Medicare Brokers Steered Retirees Into Worse Plans to Earn Higher Commissions

Retirees often spend a significant portion of their income on healthcare expenses as age-related decline leads to a higher need for medical services. Finding the right insurance coverage can help seniors keep their care costs to a manageable level. While retirees are covered by Medicare once they reach the age of 65, there are big […] The post Medicare Brokers Steered Retirees Into Worse Plans to Earn Higher Commissions appeared first on 24/7 Wall St..

Key Points

-

Insurance companies and brokers are being accused of an illegal kickback scheme.

-

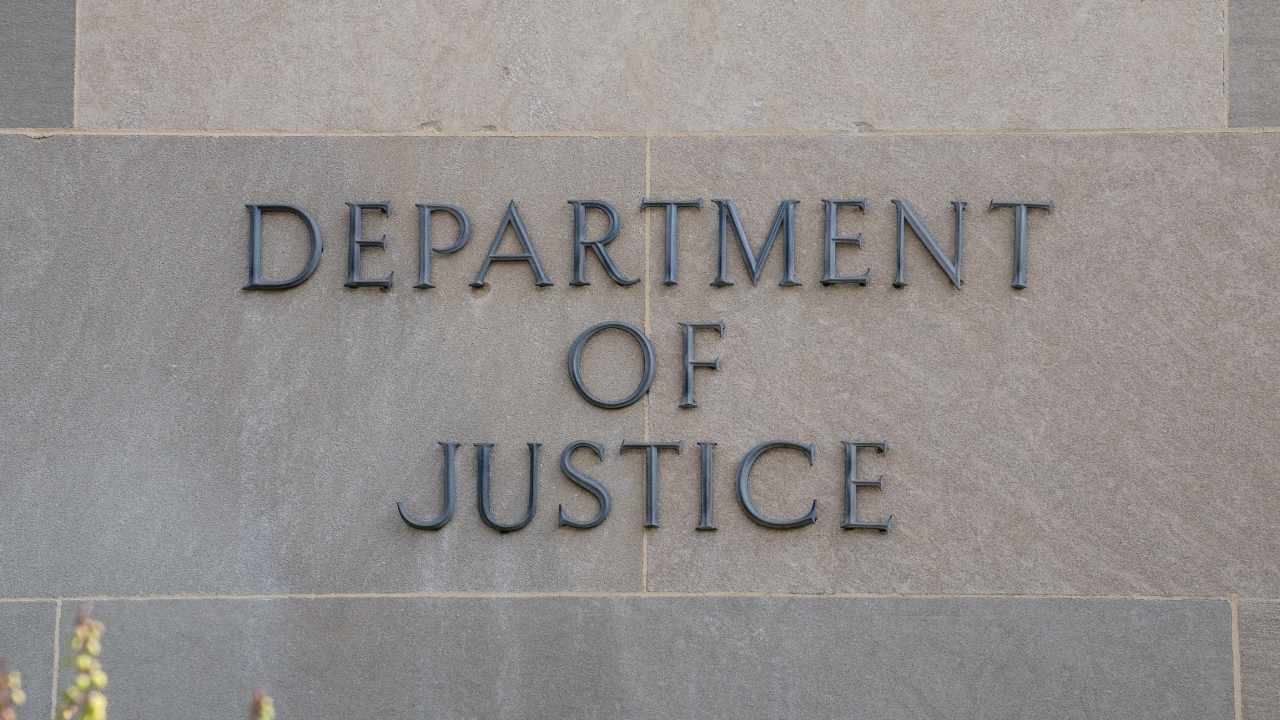

The DOJ has filed a lawsuit claiming that large insurers paid brokerage firms to steer retirees to their Advantage plans.

-

The insurers and brokers deny wrongdoing, but the DOJ claims they evaded commission rules.

-

Need help understanding Medicare or Social Security as a retiree? SmartAsset’s free tool can match you with a financial advisor in minutes to help you make the right choices about retirement benefits. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Retirees often spend a significant portion of their income on healthcare expenses as age-related decline leads to a higher need for medical services. Finding the right insurance coverage can help seniors keep their care costs to a manageable level.

While retirees are covered by Medicare once they reach the age of 65, there are big coverage gaps in traditional Medicare plans, and there are also high coinsurance costs for outpatient services. As a result, seniors usually buy either a Medigap plan to supplement traditional Medicare or they purchase a Medicare Advantage Plan that replaces traditional Medicare.

It can be confusing to figure out which plans to buy, so seniors sometimes turn to brokers for help. Those brokers, ideally, should be assisting retirees in finding a plan that makes sense for them. Unfortunately, according to the Department of Justice (DOJ), that is not always what is happening.

DOJ accuses insurers of paying kickbacks to brokers

Earlier this month, the Department of Justice launched a lawsuit against major insurers, including Aetna, Elevance Health (which was formerly Anthem), and Humana. The lawsuit claims that these insurers paid “hundreds of millions of dollars” to large insurance brokers. This money came in the form of kickbacks paid between 2016 and 2021. The funds apparently went to three major insurance brokerages — eHealth, GoHealth, and SelectQuote.

The lawsuit alleges that insurers paid these kickbacks to the large brokerages to steer certain patients into Medicare Advantage plans offered by the three companies implicated in the case. The DOJ also alleges that the insurers discouraged the brokers from enrolling costlier beneficiaries who were sick or disabled.

According to the DOJ’s claim, the insurers called the kickbacks “marketing” fees or “sponsorship fees” so they could pay a larger amount of money to the brokerage firms than is allowed under rules that cap broker commissions. The incentives were substantial, with insurers paying more than $200 per enrollee when brokers directed Medicare beneficiaries towards the coverage the company offered. The payments were made to the brokers regardless of whether the insurance plans they were directing people toward were suitable for the enrollees and regardless of the quality of the plans.

The insurers and brokerage firms named in the lawsuit have, however, denied the allegations and have indicated they will fight the DOJ in court, with a spokesperson describing the claims as “meritless” in an emailed statement to Kaiser Family Foundation Health News. GoHealth also denied the allegations in an online post.

As the case plays out, it remains to be seen whether the DOJ will be able to meet its burden of proof and show that the insurers and brokers acted wrongfully in terms of the compensation provided for signing up policyholders.

Seniors deserve better help when it comes to finding coverage

Around a third of seniors who enroll in Medicare Advantage plans get help from a broker in finding the right coverage, so a substantial number of retirees may have been steered into the wrong insurance plan by brokers looking for extra handouts — if the allegations are true.

Unfortunately, this incident highlights the serious problems older Americans face when navigating financial issues in retirement. Decisions surrounding Medicare and Social Security are complex and require a deep understanding of the intricacies of each program — and many seniors both lack that knowledge and can’t find a trusted source of information to help them make the right choices.

Insurance brokers should be a good source of aid, but if the DOJ’s allegations are accurate, that’s not necessarily the case.

Retirees need to protect themselves by researching those who they work with and who they turn to for help. Seniors can get advice from insurance brokers, but also from fee-only financial advisors who have a fiduciary duty to act in their best interests. They should research their options carefully to find the right professionals who will look at the big picture and truly make the best decisions for their clients rather than for their own enrichment.

The post Medicare Brokers Steered Retirees Into Worse Plans to Earn Higher Commissions appeared first on 24/7 Wall St..