Billionaire David Tepper’s Appaloosa Jumps Out of Adobe and Into This Iconic Company

David Tepper’s hedge fund, Appaloosa LP, filed its Q4 2024 13F holdings report recently. The billionaire owner of the Carolina Panthers is probably still seething after watching Philadelphia dismantle the Kansas City Chiefs in Super Bowl LIX, knowing that his team is nowhere close to getting to the NFL Championship. Tepper’s investment firm finished 2024 […] The post Billionaire David Tepper’s Appaloosa Jumps Out of Adobe and Into This Iconic Company appeared first on 24/7 Wall St..

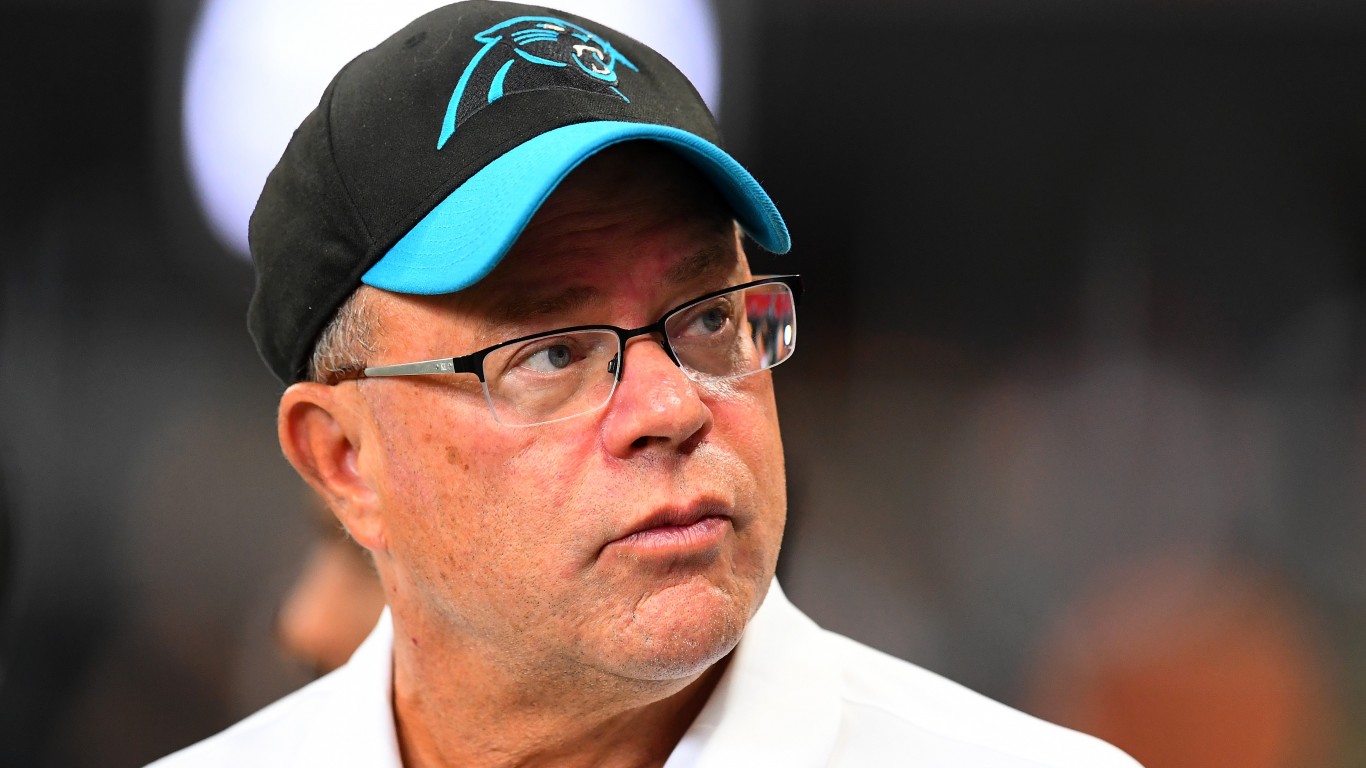

David Tepper’s hedge fund, Appaloosa LP, filed its Q4 2024 13F holdings report recently. The billionaire owner of the Carolina Panthers is probably still seething after watching Philadelphia dismantle the Kansas City Chiefs in Super Bowl LIX, knowing that his team is nowhere close to getting to the NFL Championship.

Tepper’s investment firm finished 2024 with $6.46 billion in assets invested in 37 stocks. The top 10 holdings account for nearly 69% of its investment portfolio.

Appaloosa is a high-conviction, opportunistic equity investor. Based on its fundamental research, it often takes a contrarian position if the bet makes sense.

