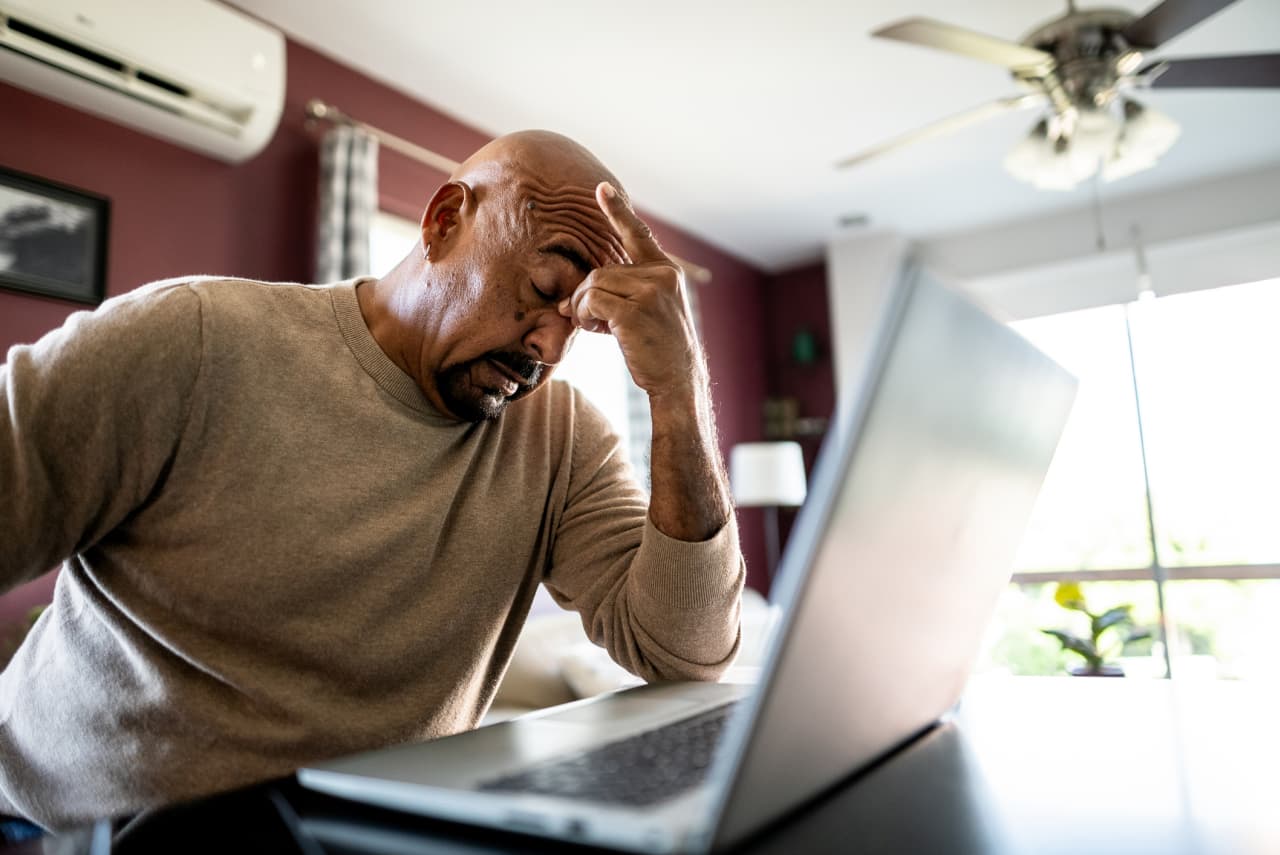

Live Updates: Nasdaq Composite Crashes Into Bear Market

Markets are in freefall once again on Friday morning. Here’s a look at futures as of April 4th: Dow Futures: -1,260 (-3.10%) S&P Futures: -169.75 (-3.12%) Nasdaq Futures:-619 (-3.33%) Yesterday, the Russell 2000 became the first major index to enter bear market territory. However, if pre-market losses hold up, the Nasdaq Composite will also enter […] The post Live Updates: Nasdaq Composite Crashes Into Bear Market appeared first on 24/7 Wall St..

Markets are in freefall once again on Friday morning. Here’s a look at futures as of April 4th:

- Dow Futures: -1,260 (-3.10%)

- S&P Futures: -169.75 (-3.12%)

- Nasdaq Futures:-619 (-3.33%)

Yesterday, the Russell 2000 became the first major index to enter bear market territory. However, if pre-market losses hold up, the Nasdaq Composite will also enter a bear market.

China Retaliates with 34% Tariffs

The main driver for this morning’s market collapse is China imposing 34% tariffs on all imported goods from the United States. That rate matches the reciprocal tariffs from the United States, although China had previously announced tariffs that put its total rate at 54%.

China’s announcement sent shockwaves through markets throughout the world as European indexes are now also trading sharply off. Prediction markets now have the probability of a recession in the U.S. in 2025 at 56%.

Market Now Pricing in 5 Rate Cuts

The market is now pricing in a 100% probability of a 1st and 2nd rate cut by July, and a 59% probability of a fifth rate cut by December. 2-Year Treasury yields are collapsing. The yield on 10-Year Treasuries now stands at 3.916%.

The challenge will be that while the Fed may need to respond to falling growth, if tariffs prove inflationary, that will limit the Fed’s options.

The post Live Updates: Nasdaq Composite Crashes Into Bear Market appeared first on 24/7 Wall St..