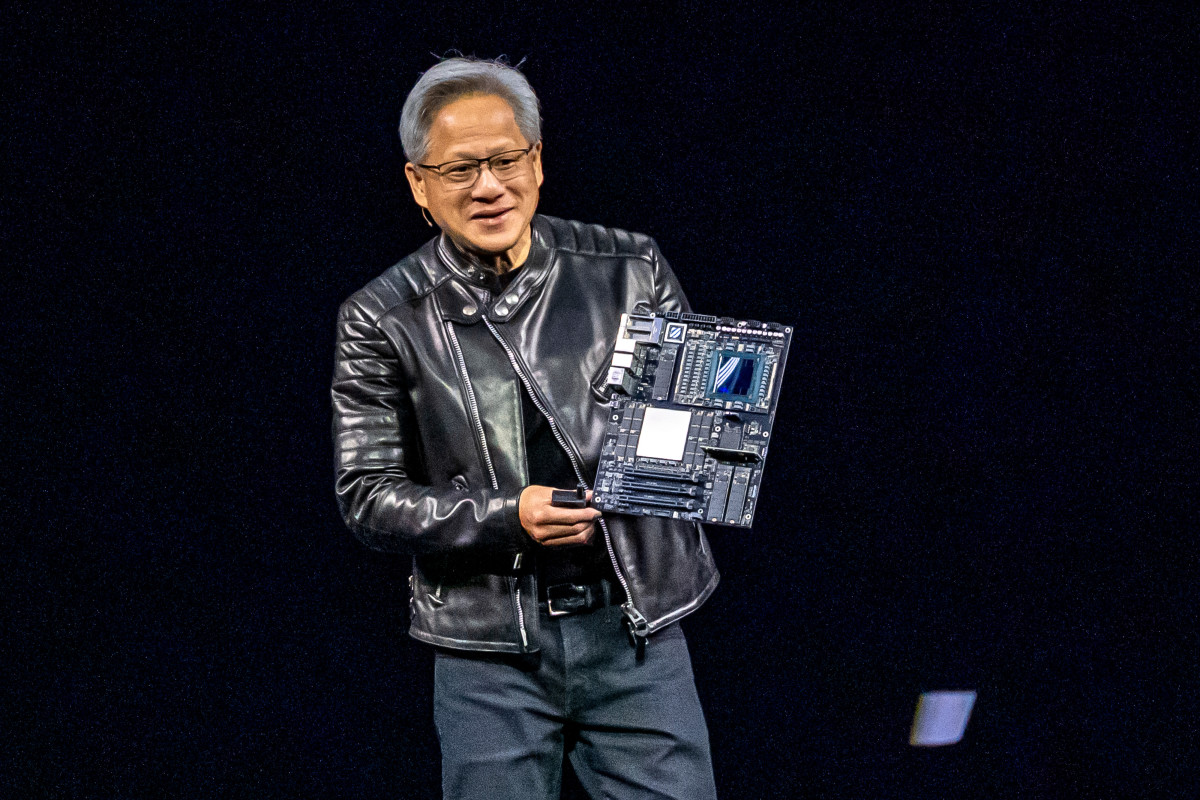

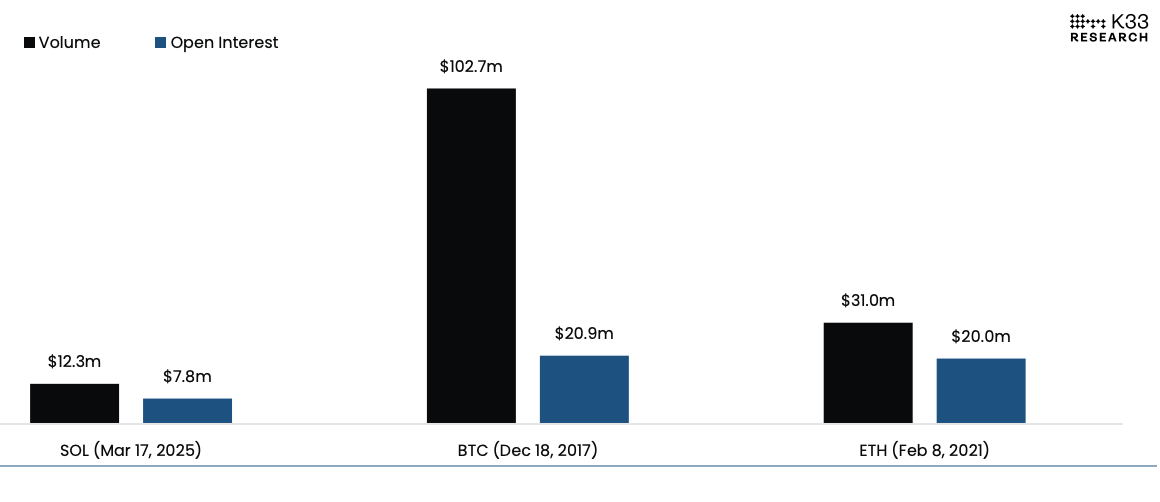

Potential Turning Point Coming on March 17

One of Nvidia’s more impressive recent days came on March 12, when the stock surged more than 7% as investors priced in anticipation around Nvidia’s upcoming GTC conference on March 17 as a catalyst for stock recovery. Recent declines stemmed from tariff concerns and recession fears. Wedbush predicted the event would refocus attention on AI growth, with analyst Dan Ives forecasting $2 trillion in AI infrastructure spending over three years. He maintained an “Outperform” rating and a $175 price target, implying a 50% upside.

Wedbush’s Dan Ives advised buying Nvidia before its GTC conference, believing growth potential wasn’t fully reflected in its valuation. The event could drive a stock rebound as Nvidia unveils innovations, new hardware, platform upgrades, or strategic partnerships, boosting investor confidence.

History Says Nvidia Could Be a Buy Here

Nvidia’s long-term stock chart (shown above) really does highlight how incredible of a long-term performer this stock has been. On a historical basis, Nvidia is among the higher-growth names that has seen marked selloffs from time to time (with 2022 being the most recent example investors can point to) in which the stock has dipped more than 30% and stagnated for some time, before resuming a march higher. On that basis, one could argue that being patient with Nvidia right now and waiting for a steeper decline may be the best move.

Indeed, sentiment around AI stocks today isn’t what it was a year ago. And there aren’t any real meaningful catalysts outside of what could be announced at this week’s GTC conference, that investors can point to as meaningful catalysts that aren’t already priced into Nvidia stock.

But over the long-term, it’s also historically true that buying Nvidia on dips has proven to be the right move. The question is whether this correction in NVDA stock will be enough to entice a large enough percentage of the market to jump back into Nvidia here. The jury’s out on that, but I’m sticking with my view that Nvidia still looks cheap here, and it’s a strong historical long position in any portfolio..

The post Nvidia (NVDA) Has Crashed, And Here is What History Says Happens Next appeared first on 24/7 Wall St..