In the fourth quarter, the hedge fund sold two stocks, one of which was Adobe (NASDAQ:ADBE), a former top 10 holding. Appaloosa used the proceeds to purchase Corning (NYSE:GLW), which was its only new purchase in the quarter.

Here’s why Tepper made these moves.

Key Points About This Article:

- Billionaire David Tepper’s hedge fund closed out two positions in the fourth quarter and made one new purchase.

- Appaloosa LP sold out of Adobe (NASDAQ:ADBE) after holding the software stock for just four quarters.

- Corning (NYSE:GLW) looks to be on the prowl for growth, which has gotten the hedge fund’s interest.

- Sit back and let dividends do the heavy lifting for a simple, steady path to serious wealth creation over time. Grab a free copy of “2 Legendary High-Yield Dividend Stocks” now.

Appaloosa Exits Adobe After Several Quarters Trimming Position

As mentioned in the introduction, Adobe was a top-10 holding but began trimming its position in the digital content creation software company in the second quarter of 2024.

Appaloosa first acquired 350,000 shares of ADBE stock in Q1 2024 at an average price of $580.69, becoming the hedge fund’s 11th-largest position. One quarter later, it added 10,000 shares, putting it in the top 10 in 9th place. It accounted for 3.24% of the hedge fund’s portfolio.

By Q3 2024, Tepper tired of its Adobe position, selling 44% of its shares, moving it down to 19th spot out of 38 stocks. Finally, in the fourth quarter, Appaloosa dumped the final 200,000 shares of ADBE to hold none.

The hedge fund’s Adobe holdings went from 350,000 shares to nothing in four quarters. It’s hard to imagine it made much money with its Adobe bet. Based on Adobe’s 2024 high ($638.25) and low ($432.47), the average share price during the four quarters was $535.36, slightly less than the average price Tepper’s firm paid for Adobe.

Why did Appaloosa buy in the first place?

Adobe’s 2024 fiscal year ended on Nov. 29. Its revenue in 2024 was $21.51 billion, 11% higher than in fiscal 2023. It earned $18.42 a share on a non-GAAP basis, 15% higher than a year earlier.

While those are both reasonable increases for a company of Adobe’s size and annual revenue, they weren’t much different from its guidance when it released its Q4 2023 results in December 2023.

On the top line, 2024 revenue was at the top end of its guidance, while adjusted EPS was 42 cents higher than the $18 estimate at the high end of its guidance. Appaloosa may have expected higher revenue growth than materialized over the year. The hedge fund has contrarian views.

Whatever the thought was, it’s no longer a problem, and Tepper’s moved on.

Corning Jumps Into 26th Spot

Appaloosa made just one new purchase in Q4 2024: Corning. This stock is off to a fast start in 2025, up over 10% through Feb. 12.

WhaleWisdom.com says the hedge fund acquired 1.5 million GLW shares in the fourth quarter at an average price of $46.34. The buy accounts for 1.10% of Appaloosa’s total portfolio. As of Dec. 31, its Corning shares were valued at $71.3 million. They’re now worth close to $80 million.

Corning is Appaloosa’s only materials stock, which could suggest that this bet is company-specific rather than sector-related. If so, the hedge fund could buy more in the first quarter of 2025.

But why would they?

Corning’s fourth-quarter results were excellent, with top-line core revenue of $3.87 billion, 18% higher than Q4 2023 and 4% better than Q3 2024. On the bottom line, its core EPS was $0.57, 46% higher than a year earlier and 6% better sequentially.

In 2024, its revenues increased by 7% to $14.47 billion, while its core EPS was up 15% to $1.96. Notably, the company’s Optical Communications segment delivered strong results in the fourth quarter and throughout 2024. The segment’s net income grew 28% in 2024, while revenues rose 16%.

Thanks to Gen AI, the segment’s enterprise sales increased by 93% year-over-year. It’s humming.

Some would argue that its stock is overvalued—its enterprise value of $48.43 billion is 3.84x revenue, higher than it has been in any of the past five years—but it’s also evident that the company is generating growth on the top and bottom lines after bad years in 2022 and 2023.

Analysts are generally optimistic about Corning. Of the 18 analysts who cover its stock, 11 rate it a buy, with a target price of $58, above its current trading price.

After Corning reported Q4 2024 results at the end of January, BofA analyst Wamsi Mohan, who has a buy rating on the stock, raised the target price to $65, well above the median estimate. The analyst was particularly enthusiastic about the Optical Communications segment mentioned previously.

More growth appears on the horizon for Corning.

The post Billionaire David Tepper’s Appaloosa Jumps Out of Adobe and Into This Iconic Company appeared first on 24/7 Wall St..