Nvidia Faces Dangerous China Competition

Huawei Technologies may soon make chips that compete with the most advanced products from Nvidia. China will not need to import Nvidia chips. The post Nvidia Faces Dangerous China Competition appeared first on 24/7 Wall St..

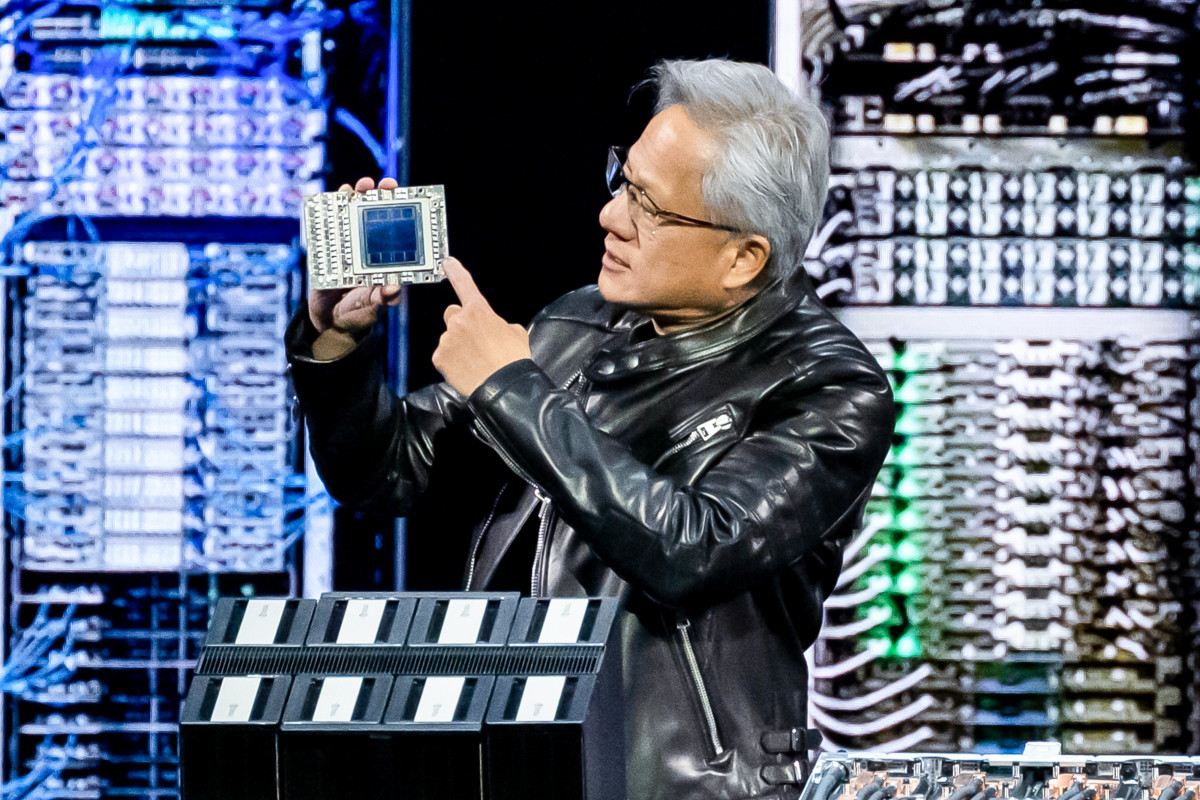

Nvidia Corp. (NASDAQ: NVDA) is struggling because many of its chips cannot be sold in China. Due to this, it has even taken a $5.5 billion write-off. Another difficulty in the number two nation in the world based on gross domestic product is that its competition is about to deepen. Local tech giant Huawei Technologies is on a path to building chips that will compete with Nvidia’s most advanced products. Then, China may not need to import Nvidia chips, which would sharply damage its long-term revenue.

24/7 Wall St. Key Points:

-

Huawei Technologies may soon make chips that compete with the most advanced products from Nvidia Corp. (NASDAQ: NVDA).

-

Then, China will not need to import Nvidia chips.

-

Take this quiz to see if you’re on track to retire. (sponsored)

The Wall Street Journal said that the company’s new chip “uses packaging technologies to integrate more silicon dies together to boost performance, said people familiar with the matter. The people said the 910D is power hungry and less power-efficient than Nvidia’s H100.” That means it will still operate with a disadvantage. However, for Chinese companies, the new chip may be the only alternative to Nvidia, making adoption brisk if the United States continues its roadblock. The U.S. rule is helping China’s homegrown industry grow to some extent. As is often the case, the Chinese government is pushing the adoption of products created and built within its borders.

While Huawei chips require more energy than those from Nvidia, the central government has more control over China’s electricity than in America. The competition in the United States for electricity to power AI server centers has become a challenge for Nvidia customers.

Another Blow to Nvidia’s Prospects

The news is another blow to Nvidia’s prospects. Its stock is down 17% this year, compared to 27% a few weeks ago. There are several reasons for the trouble. Investors have become worried about the pace at which the most prominent AI companies are building out their server farms. According to PYMMTS, both AWS and Microsoft have slowed their deployment. Investors have started to worry that the return on investment from AI products may be slower than expected.

Nvidia’s stock price relies on rapid adoption. In the current quarter, analysts expect Nvidia to have revenue of $43.1 billion, up from $26 billion in the same quarter a year ago. Earnings are expected to rise to $0.89 a share from $0.61.

Nvidia’s stock is up 1,470% in the past five years. At some point, gravity is going to catch up with it.

Three Things That Need to Happen for Nvidia to Have Another Banner Year in 2025

The post Nvidia Faces Dangerous China Competition appeared first on 24/7 Wall St..