Analyst revisits Nvidia stock price target with Q4 earnings in focus

Nvidia shares have lagged most of their Mag 7 peers, as well as the broader Nasdaq benchmark, over the past six months.

Nvidia shares edged higher in early Thursday trading, but continue to lag the broader Nasdaq benchmark, following a bullish note on the AI chipmaker heading into its highly-anticipated fourth quarter earnings next week.

Nvidia (NVDA) , at one time the most valuable company in the world, have trailed both their peers and the broader market benchmarks over the past six months amid concerns tied to chipmaking capacity, AI demand and the emergence of cheaper alternatives for its biggest hyperscaling clients.

That latter concern, in fact, triggered a $593 billion drawdown on Nvidia stock in a single day, the largest on record, following the launch of China-based DeepSeek's AI Chatbot in late January.

But skepticism has arisen about DeepSeek's claims, and reports say that it used high-end Nvidia chips that were barred from export to China under rules put in place by the Biden administration, have tempered some of that concern.

Nvidia's biggest clients aren't looking to slow down spending anytime soon, either. The so-called hyperscalers like Meta Platforms (META) , Microsoft (MSFT) , Google (GOOGL) and Amazon (AMZN) , which provide cloud and data center infrastructure at a massive global scale, are set to spend a collective total of $325 billion this year alone.

Blackwell demand in focus

Their three-year capex run rate, starting in 2023, is slated to increase nearly three-fold to around $690 billion, more than the market value of Visa (V) and just shy of JP Morgan Chase (JPM) .

Not all of that will be spent on Nvidia products, of course, and each of the four biggest hyperscalers has spoken about reducing its reliance on a single supplier by ramping investments in chips and processors that are produced in-house.

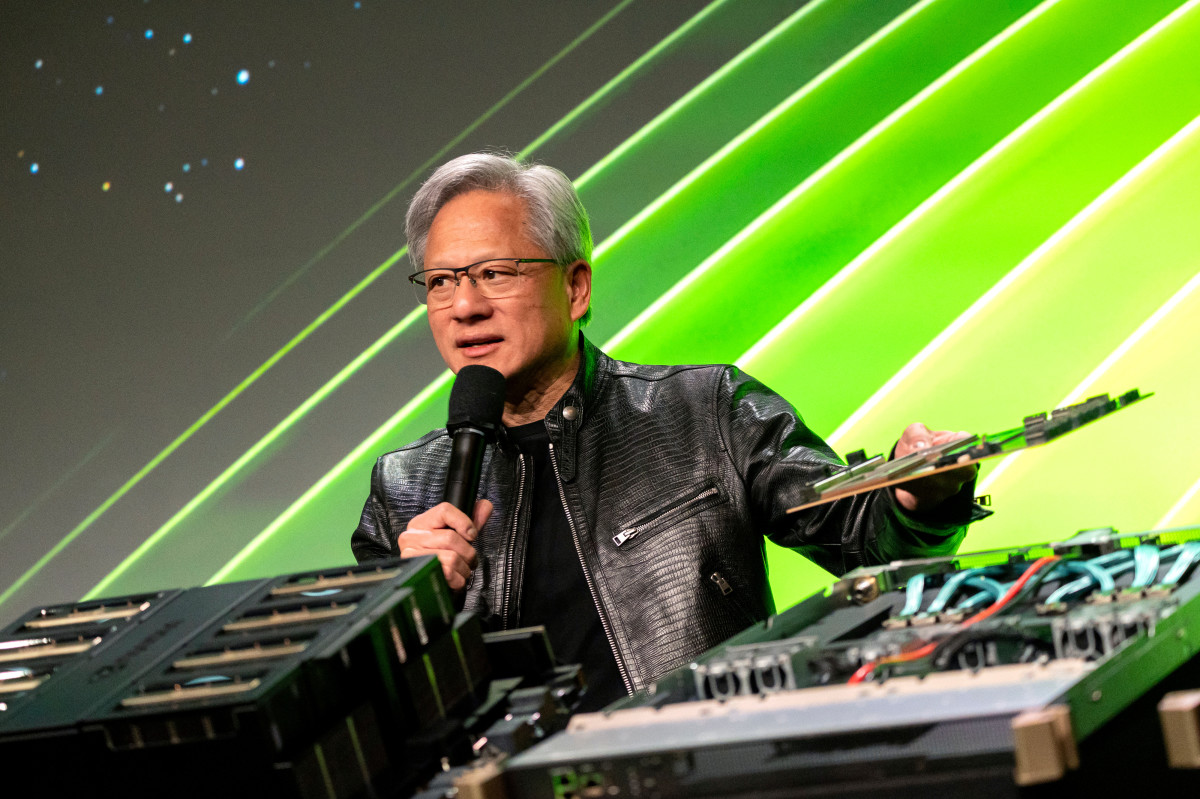

But even with that subtle shift in focus, the demand for Nvidia GPUs, which finance chief Colette Kress described as "staggering" in a call with investors in late November, isn't likely to stumble.

