USA Rare Earth (NASDAQ: USAR) Live Earnings Coverage (May 14th)

USA Rare Earth (Nasdaq: USAR) reports tonight with no revenue expected, but strategic progress remains the focal point. The stock has been volatile since completing a $75 million PIPE financing in Q1, which provided critical funding for the company’s rare earth separation and magnet manufacturing initiatives. Investors are watching closely for updated timelines on its […] The post USA Rare Earth (NASDAQ: USAR) Live Earnings Coverage (May 14th) appeared first on 24/7 Wall St..

USA Rare Earth (Nasdaq: USAR) reports tonight with no revenue expected, but strategic progress remains the focal point. The stock has been volatile since completing a $75 million PIPE financing in Q1, which provided critical funding for the company’s rare earth separation and magnet manufacturing initiatives.

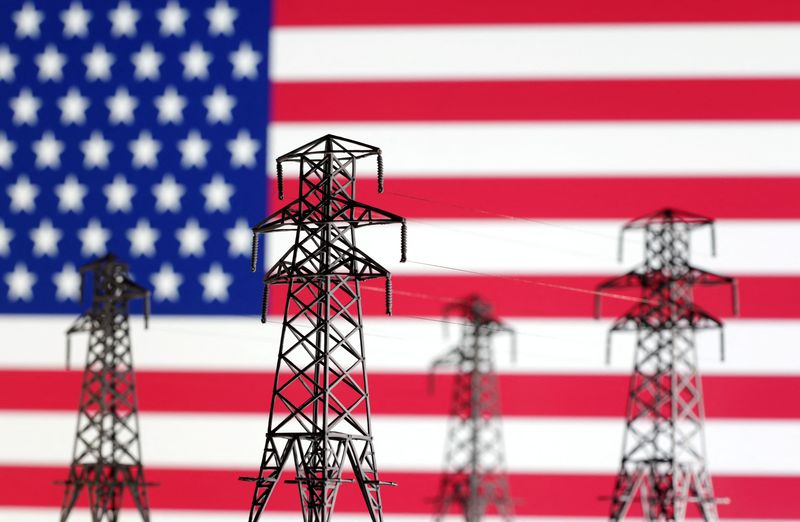

Investors are watching closely for updated timelines on its Round Top project in Texas — a rare domestic source of heavy rare earths — and the operational ramp of its magnet facility in Oklahoma. Any clarity on environmental permitting or Department of Defense partnerships could be market-moving.

The long-term thesis rests on reshoring U.S. rare earth and battery material supply chains. With China tightening export controls and the Inflation Reduction Act continuing to favor domestic content, USAR is strategically well-positioned. But it needs to show execution momentum.

EPS is expected to remain negative. What matters tonight is commentary on capex pacing, customer engagement (especially in defense/aerospace), and progress toward first commercial production. If USAR outlines a credible 2025 revenue path, it could reframe the pre-revenue narrative.

The post USA Rare Earth (NASDAQ: USAR) Live Earnings Coverage (May 14th) appeared first on 24/7 Wall St..