Live S&P 500 (NYSEARCA: SPY): Markets Hunt Direction in Tech-Heavy Earnings Week

The markets have wavered from early gains in what is shaping up to be an indecisive day of trading. Signs suggest that the tariff wars are easing, with Treasury Secretary Scott Bessent forecasting new trade agreements as soon as this week while also placing the burden on China to de-escalate tensions between Beijing and Washington, […] The post Live S&P 500 (NYSEARCA: SPY): Markets Hunt Direction in Tech-Heavy Earnings Week appeared first on 24/7 Wall St..

The markets have wavered from early gains in what is shaping up to be an indecisive day of trading. Signs suggest that the tariff wars are easing, with Treasury Secretary Scott Bessent forecasting new trade agreements as soon as this week while also placing the burden on China to de-escalate tensions between Beijing and Washington, D.C. Meanwhile, Magnificent Seven names will be taking the earnings spotlight this week, adding doses of both excitement and caution in these uncertain times. If it’s any indication, last week, Google parent company Alphabet (Nasdaq: GOOGL) reported better-than-expected Q1 results.

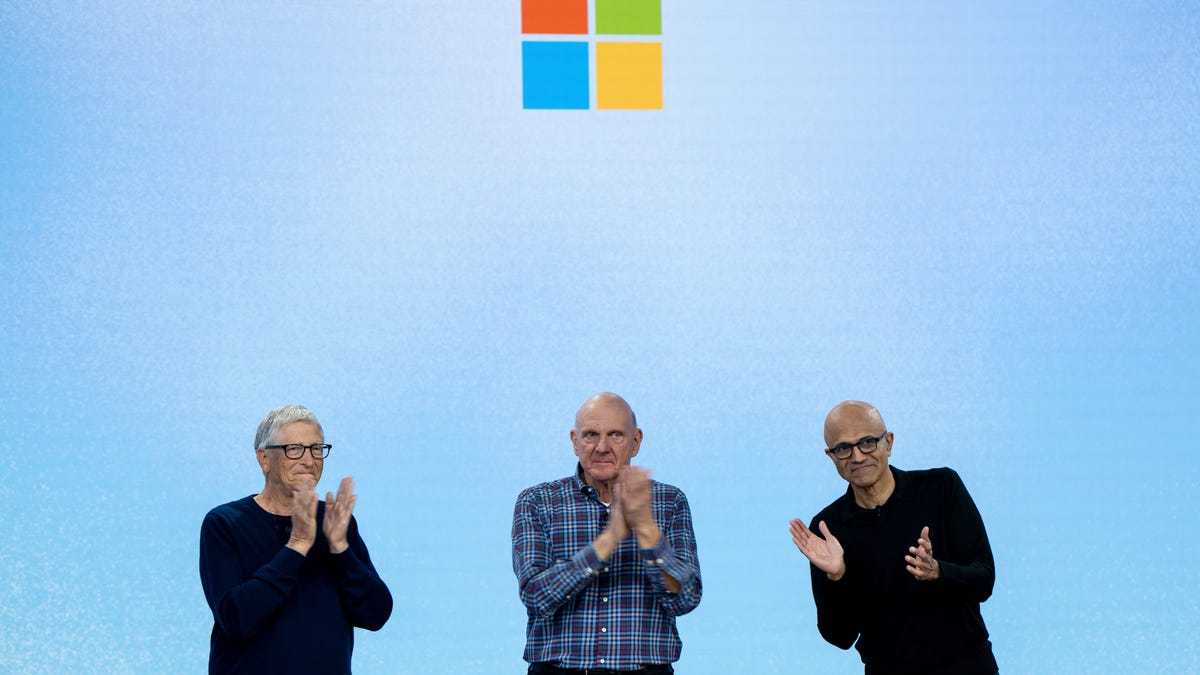

Stocks have distanced themselves from from a “Liberation Day” low reached earlier this month where the S&P 500 shaved off approximately 20% from its recent high. The S&P 500 has tacked on 7.1% over the past five-day period. Big Tech stocks on deck for earnings this week include Microsoft (Nasdaq: MSFT), Amazon (Nasdaq: AMZN), Meta Platforms (Nasdaq: META) and Apple (Nasdaq: AAPL). Morgan Stanley Chief Equity Strategist Michael Wilson told Bloomberg the weak U.S. dollar will serve as a positive catalyst for corporate America’s earnings and will buoy the U.S. stock market ahead of international equities.

Here’s a look at the performance as of morning trading:

Dow Jones Industrial Average: Up 203.08 (+0.51%)

Nasdaq Composite: Down 15.81 (-0.09%)

S&P 500: Up 9.70 (+0.18%)

Market Movers

Intel (Nasdaq: INTC), which is a component in both the S&P 500 and Nasdaq Composite, is adding 4% today as a standout performer today.

Cruise stocks are rising, with Carnival (NYSE: CCL) and Norwegian Cruise Lines (NYSE: NCLH) each up over 3%.

Bernstein is bullish on Dow stock Boeing (NYSE: BA), upgrading shares to an “outperform” rating from “market perform” as the company’s restructuring efforts pay off.

Bank of America has reiterated its “buy” rating on Meta in anticipation of the company’s quarterly results on Wednesday. Analysts are confident Mark Zuckerberg’s company will reach its revenue targets.

IBM (NYSE: IBM) is up 1.1% and has designated $150 billion to advance U.S. tech innovation.

The post Live S&P 500 (NYSEARCA: SPY): Markets Hunt Direction in Tech-Heavy Earnings Week appeared first on 24/7 Wall St..