3 Dividend Stocks Set to Provide Stability in Market Chaos

Investors were in growth mode in the last two years as the stock market delivered blockbuster returns. AI stocks handily beat estimates due to solid demand, and they defied gravity quarter after quarter. The recent bout of stock market panic has dragged down the Nasdaq to correction levels, and the S&P 500 could follow soon. […] The post 3 Dividend Stocks Set to Provide Stability in Market Chaos appeared first on 24/7 Wall St..

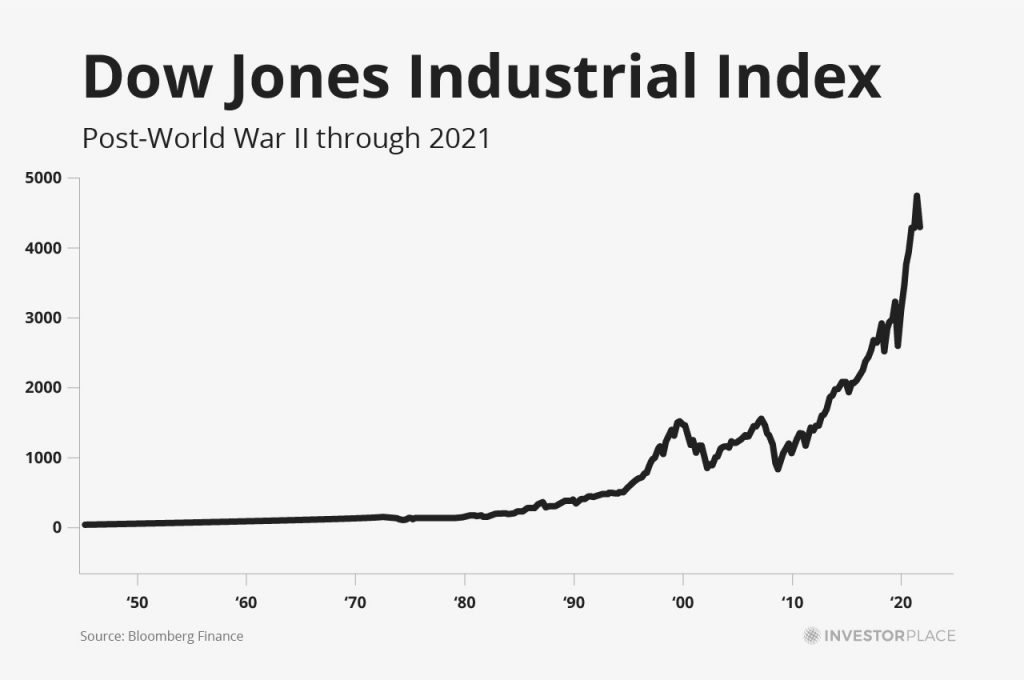

Investors were in growth mode in the last two years as the stock market delivered blockbuster returns. AI stocks handily beat estimates due to solid demand, and they defied gravity quarter after quarter.

The recent bout of stock market panic has dragged down the Nasdaq to correction levels, and the S&P 500 could follow soon. Investors are worried first due to the slowdown in AI. Microsoft (NASDAQ:MSFT) canceled two data center contracts, Nvidia (NASDAQ:NVDA) failed to beat estimates by a wide margin, and OpenAI came out with a pretty underwhelming model. All three catalysts caused Wall Street to become uncomfortable.

However, the Atlanta Fed’s estimate of a 2.8% GDP decline this quarter has started to send even non-tech stocks lower. This is plausible due to the economy facing multiple tariff-related shocks. The government is flip-flopping on tariffs every other day, so many see selling as a better option instead of bearing the brunt of the uncertainty.

If you are also one of the people taking profits, here are three dividend stocks to rotate those gains into. These stocks have generally been quite stable during market downturns.

24/7 Wall St. Key Points:

- Investors are rotating their gains from tech stocks into defensive stocks.

- Dividend stocks with defensive characteristics are among the most resilient during downturns.

- These dividend stocks have already started trending up. In the meantime, grab our free “The Next NVIDIA” report. It includes a software stock with 10X potential.

General Mills (GIS)

General Mills (NYSE:GIS) is a dividend stock with strong appeal during downturns or recessions. It is a consumer staples company with a portfolio of household brands like Cheerios, Pillsbury, and Betty Crocker. These brands have inelastic demand that keeps the company afloat with solid cash flow regardless of the economic cycle.

General Mills has a long history of paying reliable dividends. The forward dividend yield is at 3.72%, which is much higher than the broader consumer staples industry yield of 1.89%. However, it only has five years of consecutive dividend increases, but the record is likely to improve due to the solid cash flow.

General Mills posted $1.8 billion in Q2 FY2025 operating cash flow. It reported $1.4 in EPS and beat estimates by $0.18, and it also reported $5.24 billion in revenue, up 1.96%. The top line beat estimates by $96.92 million. The first six months of fiscal 2025 saw $600 million in share repurchases on top of its regular dividend payouts.

The company did lower its full-year guidance, but management expects the investments to lead to stronger growth in fiscal 2026 and beyond.

The stock itself has started to rebound as investors are de-risking their portfolios. GIS is down over 28.8% from its peak, so the current setup leaves room for significant upside and little downside risk.

Johnson & Johnson (JNJ)

Johnson & Johnson (NYSE:JNJ) hasn’t delivered the most upside over the past few years, but it is considered to be one of the most reliable dividend stocks. It is a Dividend Aristocrat with a long history of paying dividends and 63 years of consecutive dividend increases. The forward dividend yield here is 2.98%.

The stock has started to trend higher recently as investors are retreating into defensive stocks, and the company itself is doing quite well. JNJ stock is up 15.74% year-to-date.

In its Q4 2024 report, JNJ posted $22.52 billion in revenue, up 5.3% year-over-year. Full-year revenue grew 5.9% to $88.8 billion, and GAAP net earnings for Q4 were $3.4 billion. This was a decline of 17% year-over-year due to higher costs and acquisition-related charges. Adjusted EPS for Q4 declined 10.9% to $2.04 and still exceeded analyst expectations of $1.99. Full-year adjusted EPS grew 0.6% to $9.98.

Johnson & Johnson reported $19.8 billion in 2024 FCF. Plus, the healthcare sector is significantly less cyclical than most other industries, so the stock and dividends both are likely to remain stable in a downturn.

American Water Works Company (AWK)

American Water (NYSE:AWK) is on the caboose of this article because it has a relatively low dividend yield of 2.1%. The company is one of the most stable names you can invest in. It is the largest investor-owned water and wastewater utility in the U.S. This market will unlikely see a big shake-up in a downturn. AWK also has 17 years of consecutive dividend increases.

The stock declined about 35% from its peak in late 2021 to its trough in late 2023. It still delivered little upside from there up until the start of the year. However, AWK has started to soar due to defensive stocks getting hot again. It has gained 17.39% year-to-date. It is relatively expensive at 27 times earnings, but the growth here makes it very much worth it.

It posted sales grew 16.4% to $1.2 billion in Q4 2024. This beat estimates by 8%, and EPS also grew 38.64% year-over-year to beat estimates by 9.2%. A recession will likely slow both these figures down, but AWK still warrants a premium due to it being a defensive stock.

The post 3 Dividend Stocks Set to Provide Stability in Market Chaos appeared first on 24/7 Wall St..