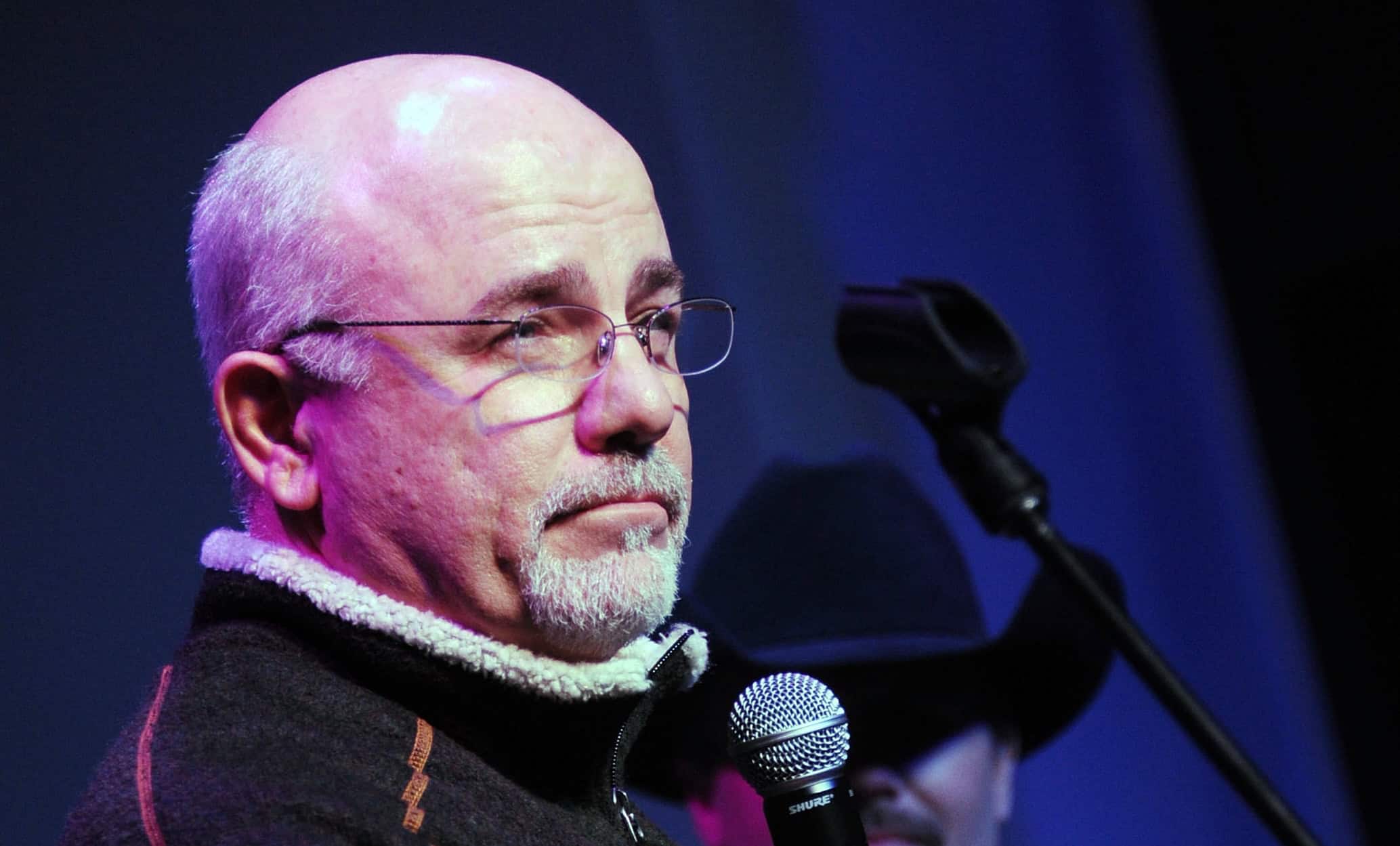

Dave Ramsey’s Warning: Don’t Tap Your 401(k) to Pay Your Mortgage

When faced with rising rent and mounting debt, the temptation to dip into a 401(k) to buy a home can be strong, but personal finance expert Dave Ramsey, renowned for his candid and sometimes brutal advice, warns against it. A caller to his program recently shared her dilemma with Ramsey: with $35,000 in her 401(k), […] The post Dave Ramsey’s Warning: Don’t Tap Your 401(k) to Pay Your Mortgage appeared first on 24/7 Wall St..