Related: Big tech will spend a staggering amount on AI in 2025

Oppenheimer analyst Rick Schafer, who reiterated his 'outperform' rating and $175 price target on Nvidia in a note published Thursday, is also bullish on Nvidia's near-term prospects.

Schafer said he sees "upside" to both Nvidia's fourth quarter results and April-quarter outlook "led by sustained CSP AI accelerator demand", adding that demand for Nvidia's older H200 processors, may be "possibly stronger than expected near-term as supply-constrained Blackwell ramps."

DeepSeek a positive for Nvidia?

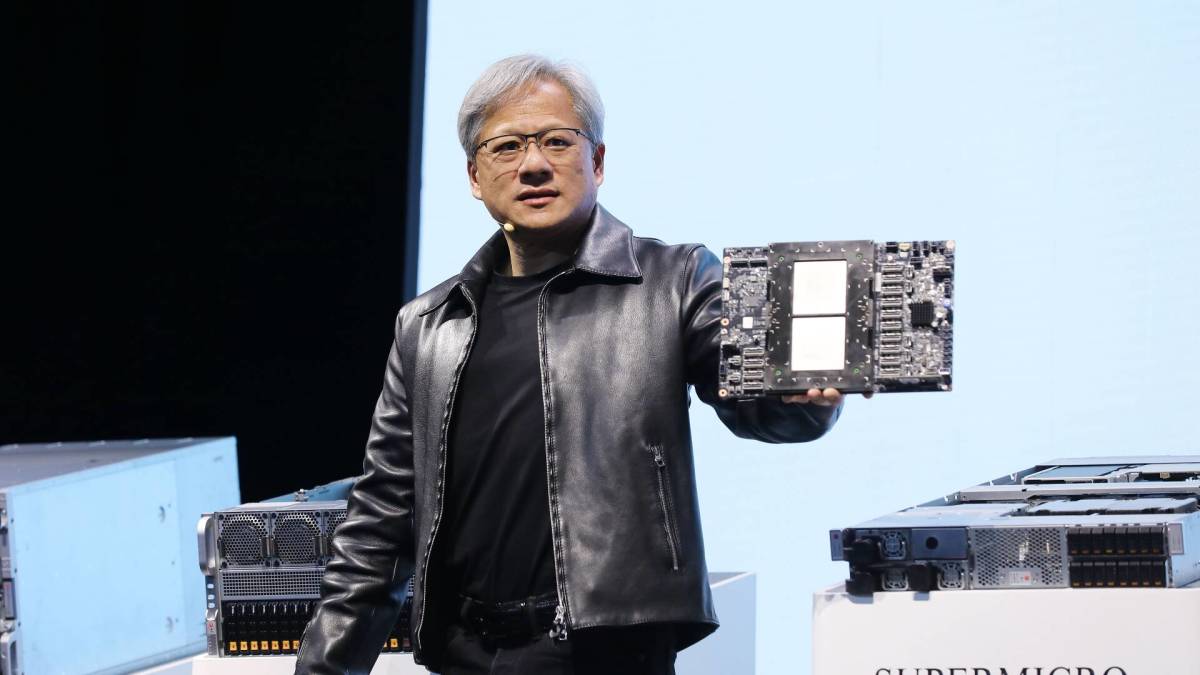

Nvidia's GB200 chip, built on the new Blackwell processing architecture, has been in full production since December. It's touted as being faster and more energy-efficient than Nvidia's legacy "hopper" chips.

Shafer thinks Nvidia' next Blackwell iteration, the GB300, will come to the market later this year.

The analyst also said that DeepSeek's recent emergence, and its claims to have developed a high-end Chatbot at a fraction of the price of its U.S.-based rivals, is a "positive for Nvidia as (hyperscalers) rapidly integrate innovations into Western models."

Related: Nvidia stock faces fresh China concerns

"Hyperscaler custom AI ASIC projects coexist with GPUs, in our view—ASICs primarily used for internal workloads while GPUs used for broader, dynamic, higher performance AI applications.

"Nvidia remains best positioned in AI, benefiting from full-stack AI hardware/software, " Schafer said, arguing that even if some of its hyperscaler clients use custom-made chips for internal workloads from rivals such as Broadcom (AVGO) and Marvell Technologies (MRVL) , they will "coexist" with Nvidia processors, which are used for "broader, dynamic, higher performance AI applications"

Earnings, outlook on deck

Nvidia will publish its fourth quarter earnings after the close of trading on Feb. 26, with investors looking for a headline revenue tally of $38.5 billion and net income of around $20.9 billion.

More AI Stocks:

- AI startup smashes funding round, signals big changes for health care

- Analyst revisits Palantir stock forecast following annual report filing

- Analyst who predicted Palantir rally picks best AI software stocks

Looking into the group's fiscal first quarter, which ends in April, analyst expect Nvidia to guide investors to revenues in the region of $42.1 billion, a 61.6% increase from the same period last year.

Nvidia shares were marked 0.08% higher in premarket trading to indicate an opening bell price of $139.33 each, pegging the stock's six-month gain at around 9.4%.

Related: Veteran fund manager issues dire S&P 500 warning for 2025