IRS-Approved Strategies the Wealthy Use to Obliterate Debt

The tax code is filled with rules that allow people to minimize their taxes. Applying the right tax strategies can transform your debt payoff plan and make it easier to address various expenses. If you don’t know the best IRS codes, you could be missing out on thousands of dollars in savings. This guide will […] The post IRS-Approved Strategies the Wealthy Use to Obliterate Debt appeared first on 24/7 Wall St..

The tax code is filled with rules that allow people to minimize their taxes. Applying the right tax strategies can transform your debt payoff plan and make it easier to address various expenses. If you don’t know the best IRS codes, you could be missing out on thousands of dollars in savings. This guide will explore some of the most popular IRS-approved strategies that the rich use to keep their taxes low and pay off debt.

Key Points

-

Knowing the tax code can help you reduce your tax bill and get out of debt faster.

-

Many high-net-worth individuals use these four IRS codes to save money.

-

Most Americans don’t realize how shockingly good personal loans are today. See for yourself, with 6.4% rates and no hit on your credit score there is nothing to lose, you can get started today.

- Most Americans don’t realize how shockingly good personal loans are today. See for yourself, with 6.4% rates and no hit on your credit score there is nothing to lose, you can get started today.

1. Leverage the Student Loan Interest Deduction (Section 221)

Section 221 of the IRS tax code allows you to deduct student loan interest payments from your total tax bill. The loans must have been used for qualified higher education expenses, and this rule applies to federal and private student loans.

However, you cannot file tax returns as married; you can file them separately. If you are married, you must file taxes jointly to capitalize on this tax deduction. Furthermore, the IRS sets a modified adjusted gross income limit. If you exceed this limit, you won’t be able to use the deduction.

This tax code is a great starting point, but it is limited. You can only deduct $2,500 per year with Section 221. You should receive a Form 1098-E from your loan provider if you paid at least $600 in interest this tax year. This form will make it easier to show your deduction to the IRS.

2. Maximize Your Retirement Contributions

Retirement contributions are one of the simplest and most effective ways to reduce your taxes. You can contribute to a Roth IRA to avoid taxes in the future, but traditional retirement plans let you avoid taxes right now. Each contribution to a traditional 401(k) or a traditional IRA will reduce your tax burden.

While some people prefer Roth IRAs, there is a hidden advantage with traditional retirement accounts. You can withdraw from these accounts when you are retired and don’t generate as much income. Then, you will be in a lower tax bracket. You can also withdraw more money from your traditional retirement account during a year where you have a massive tax write-off.

The IRS also allows you to make catch-up contributions if you are 50 years or older. People who qualify for these contributions can put an additional $1,000 into a traditional IRA plan. Anyone who is 50-59 years old or older than 63 years old can contribute an extra traditional 401(k), while people who are 60-63 years old can contribute an additional $11,250 per year to their 401(k) plans.

3. Use an IRS-Sanctioned 0% Balance-Transfer Loan

It’s important to read the fine print before taking out any loan, but if you find a good 0% balance-transfer loan, you can prolong interest accumulation. Some of these loans have intro offers that last 12-24 months, giving you plenty of time to get out of debt.

You can also time your application to maximize the benefits. For instance, you can opt for a 0% balance-transfer loan if your finances go down. Then, the repercussions won’t be as severe if you can’t make meaningful progress with your balance. You can also opt to wait until you have a lot of cash so you can trim your balance before converting the rest of itinto a 0% balance-transfer loan.

4. Claim the Home Office Deduction to Boost Your Budget

The IRS allows taxpayers to deduct a part of their home if they use it exclusively for business activities. You can’t use it for both personal and professional purposes. The IRS has a standard rate of $5 per square foot, and you can have a home office of up to 300 square feet. That means you can deduct up to $1,500 per year with a home office.

However, you can potentially boost your savings with the actual expense method. This approach involves calculating your home office’s square feet as a percentage of your home’s total square feet. Then, you can apply this percentage to all of your home expenses. For instance, if your home office takes up 30% of your home’s total square feet, you can turn a $500/mo utility bill into a $150 tax write-off.

