My traditional IRA has $1.8 million and my Roth only has $300k – am I doing this right?

A Redditor has amassed millions of dollars in their investment accounts and is looking for the most optimal way to withdraw from retirement accounts. He shared his finances in the Fat FIRE Reddit group and is looking for somesuggestions. The individual is in their mid-50s and expects to receive $62k/yr in Social Security at 62. He has […] The post My traditional IRA has $1.8 million and my Roth only has $300k – am I doing this right? appeared first on 24/7 Wall St..

A Redditor has amassed millions of dollars in their investment accounts and is looking for the most optimal way to withdraw from retirement accounts. He shared his finances in the Fat FIRE Reddit group and is looking for somesuggestions.

The individual is in their mid-50s and expects to receive $62k/yr in Social Security at 62. He has a $6.3 million brokerage account, a $1.8 million traditional IRA, and a $300k Roth account. The Redditor estimates having to spend $200k/yr after paying taxes. I’ll share my thoughts, but it is good to speak with a financial advisor if you can.

Key Points

-

A Redditor is planning out their upcoming retirement account withdrawals.

-

Starting with the traditional IRA and delaying Social Security payments may be the optimal move.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Start with the Traditional IRA

When the Redditor makes withdrawals, it’s good to start with the traditional IRA. While these withdrawals are taxed, the Redditor can withdraw funds when they retire to lower their tax bill. This strategy also protects the brokerage account and Roth IRA. Brokerage accounts qualify for step-up basis when you pass them on to your heirs. Furthermore, Roth IRAs aren’t taxed, and your heirs have up to 10 years before they have to exit Roth IRAs that they inherit.

It’s better to give your kids a small traditional IRA instead of $1.8 million since it’s all taxable. On top of that, the children will likely earn income from jobs or businesses that will put them in higher tax brackets. The Redditor calculated that he has to withdraw $267k per year to support his lifestyle. Most of these funds should come from a traditional IRA when it’s time to withdraw from the account.

Don’t Rely on Software to Plan Out Long-Term Finances

The Redditor was also looking for software to plan out their withdrawals over the long run. While Boldin was recommended and made it on the Redditor’s radar, not everyone in the comments thought it was a good idea.

One commenter mentions that the tax landscape appears to have changed moving forward due to the change in U.S. leadership. A lot of variables can change, which may prompt a year-to-year planning process instead of using software like Boldin. Granted, other Redditors recommended the software, but a lot can change within the tax code over the next four years.

President Trump has floated the idea of abolishing income taxes and replacing them with tariffs. If that happens, it would make sense to withdraw all of the traditional IRA funds if they won’t get taxed. That way, the account is depleted and moved to a brokerage account in case this proposed policy gets enacted and reversed a few years later.

Wait Before Taking Out Social Security

The Redditor is considering taking out Social Security upon turning 62. This arrangement should net the Redditor $36k per year. There are some risks with this strategy since the Social Security income can push the Redditor into a higher tax bracket. Furthermore, the benefits grow each year if the Redditor waits.

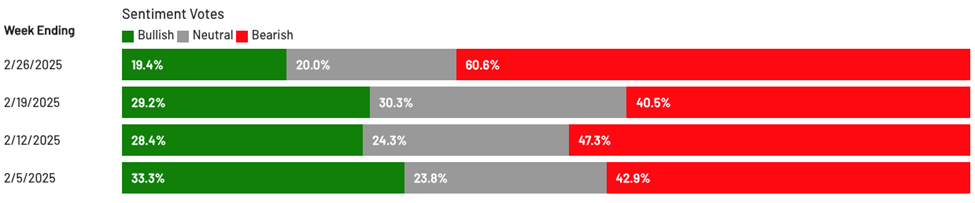

The Redditor mentioned their family’s relatively short life expectancy as one reason to tap into Social Security now instead of at 70. The Redditor assumes that they can generate an 8% annualized return from each Social Security paycheck from 62-70. However, the stock market is uncertain, and it’s riskier to make those types of investments as you get closer to retirement.

It’s better to withdraw funds from the traditional IRA to cover expenses in the beginning while the tax burden is lower. The Redditor can also use their early 60s to rollover funds from the traditional IRA to the Roth IRA if they have enough money leftover. The Redditor mentions a shorter life expectancy, but people have been living longer lately. While genetics play a role, the Redditor can consider waiting until their mid to late 60s if they don’t want to wait until 70. However, it can result in a tax hit if the Redditor rushes to tap into Social Security upon turning 62.

The post My traditional IRA has $1.8 million and my Roth only has $300k – am I doing this right? appeared first on 24/7 Wall St..