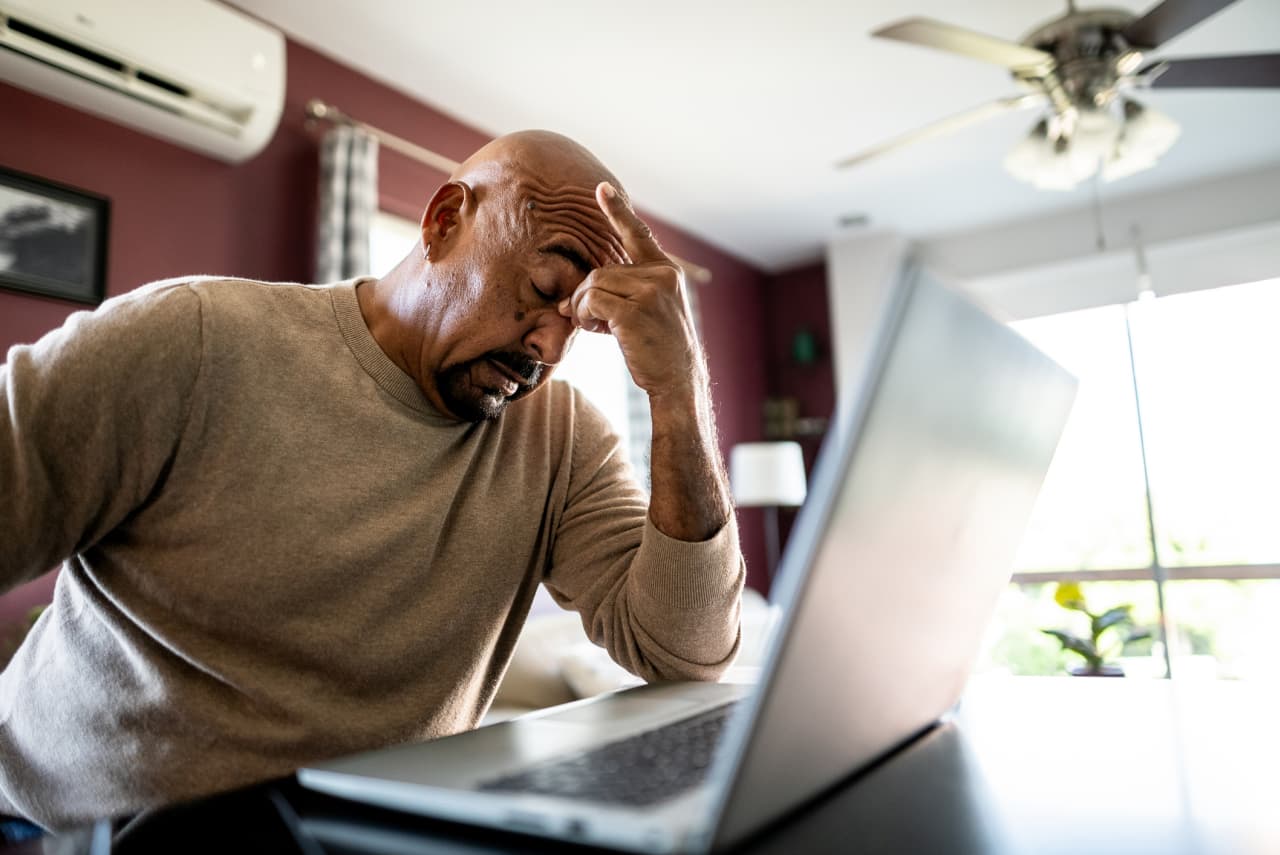

My parents are retiring with just $210k and never invested their money – what’s the safest move for their nest egg?

A Reddit user is very concerned about his parents’ retirement prospects. His father is retiring within weeks and, when he does, he’s planning on taking $210,000 from his workplace retirement account and moving it to a bank or an investing firm. The poster said that his dad never invested the money, and neither the poster’s […] The post My parents are retiring with just $210k and never invested their money – what’s the safest move for their nest egg? appeared first on 24/7 Wall St..

Key Points

-

A Redditor is worried that his parents haven’t invested their retirement funds.

-

His dad is retiring and planning to pull $210K from his workplace retirement account.

-

The Redditor’s dad should make sure he’s doing a rollover and should work with an advisor to decide what to invest in.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

A Reddit user is very concerned about his parents’ retirement prospects. His father is retiring within weeks and, when he does, he’s planning on taking $210,000 from his workplace retirement account and moving it to a bank or an investing firm.

The poster said that his dad never invested the money, and neither the poster’s dad nor the poster’s mom wants to have a discussion about where the funds should go. However, the Redditor wants to help them to ensure they are making the most of their money so their retirement can be as secure as possible.

What’s the best move for the Redditor’s parents?

The first key thing to determine here is exactly what the poster’s dad is doing with his retirement funds.

