Market Would Drop By 8,000 In A “Black Monday” Sell Off

On October 19, 1987, the Dow Jones Industrial Average fell 22.6%, a record based on a percentage sell-off in the market’s history. It plunged 508 points to 1,738. A similar drop today would shave 8,000 points off the DJIA. The early market carnage in 1987 looked something like this last Thursday and Friday. The Dow […] The post Market Would Drop By 8,000 In A “Black Monday” Sell Off appeared first on 24/7 Wall St..

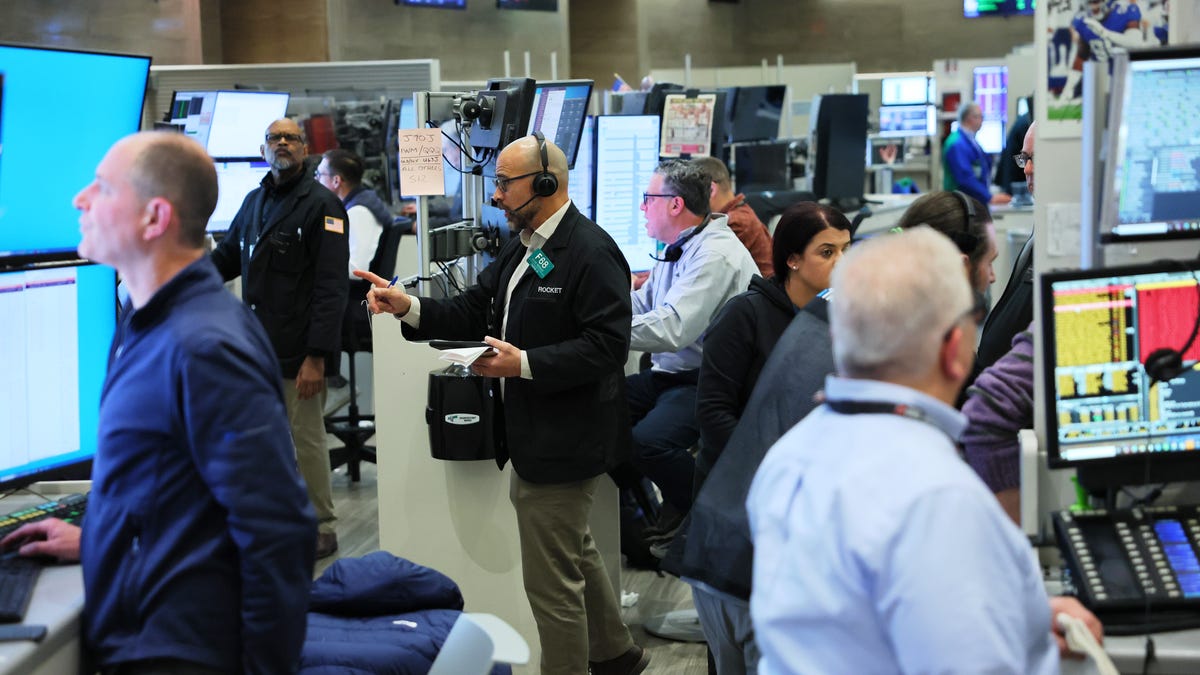

On October 19, 1987, the Dow Jones Industrial Average fell 22.6%, a record based on a percentage sell-off in the market’s history. It plunged 508 points to 1,738. A similar drop today would shave 8,000 points off the DJIA.

The early market carnage in 1987 looked something like this last Thursday and Friday. The Dow sold off 2.4% on the Thursday before Black Monday and 4.6% on Friday. (The drop began Wednesday, as the Dow fell 3.8% that day.)

The effort to sell stocks on Monday, October 19, was so extreme that 11 stocks in the DJIA opened late, and 95 stocks in the S&P 500 did the same.

A Federal Reserve history of the event said, “At the time of the crisis, stock, options, and futures markets used different timelines for the clearing and settlements of trades, creating the potential for negative trading account balances and, by extension, forced liquidations.” It added that there were no mechanisms in place to slow the sell-offs.

Jim Cramer observed that another Black Monday could be tomorrow because of the economic destruction that new tariffs will trigger. He added that the market is being propped up by good employment numbers last week. He commented, “If the president doesn’t try to reach out and reward these countries and companies that play by the rules, then the 1987 scenario… the one where we went down three days and then down 22% on Monday, has the most cogency.” The market did recover after about two years, and the drop did not cause a disaster across the rest of the economy. There was not a significant recession until 1990.

A large block of tariffs completely differs from the factors that caused the 1987 crash. They are a tax on consumer and business spending, which immediately affects consumer sentiment. Consumer spending is two-thirds of GDP. Consumer spending plunges lead to layoffs, which trigger profit challenges for businesses. Tariffs also cause inflation. The reasons for the markets to stay down this time multiply

There will be future selloffs in the market, which could be violent

The post Market Would Drop By 8,000 In A “Black Monday” Sell Off appeared first on 24/7 Wall St..