Mortgage rates are dropping, but buyers still skeptical of housing market

A few factors are causing inconsistency despite small housing improvements.

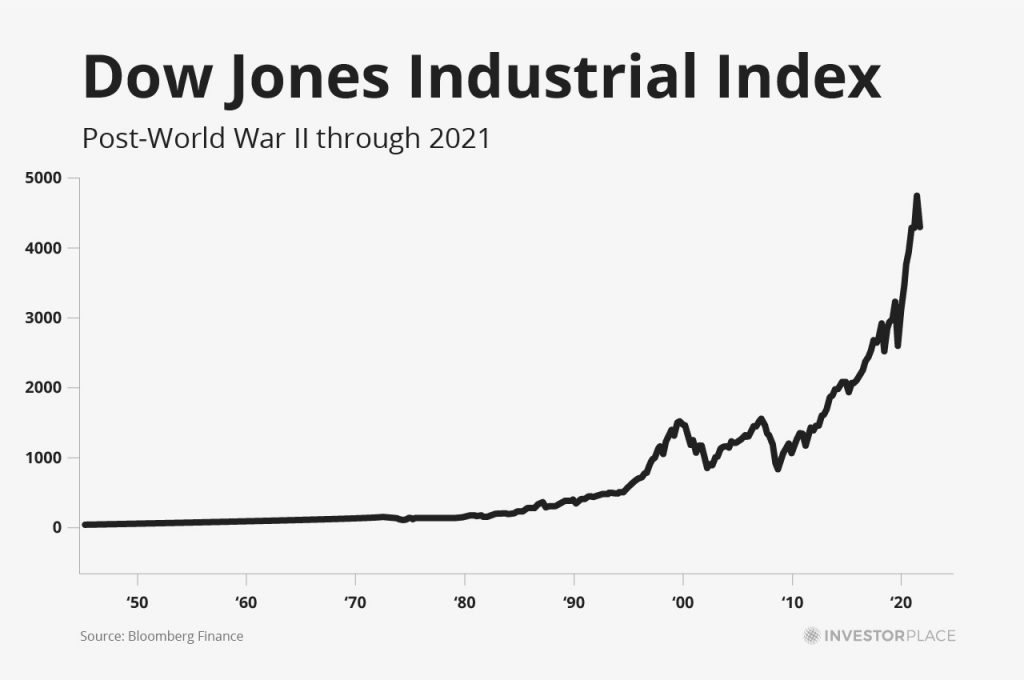

After the 2008 financial crisis, the housing market recovered fairly well, with mortgage rates remaining below 5% and competitive housing prices.

However, the post-COVID housing market faces instability and long-lasting affordability concerns, making homeownership historically expensive and dampening buyer demand.

Following the Fed's interest rate cut in September last year, mortgage rates were projected to drop two percentage points by the end of 2026.

Don't miss the move: Subscribe to TheStreet's free daily newsletter

However, rising inflation, uncertainty, and high treasury yields put upward pressure on rates, peaking at over 7% in January. Although mortgage rates began receding recently, Americans remain wary of the housing market.

Many believe that homeownership has become increasingly out of reach, dampening homebuyer demand and market activity. And though lower mortgage rates are a welcomed relief, the shift may stem from worrying economic factors. Shutterstock

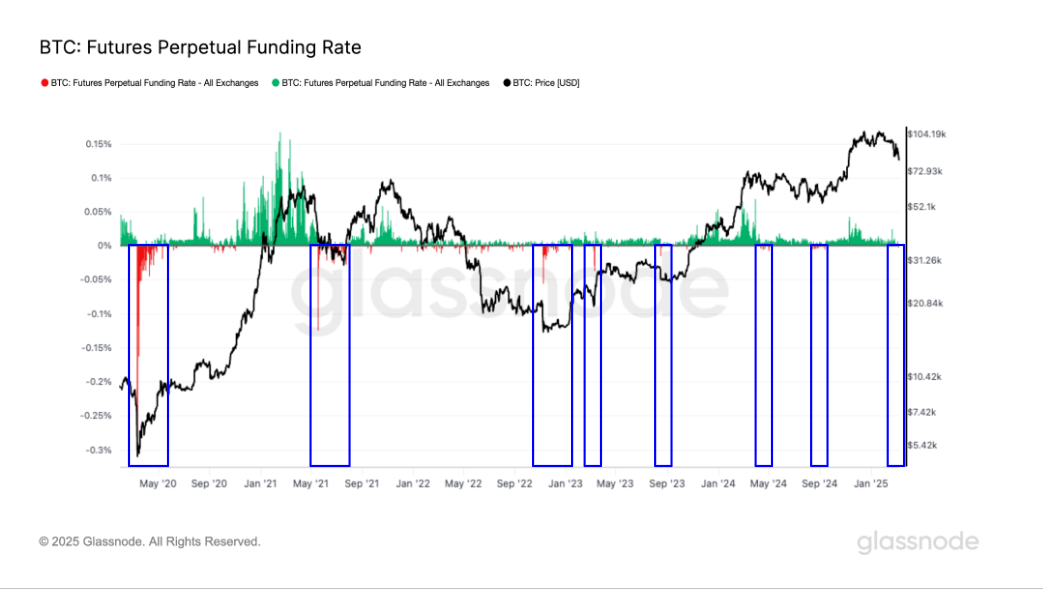

Recession fears fuel a lower treasury yield

The average 30-year fixed mortgage rate dropped to 6.63% this week, the lowest level seen since October, and most experts attribute the decline to a lower 10-year treasury yield

The Trump administration and new Treasury Secretary Scott Bessent recently committed to bringing down the 10-year treasury yield to curb mortgage rates, as the two are closely linked.

Several factors influence the treasury yield, but the strong economic uncertainty pushes more investors to favor safe investments like bonds, driving down the overall yield. Mortgage lenders tend to set mortgage rates to the 10-year treasury yield to make mortgage-backed securities appealing to investors.

More on homebuying:

- Dave Ramsey warns Americans on a homebuying mistake to avoid

- Housing expert reveals surprising ways to reduce your mortgage rate

- Americans buying homes may see major housing cost changes in 2025

- Finance veteran has a warning for Americans purchasing a home now

While home buyers and sellers have been eagerly awaiting lower mortgage rates, if they come at the cost of a recession, the housing market still may not recover as soon as hoped.

Reuters notes that "members of the Trump administration have said they want lower bond yields, as that makes it cheaper to finance the government and could eventually benefit consumers through lower home mortgage and auto loan rates. But the rationale for the drop - a flight to safety from rising economic uncertainty and potential recession risks - is less than assuring."

Homeownership feels increasingly out of reach for younger buyers

Mortgage rates are just a piece of the housing affordability equation, and inflation has increased the cost of living — particularly home prices — in recent years. Housing prices are expected to decelerate but will still increase by 3.6% over the next year.

Related: Warren Buffett's Berkshire Hathaway sounds the alarm on the 2025 housing market

Northwestern Mutual released its 2025 Planning and Progress Study, and the results indicate a growing trend: many Americans feel shut out from an inaccessible and unaffordable housing market.

52% of Americans note that inflation has increased their housing costs, and 45% say rising housing expenses are significantly impacting their finances. The sentiment is even more grim among non-homeowners: 53% of those who don't own a home don't believe they ever will.

While market conditions are easing, it may take longer than anticipated for those improvements to translate into increased demand and home sales

Related: Veteran fund manager unveils eye-popping S&P 500 forecast