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Key Points in This Article:

When faced with rising rent and mounting debt, the temptation to dip into a 401(k) to buy a home can be strong, but personal finance expert Dave Ramsey, renowned for his candid and sometimes brutal advice, warns against it.

A caller to his program recently shared her dilemma with Ramsey: with $35,000 in her 401(k), $28,000 in car loans, and credit card debt, she considered cashing out her retirement savings to pay off debts and fund a home purchase in a better school district.

Ramsey’s blunt response was, “That would be stupid.” Her plan to escape escalating rent was derailed by a recent vacation that added to her debt, undermining her debt repayment efforts.

The financial guru’s advice can be applied to anyone in a similar situation, and underscores why using a 401(k) to pay a mortgage or debts is a risky move. Below are smarter alternatives to achieve financial stability without sacrificing long-term security.

The Caller’s Financial Dilemma

The caller’s situation is precarious: a modest 401(k) balance, hefty car loan debt, and additional credit card debt, was worsened by a recent spending splurge. Although she hoped to use her 401(k) to clear debts and buy a home, motivated by rising rent and a desire for a better school district for her children, Ramsey quickly pointed out her financial missteps, noting, “You quit” the debt repayment plan by racking up more debt on a vacation.

He emphasized that with her current financial strain, she’s “broke” and can’t afford a home or vacations, making a 401(k) withdrawal particularly unwise.

The High Cost of Early Withdrawals

Withdrawing from a 401(k) before age 59-1/2 comes with steep penalties. Ramsey warned the caller she could lose 40% of her withdrawal to taxes and penalties, stating, “You don’t need to be cleaning out your 401(k) and adding to the stupid sauce.” A $35,000 withdrawal could incur a 10% federal penalty and income taxes (federal, state, and potentially local, depending upon where she lived), leaving her with little left over. This immediate loss drastically reduces funds available for debt repayment let alone a down payment.

More critically, early withdrawals sacrifice future growth. That $35,000, if left invested at a 5% annual return, could grow to $57,000 in 10 years, assuming annual compounding. Cashing it out now not only shrinks her retirement nest egg but also eliminates the compounding potential, leaving her vulnerable when she’s no longer working. For someone already in debt, this move compounds financial insecurity, making it harder to achieve long-term stability.

Why Not Use a 401(k) for a Mortgage?

Ramsey’s advice was clear: the caller shouldn’t buy a home while drowning in debt. Instead of tapping her 401(k), she should focus on eliminating her car loans and credit card debt, possibly by finding a more affordable rental in a better school district.

Using retirement savings for a mortgage might seem like a solution to rising rent, but it’s a short-term fix with long-term consequences. A mortgage commits her to ongoing payments, which her strained finances can’t support, especially after losing nearly half her 401(k) to taxes and penalties. Moreover, a home purchase adds maintenance costs and risks, further stretching her budget.

Smarter Alternatives

Financial experts suggest several alternatives:

- Recommit to Debt Repayment: Resume the debt snowball method, paying off smaller debts first to build momentum, and avoid lifestyle splurges like vacations until debts are cleared.

- Find Affordable Housing: Relocate to a cheaper rental in a suitable school district, preserving the 401(k) for retirement and reducing immediate financial pressure.

- Explore Assistance Programs: Look into first-time homebuyer programs or school district options that don’t require depleting savings, such as scholarships or public school transfers.

- Increase Income: Consider part-time work or side gigs to boost income, directing extra funds to debt repayment without touching the 401(k).

The Role of a Financial Advisor

I’m not a financial planner or tax advisor, so these are only my opinions, but before considering a 401(k) withdrawal, consult a financial professional. They can quantify the tax and penalty costs and create a tailored debt repayment plan.

For this caller, an advisor might recommend a budget overhaul, prioritizing high-interest credit card debt to free up cash flow without sacrificing retirement savings. Online tools, like those on ssa.gov or IRS calculators, can illustrate the long-term impact of withdrawals, reinforcing the need to keep the 401(k) intact.

Key Takeaway

Dave Ramsey’s stark warning — don’t tap your 401(k) to pay a mortgage or debts — resonates for anyone in a financial bind. For this caller, with limited savings and mounting debt, cashing out her $35,000 401(k) would cost her dearly in taxes, penalties, and lost growth, undermining her future security.

By recommitting to debt repayment, finding affordable housing, and seeking professional guidance, she can achieve her goals without the jeopardy of financial missteps Ramsey calls “stupid sauce.”

The post Dave Ramsey’s Warning: Don’t Tap Your 401(k) to Pay Your Mortgage appeared first on 24/7 Wall St..