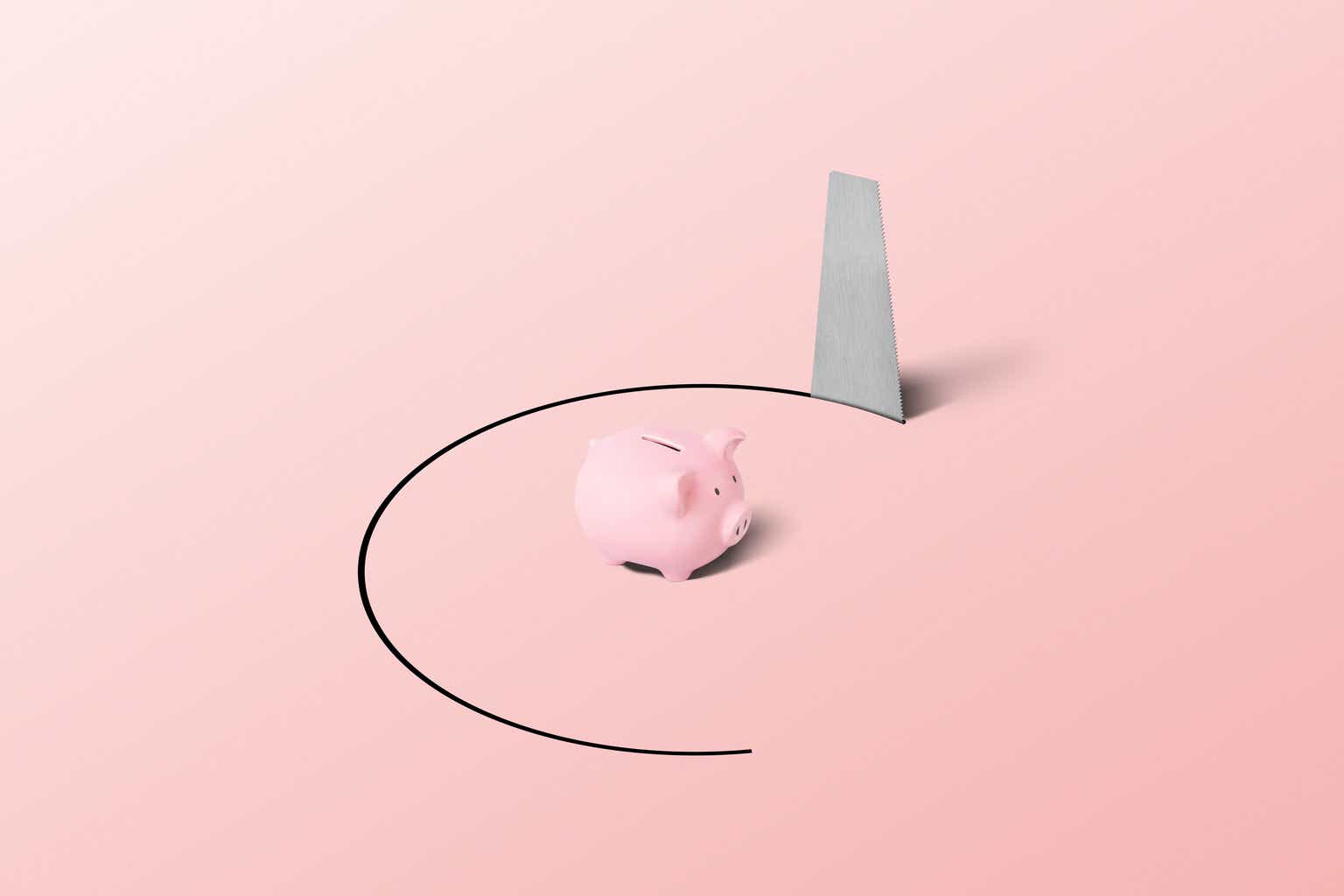

Don’t Let High APRs Drain Your Wallet

Carrying credit card balances can feel like watching money slip through your fingers every month. At average rates near 25%, you’ll pay $625 in interest alone on a $30,000 balance.

But there’s a smarter route: AmOne’s free match-maker service connects you with lenders offering rates as low as 5.90% APR. On that same $30,000, your interest drops to just $147.50/month—keeping an extra $477.50 in your pocket!

No perfect credit score needed, and running your options won’t ding your credit. With over 2,500 five-star Trustpilot reviews, AmOne exists to help hardworking people get back in control. In minutes, you can click here see if you qualify—and start saving.

The post IRS-Approved Strategies the Wealthy Use to Obliterate Debt appeared first on 24/7 Wall St..