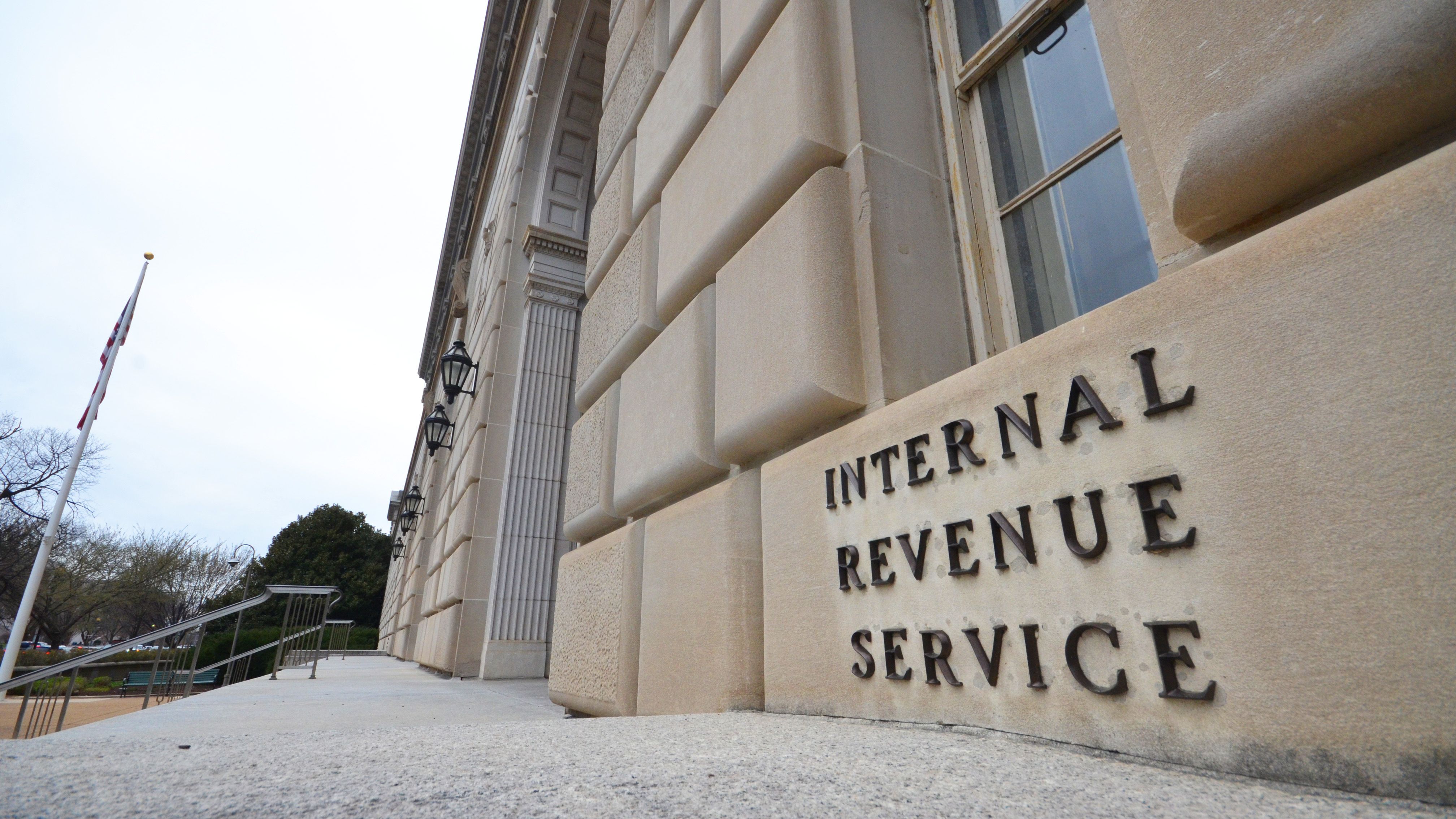

The Redditor said his dad is pulling $210K from his account to move it to a bank or investing firm. However, Dad should not just withdraw that much money from a tax-advantaged workplace plan. Doing so would be a taxable event that could push him into a much higher tax bracket and cause him to lose a good portion of the money.

Now, the Redditor’s dad should be able to roll over the funds into an IRA if he doesn’t want to leave the money invested at work. This can be a good idea as it may give him more flexibility in where the money should be invested. It would also allow the money to keep growing on a tax-free basis. However, he’ll need to make sure he follows the IRS rules for the rollover to avoid the tax hit.

What should he invest his money in?

The next big question is exactly what Dad should invest in once the money has been moved from his workplace account to his new IRA. That will depend a lot on factors such as his risk tolerance, whether he has any other assets, and how much he knows about investing.

Since the Redditor said his parents have never invested and don’t know how, the right option is probably going to be the simplest one.

The Redditor’s dad should put a portion of the money into an S&P 500 index fund, which is a fund that tracks the performance of around 500 large U.S. companies. An S&P fund comes with low fees, is relatively safe, and has consistently produced around 10% average annual returns over the long term. He should also keep some liquid cash accessible in case he needs to live on the money during a market downturn, and he should also put some money into more conservative investments such as bonds.

The best way for the Redditor’s dad to decide what to do with his money would be to talk with a financial advisor. Since the poster said his dad didn’t want to take his advice anyway, getting professional help could alleviate financial conflict while ensuring that the parents get the help and support they need for a secure retirement.

The advisor can help them decide whether taking the money out of the workplace plan makes sense, where the money should be deposited, and what asset allocation is appropriate. Getting this professional help from a fee-only advisor who acts as a fiduciary would allow the Redditor’s parents to get advice from someone they can count on who is acting in their best interests and who can help them to develop a personalized plan that’s right for their needs.

The post My parents are retiring with just $210k and never invested their money – what’s the safest move for their nest egg? appeared first on 24/7 Wall St..