Stock Market Today: Stocks plunge as Trump won't rule out recession risk

The S&P 500 is on pace for its lowest close since September.

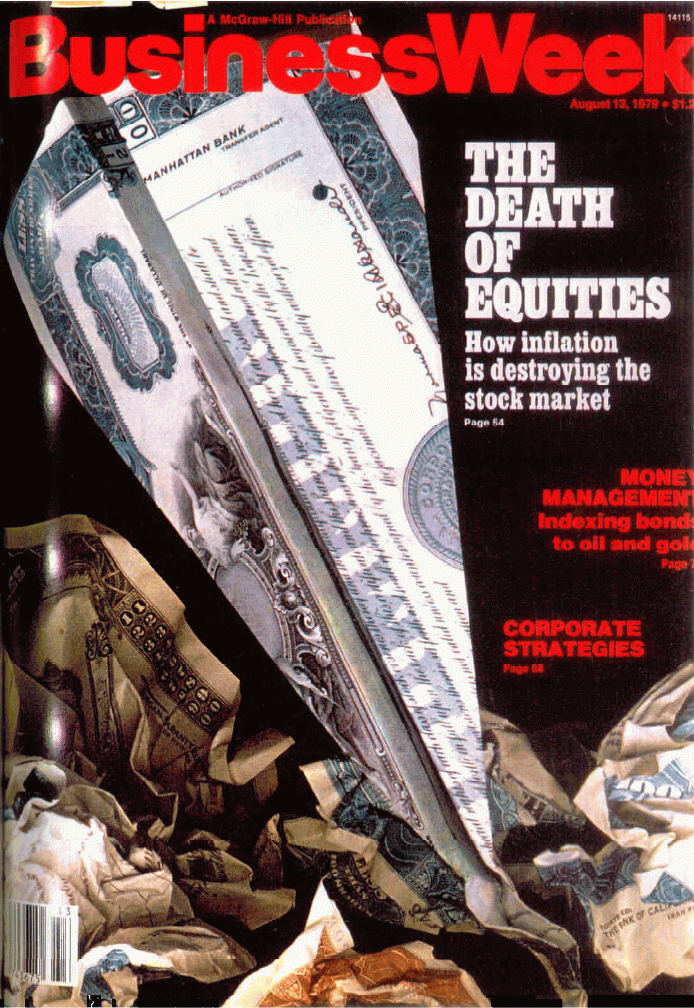

U.S. stock losses deepened in afternoon trading Monday, while the dollar extended its weeks-long slump and Treasury bonds rallied, as investors extended their retreat from risky markets amid broadening concerns that President Donald Trump's tariffs and cuts to government jobs could tip the world's biggest economy into recession.

Updated at 1:31 PM EST

Getting worse

The S&P 500 was last marked 137 points, or 1.37% lower on the session, with the Nasdaq down 693 points, or 3.8% lower. The Dow was last marked 633 points.

"The market is bipolar," said Gina Bolvin, president of Bolvin Wealth Management Group. "We’ve gone from animal spirits to what are the odds of a recession, from the 10 year flirting with 5% to falling to 4.2, from raising rates in order to slow the too hot too hot economy growing at 3.9% GDP and three weeks later we’re talking about–2.5% GDP with a need for emergency cuts

Just two years ago we were worried about the regional banking crisis. Last August it was the Yen carry trade. Deep Seek. GDP Now extrapolating January data Now, tariffs," she added. "This is a headline driven market; one that could change in an hour."

Related: Analysts revisit S&P 500 forecasts amid recession worry

Updated at 10:54 AM EST

Session lows

The S&P 500 is now down 2% on the session, and near the lowest levels since September, as stocks extended the early March slump amid renewed tariff, job cut and recession risks.

The CBOE Group's VIX index, meanwhile, hit a fresh year-to-date high of $26.87 earlier in the session, a level that suggests daily swing of around 1.67%, or 95 points, for the S&P 500.

"Technical damage within the index is a growing concern. Only 53% of the index remains above their 200-day moving average," said Adam Turnquist, chief technical strategist for LPL Financial.

"While this reading remains above the January low level of 52%, it leaves little room for error as 50% is the general threshold used to bifurcate bullish and bearish market breadth," he added.

Benchmark 10-year Treasury note yields, meanwhile, have fallen 10 basis points from late-Friday levels to 4.215% amid a flight-to-safety move, although the U.S. dollar index remains in negative territory on the day at 103.824.

Mid-20s $VIX is not where the bulls want to be

Low forward SPX returns.. pic.twitter.com/I9LO5ZrcoR— Mike Zaccardi, CFA, CMT